News Analysis | May 25,2024

Feb 15 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

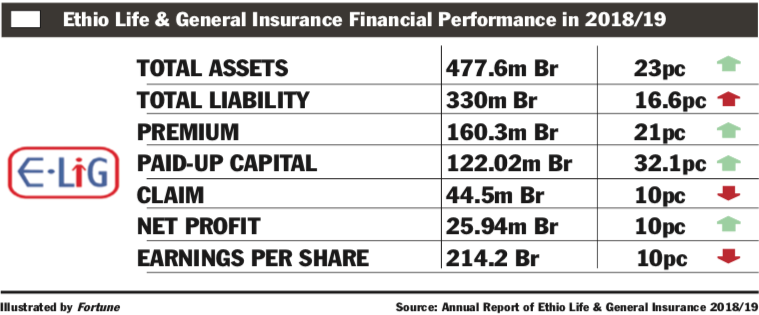

The firm's paid-up capital grew by 32.1pc.

Ethiopian Life & General Insurance Financial Performance in 2918/19.

Ethiopian Life & General Insurance Financial Performance in 2918/19. Despite a considerable growth in profit, Ethio Life & General Insurance's earnings per share (EPS) fell by 10pc in the 2018/19 fiscal year.

The company netted 25.9 million Br in profit, achieving 10pc growth. However, its EPS fell by 21 Br to 214.2 Br. The EPS decline was caused by an increase in paid-up capital, which was boosted by a massive 32.1pc to 122 million Br.

Shimeles G. Giorgis, the company's chief executive officer, explains that the management's effort to increase premium production and diversifying the company’s income streams has contributed to the growth in profit for the company.

The underwriting surplus soared by 34pc to 67.7 million Br, mainly due to a reduction in claims. The total gross written premium both in life and general insurance grew by 21pc to 160.3 million Br.

The company performed well, despite serious and numerous challenges, according to Yoseph Endeshaw, board chairperson of the company.

"Political instability, chronic forex crunch, worsening inflation and fierce competition in the industry were the challenges," remarked Yoseph in his message to shareholders.

The growth rate is remarkable, according to Abdulmenan Mohammed, a financial analyst with close to two decades of experience.

Out of total gross written premium, 43.3 million Br was ceded to reinsurers, leading the retention rate to slightly grow by 0.5 percentage points to 73pc.

Even though the retention rate increased, there is still room for further growth, according to Abdulmenan.

The average retention rate of insurance companies stands at more than 77pc.

Claims paid and provided for went down by 10pc to 44.5 million Br. Over the past few years, claims at the firm have been declining, while the industry is challenged by soaring claims.

"This is impressive," noted Abdulmenan.

Careful underwriting and claims management practices are the main reason for claim reduction, according to the CEO.

In the reporting period, the company paid 11.3 million Br in commission to agents, an increase of 45pc.

This shows that the firm spent more money to attract customers due to tough competition, according to Abdulmenan.

The involvement of intermediaries in the business also boosted commission payments, according to Shimeles.

"Further, there are major classes of businesses that required a greater commission like bond and engineering-related activities,” Shimeles said.

Ethio Life & General reported a mixed performance in investment activities. Interest earned on time deposits decreased by six percent to 16.6 million Br, whereas dividend income increased by 17pc to just over two million Birr.

The company's expenses expanded considerably due to the expansion of the business. Salaries and benefits went up by 28pc to 30.3 million Br, while general administration expenses spiked by 17pc to 20 million Br.

The expert cautions the management to watch the growth of salaries and benefits.

Last year the company opened two branches, pushing its total branch network to 22, of which 20 branches were for general and two were for life and health insurance. It also has two more contact offices. It gave salary raises to its 185 employees.

The company has transferred 9.5 million Br to its life fund, an increase of 82pc.

The total assets held by Ethio Life & General increased by 23pc to 477.6 million Br. Out of this 148.7 million Br was invested in fixed time deposits, while 47.4 million Br was invested in shares, bonds and properties.

Its capital and non-distributable reserves account for 27.3pc of its total assets.

These investments account for 41pc of the total assets of the company. This proportion is far lower than the preceding year’s ratio of 47.7pc.

This must have been due to increased liquidity, according to the expert.

The company invested in Addis International Bank and other financial institutions. It also bought a seven-storey building with 90 million Br, both contributing to the increase in its total assets. The firm already acquired its own building and is currently building a recovery site.

Liquidity analysis shows that cash and bank balances of Ethio Life & General increased in value and in relative terms. Cash and bank balances soared by 79pc to 73.1 million Br. The ratio of cash and bank balances to total assets went up to 15pc from 10.2pc.

The liquidity level of the firm is twice the average of other insurance companies.

The management should consider reducing its liquidity level by investing more money in income-generating activities, according to Abdulmenan.

Dereje Worku, a shareholder of the firm for the past seven years, says that he is satisfied with the company's performance.

The economic condition of the country challenged the financial industry, according to him.

"Many financial institutions have failed in achieving a considerable profit," he said. "The capital investment is a worthy way in a time where the inflation rate is heavily increasing."

PUBLISHED ON

Feb 15,2020 [ VOL

20 , NO

1033]

News Analysis | May 25,2024

Radar | Dec 12,2020

Fortune News | Oct 14,2023

Fortune News | Jan 25,2020

Radar | Oct 01,2022

Commentaries | Jun 29,2019

Exclusive Interviews | Nov 21,2018

Radar | Dec 12,2020

Fortune News | Mar 18,2023

Radar | Sep 22,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...