The Birr was devalued against a basket of major currencies twice over the last almost three decades. The first one was in 1992, when a new government under the late Meles Zenawi devalued the Birr from 2.07 to a dollar to five Birr. Following a series of depreciation since, the National Bank of Ethiopia (NBE) trimmed the currency by 17pc in 2010. Macroeconomists warned of major inflation as a result, and they were not wrong. Inflation picked up following the devaluation and before 2012 had reached 40pc to the exasperation of consumers.

Seven years went by and inflation came down to the single digits until only interrupted by the El Nino-induced drought in the mid-2010s. But in October 2017, the central bank took another slice out of the value of the Birr, this time with officials promising that inflation would not pick up. But it did and currently, together with a creeping 10-cent a day devaluation of the Birr in the last months of 2019, the inflation rate broke past 20pc, an amount as high as in 1992 but half it was recorded in 2008s historical high.

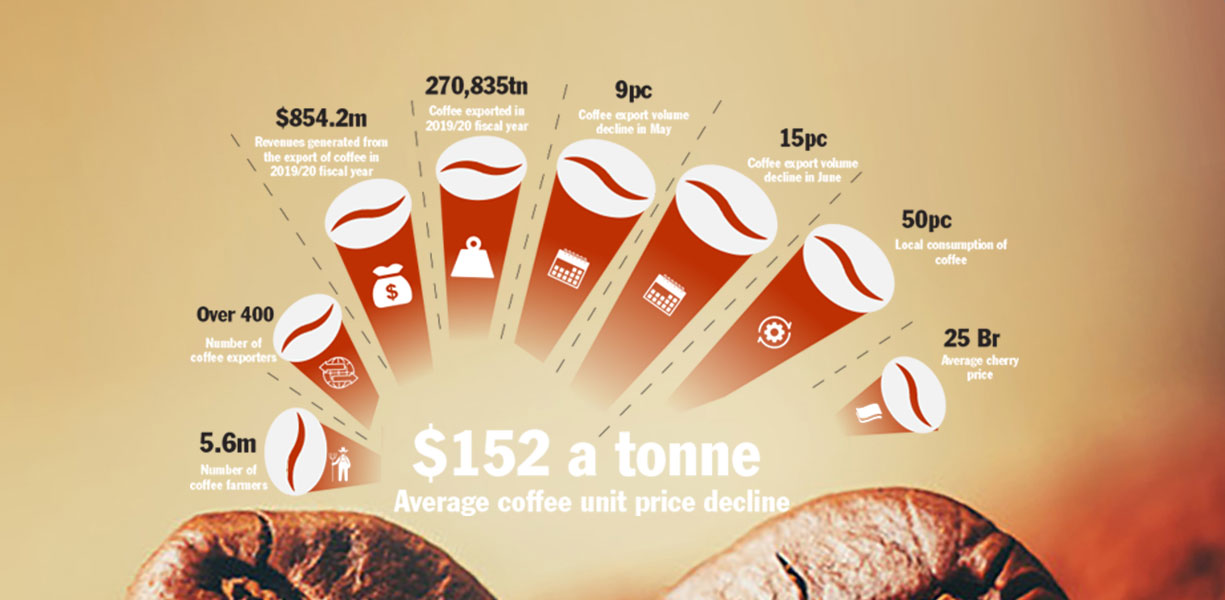

Increasing export earnings had been one of the main justifications for this policy. But neither the devaluation in 2010 nor in 2017 has been followed by an improvement to the state of the external sector. Now, as in then, revenues from the export of goods lies dormant at below three billion dollars.

PUBLISHED ON

Jan 05,2020 [ VOL

20 , NO

1028]

Commentaries | Jan 16,2021

Fortune News | Jul 07,2024

Editorial | Oct 20,2024

Featured | Jan 30,2021

Fortune News | Jul 18,2020

News Analysis | Jan 05,2020

Commentaries | Jun 19,2021

News Analysis | Jan 05,2020

Commentaries | Aug 10,2024

News Analysis | Jan 05,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...