Mar 9 , 2019

By FASIKA TADESSE ( FORTUNE STAFF WRITER )

Effective as of March 1, 2019, the new rate has increased borrowing rates for priority area projects to 11.5pc. Borrowers who export 80pc of their products have been paying nine percent interest, while import substitution companies were paying 9.5pc interest.

Effective as of March 1, 2019, the new rate has increased borrowing rates for priority area projects to 11.5pc. Borrowers who export 80pc of their products have been paying nine percent interest, while import substitution companies were paying 9.5pc interest. Interest rates on loans by the state policy bank, Development Bank of Ethiopia (DBE), have jumped by 2.5 percentage points beginning from this month.

The Board of Directors of the Bank, chaired by Ex-UN staffer Tegegnework Gettu (PhD), issued a new circular that raised the borrowing interest rate two weeks ago. The circular raised the borrowing interest rate for priority area projects and lease financing.

Effective as of March 1, 2019, the new rate has increased borrowing rates for priority area projects to 11.5pc. Borrowers who export 80pc of their products have been paying nine percent interest, while import substitution companies were paying 9.5pc interest.

Priority area projects financed by the Bank include commercial agriculture, agro-processing, manufacturing and extractive industries. DBE also extends a special line of credit for borrowers that operate in the textile, garment and leather and leather product industries. As an additional special line, the Bank offers credit for the procurement of raw materials in the pharmaceutical industry and to companies that supply products to corporate government entities.

The lending interest rate for lease financing has also increased by 2.5 percentage points to 11.5pc. Borrowers running non-priority projects will pay 12pc interest, unchanged from the previous rate.

The lending interest rate of the Bank remains lower than the average borrowing rate in the private banking industry of 13.5pc during the last fiscal year. The total outstanding debt loaned by the banking industry, including the 16 private and two state banks, stood at 111.6 billion Br as of last June.

DBE gives loans under three schemes: long-term, that extends up to 20 years; medium-term that extends from three to five years; and working capital, which can be part of the long and medium-term loans that will be recovered within the loan repayment period.

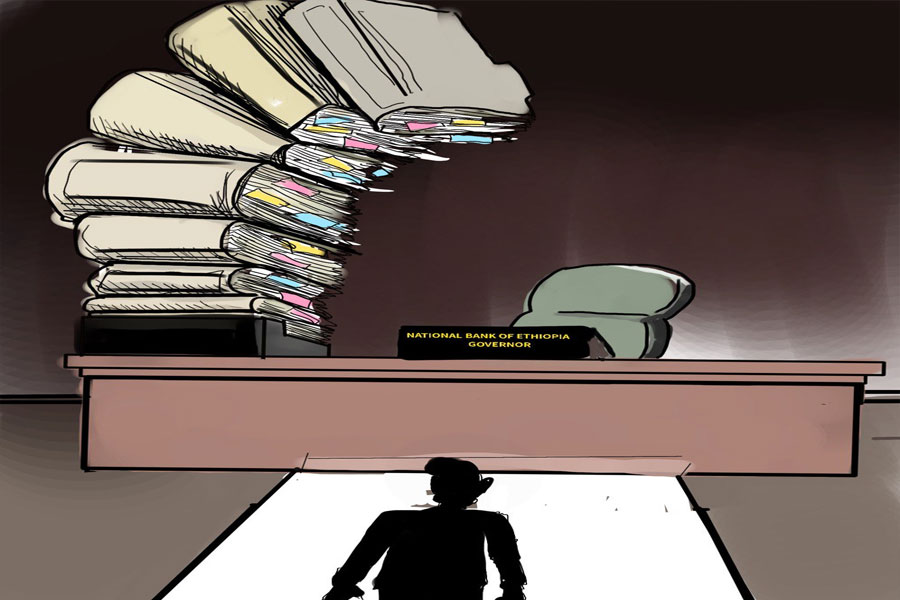

“The main aim of the adjustment is to cover our operational expenses,” said Kifle Haileyesus, director of strategic change and communications at the Bank, which has extended a total of 43.5 billion Br as loans to private borrowers. "The interest rate we pay to the central bank was increased months ago."

The Bank finances long-term projects in the private sector through the National Bank of Ethiopia Bill (NBE Bill), the 27pc bond the commercial banks purchase from the central bank for every loan they disburse.

In 2011, the central bank issued the directive with the primary aim of mobilising savings that would otherwise be used to finance private investors – which accounts for around 41pc of the country’s annual GDP. The finance is through DBE, which has approved 3.94 billion Br loan and disbursed 2.4 billion Br in the first half of this fiscal year and collected 1.03 billion Br loan it has extended to project and lease financing services.

Since the introduction of the NBE Bill market, the total bill purchased by the banking sector reached 21.01 billion Br at the end of the last fiscal year.

For the bonds, buyers were getting a three percent interest yield until last September when the return was pushed to five percent by the macroeconomic committee, which is chaired by Prime Minister Abiy Ahmed (PhD). The commercial banks were getting a three percent yield for the deposit they mobilise, paying a minimum deposit interest rate of five percent.

PUBLISHED ON

Mar 09,2019 [ VOL

19 , NO

984]

Fortune News | Oct 19,2019

Radar | Feb 19,2022

Radar | Feb 25,2023

Radar | Feb 03,2024

Editorial | Jan 28,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...