Editorial | Sep 16,2023

The third largest exporter of pulses last year, Edao Abdi, has grown anxious over the past three months. His 500 million Br loan request from a couple of the top private commercial banks, remains up in the air.

International customers from Europe are expected to receive 8,000tns of a variety of crops by November. But, they will have to settle for an eighth of the amount as the exporter cannot access credit for the 20,000tns of inputs he needs.

"No one waits around if payment is not made," he told Fortune in disappointment.

Edao sources its pulses from the Ethiopian Commodities Exchange (ECX) and farmers from Oromia and Sidama regional states through contract farming arrangements. His 16-year-old company Edao Trading was founded with a million Birr capital.

The 14 million dollars in export revenues from last year has little to offer in the form of comfort this year, as the company thirsts for fresh credit.

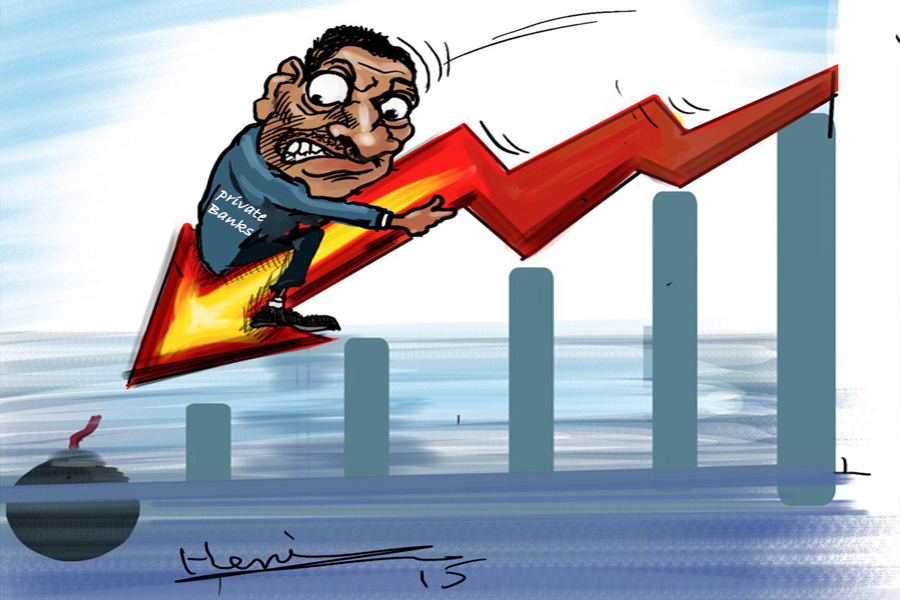

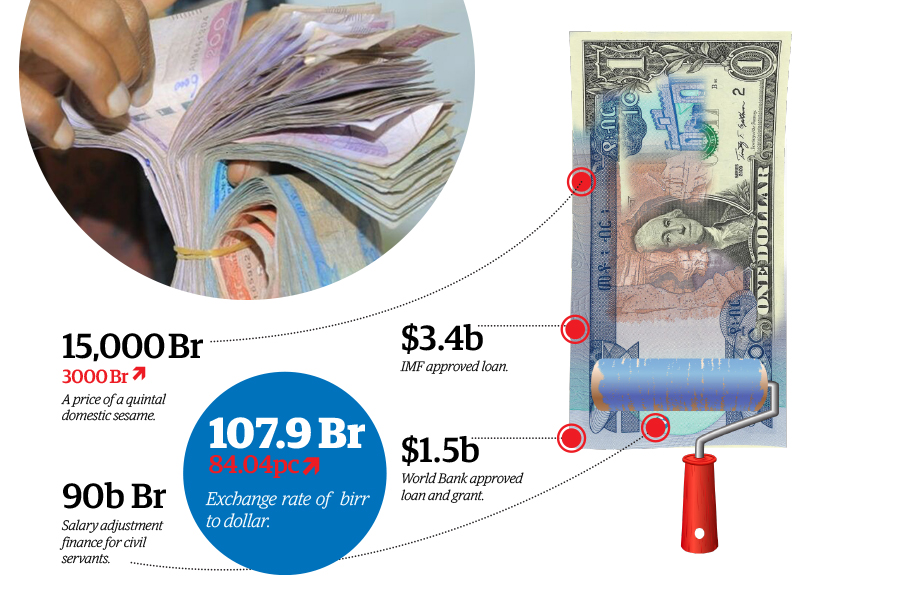

Commercial banks have placed a tight clasp on new loans to customers, following a cap on credit growth of 14pc by the National Bank of Ethiopia (NBE). The policy shift rolled out in August is similar to the one imposed a decade ago, aimed at battling inflation.

A 27pc inflation rate has been maintained recently while regulators of the central bank laud their priorities to further tame the rate to 20pc by the end of the year. Governor Mamo Mihretu underscored that price stability would remain a top priority of monetary policy for at least the next three years "at the cost of some growth."

While the result remains to be seen, Vice Governor Fikadu Digafe suggests that it is still too early to determine the exact impact of the loan cap on overall price levels.

"I can't deny there has been some impact," he told Fortune.

Although the move may contribute to containing the inflation rate, several impacts are strained on the banking industry.

In the third quarter of 2022/2023, a few months before the credit cap was announced, the banking sector disbursed 123 billion Br in new loans, signifying a 13pc annual growth from the prior year. The total banking industry's loans and advances had grown by 35pc from the prior year to 1.4 trillion Br.

The benefits of reducing the inflation rate at the expense of revenues sit well for seasoned institutions such as Zemen Bank which netted 1.8 billion Br this year.

Dereje Zenebe, president of Zemen, indicates the importance of increasing the purchasing power of money to realise price stability.

"The policy interventions are rather late," he said, pointing to the ballooning prices of homes and vehicles over the past two years.

However, he noted that the decline in loans will limit business owners with prior credits, as they will be limited in working capital to run businesses at full capacity. The Bank looks into credit scores and prior relationships to approve credit lines, according to Dereje.

On the contrary, the loan cap has put a tighter clasp on new entrants, with some suspending loan requests for employees while others restrict their growth. Ethiopia's financial landscape has been on an accelerated growth trajectory, with new entrants looming in the banking industry while some upgrade from microfinance institutions.

Sinqee Bank grew into a full-fledged commercial bank last year from Oromia Credit & Saving Microfinance, which amassed 371.6 million Br in profits last year. The Bank has been feeling the impact of the new monetary policy prescriptions.

Its President Neway Megerssa has mixed feelings about introducing caps on credit growth. He reasons that the longstanding provision where half the amount of deposits is set aside for legal reserves and treasury bonds already put structural limits on credit.

"It'll reduce inflation," he underscored, "and our interest income."

To keep momentum, Sinqee has halted giving loans to its employees, one of the perks associated with a position at a Bank. Neway cautioned that the slowdown in business caused by the credit cap will fuel unemployment rates as employers face a growing inability to make salary payments.

"There will be no new employment if businesses can't expand," he said.

The Bank management opted to prioritise import-exports, domestic trade, hotel and tourism businesses. Neway acknowledged that liquidity has been a problem in the banking industry over the past year, revealing that rigorous credit history evaluations precede the approval of any new bank loans.

'We're making sure that prior loans are properly collected," he noted.

One of the budding financial institutions that penned a letter to the central bank pleading for reconsideration of the loan cap on new entrants is Sidama Bank. It joined the banking fold last year with 574 million Br paid up capital from 2,000 shareholders, after operating as Sidama Microfinance Institution for 26 years.

Sidama has already hit its credit ceiling a mere two months into the financial year.

"We gave sizeable loans early on," said Tadesse Hatiya, the Bank President.

He indicates that the impact of the loan cap reaches into associated fees obtained during the valuation of assets that will be seized as collateral. He revealed that cost-minimisation strategies such as halting branch expansion are underway to maintain profitability.

Experts contemplate the prospects and perils of policy change for the banking industry.

While acknowledging the effect loan caps would have on inflation, London-based financial analyst Abdulmenan Mohammed forecasts an increase in lending interest rates. He argues the inevitability of credit rationing as borrowers struggle to pay back previous non-performing loans.

Abdulmenan recommends pursuing a capitalisation policy to maintain healthy profit earnings.

"Banks should invest in treasury bills to maintain a high source of income," he told Fortune.

Meanwhile, the decision seems to be fueling panic across businesses that have their lifelines entwined with creditors. Challenges are faced from several directions.

The shake-up in commodity markets is mirrored in the performance of the export sector, which only met 65pc of the target in the first quarter. A 1.06 billion dollars earnings was reported by officials at the Ministry of Trade & Regional Integration while they anticipate earning 1.7 billion dollars from 350,000tns of the country's top export commodity.

Prices of sesame have fallen by a third on the ECX floor over the past three months while coffee, which has been struggling to keep up with international markets, is wilting by the day during peak harvesting season.

"Credit is one of the many problems," said Gizat Worku, manager of the Ethiopian Coffee Exporters Association.

Gizat insists on the importance of calibrating the domestic and global market patterns and enabling the central bank to manage inflation at the same time. He reasons that a large number of intermediaries between the farmers and exporters unnecessarily cause price hikes, further fueling a high demand for credit.

"We won't need too much cash if unnecessary mediums are cut out," he underscored.

The inflation targetting strategy has also caught real estate businesses off guard. A decade and half into the business, Flintstone Homes, relies on outpouring credit from the banking sector to sell properties.

The Company use the sale of finished projects and finance ongoing construction. Although no comprehensive assessments have been conducted on the exact cause, a 50pc decline is observed in sales over the past three months, according to Biruk Shimeles, deputy CEO of the company.

"I presume the loan cap has something to do with it," he said.

Biruk disclosed facing serious challenges to complete 5,000 housing units, exacerbated by rising costs of inputs. Buyers are squeezed for credit to afford homes sold between 69,000 Br to 121,000 Br for a square metre, as title deeds that enable collateral lending will not be transferred until a certain portion of the payments are completed.

Businesses that flourish during seasonal peaks such as the furniture business are also barely keeping afloat.

Medium-scale manufacturers like Tewodros Jida, who runs a furniture workshop, have been feeling the tight monetary squeeze as he relies on the constant imports of materials such as glue, textiles, sponges and wood. Tewodros has requested a three million Birr loan from Awash Bank, the largest private commercial bank, to stock up on inventory during the slow season. However, the prolonged response time is pushing him to look for alternatives.

"I can't miss upcoming holiday sales," he told Fortune.

Economist Arega Shumete (PhD) observes the potential of minimising inflation with monetary policy measures while noting that conflict, imported inflation and political instability also contribute to the galloping price levels in Ethiopia. He cautions against restrictions on investment loans and recommends floating treasury bills to individuals to trim the money supply.

"Only consumer loans should be capped," he said.

PUBLISHED ON

Dec 02,2023 [ VOL

24 , NO

1231]

Editorial | Sep 16,2023

Editorial | May 18,2024

Editorial | Jun 21,2025

Editorial | Jul 22,2023

Fortune News | May 27,2023

Commentaries | Jan 19,2024

Fortune News | Jul 08,2023

Fortune News | Jun 29,2024

Fortune News | Aug 04,2024

Life Matters | May 29,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...