Radar | Jun 11,2022

Feb 15 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

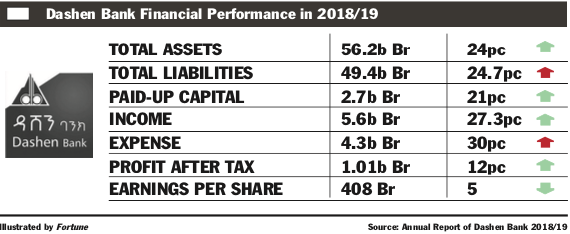

Dashen Bank Financial Performance for the fiscal year 2018/19.

Dashen Bank Financial Performance for the fiscal year 2018/19. Dashen Bank, one of the pioneering private banks, registered a considerable profit growth last fiscal year, yet its earnings per share (EPS) slid slightly due to the sale of more shares.

In the last fiscal year, the Bank netted one billion Br in profit, a 12pc increase from the preceding year. Its EPS, which has been in a spiral of decline in the past couple of years, fell by 28 Br to 408 Br.

While declining between 2013 and 2017, the fall in EPS lightly reversed two years ago until it fell again last year.

The reduction in EPS was due to slow-growing profit coupled with a considerable increase in paid-up capital, according to Abdulmenan Mohammed, a financial analyst based in London, the United Kingdom.

Dashen's paid-up capital grew by 21pc to 2.7 billion Br, making it the second-most capitalised private bank, next to Awash that has a paid-up capital of 4.4 billion Br.

“Unless the management comes up with strategies to increase profit after tax or change its capitalisation policy," said Abdulmenan, "further reduction or stagnation in EPS is inevitable."

However, CEO Asfaw Alemu seems an optimist, pointing to management's work on organisational structure, customer segmentation, deposit mobilisation and resource monitoring.

"After we finalise implementing our five-year strategic plan," said Asfaw, "we'll register positive performance in the coming three to four years."

The strategic plan targets to increase the Bank's capital and maintain investments, which will bring a better profit, according to the CEO.

Dashen has reported mixed results in income-generating activities. It did well in financial intermediation operation and some areas of non-financial intermediation.

Its interest on loans and advances, NBE bonds and other deposits soared by 33pc to 4.3 billion Br and net fees and commissions income went up by 20pc to 788.1 million Br. Yet gains on foreign exchange dealings plummeted for the second consecutive year by 31pc to 101.4 million Br.

"This is very concerning," said the expert, "it needs serious attention of the management."

Neway Beyene, the board chairperson of the Bank, stated that the disappointing performance of exports, the chronic forex crunch and spiraling inflation were headaches for the Bank.

"These have been big and persistent challenges," remarked Neway in his message to shareholders in the annual report.

Asefaw said that the foreign currency earnings of the Bank through remittances, exports, SWIFT and cash exchange, in fact grew marginally by 1.5pc.

"However, the dismal performance in exports and the continued wide gap in exchange rates of the official and parallel markets had impacts on the process," said Asfaw.

Dashen disbursed loans and advances of 32.4 billion Br, an increase of 40pc, while mobilising 44.7 billion Br in deposits, an increase of 22pc. This made the loan-to-deposit ratio of the Bank go up by eight percentage points to 72pc.

“This is a remarkable performance,” commented Abdulmenan.

Dashen reversed its provision for impairment of loans and other assets by 14.1 million Br.

"Such a massive reduction helped Dashen improve its profit performance," said the expert, "this indicates that the level of credit risk was well controlled."

In line with expansion in business, the expenses of Dashen increased. Interest paid on deposits soared by 35pc to 1.9 billion Br. Salaries and benefits increased by 27pc to 1.4 billion Br, while general administration expenses went up by 28pc to 752.8 million Br.

In the reported period, the Bank raised its time deposit interest rate based on the demand of clients, according to the CEO. He also added that due to the new organisational structure that was implemented last year, the Bank increased salaries.

Branch rental costs spiked, as well as growth in promotional, stationary and health insurance for employees, according to Asfaw.

Dashen's assets increased by 24pc to 56.2 billion Br. The investments in NBE five-year bonds increased by 21pc to 12.3 billion Br. These investments account for 22pc of total assets and 27pc of total deposits of the Bank.

Liquidity analysis indicates that the liquidity level of Dashen decreased in value and relative terms. Its cash and bank balances drifted down by 15pc to six billion Birr. Its ratio of liquid assets to total assets fell to 11pc from 15.5pc. Dashen's ratio of liquid assets to total liabilities also decreased to 12pc from 17.8 pc.

"This must have been due to increased lending activities," remarked the expert.

The management of Dashen should take extra caution from a further reduction of the liquidity level, according to Abdulmenan.

Asfaw, who believes that a Bank's achievement is measured by its loan provision, argues that the Bank was using its cash efficiently and it invested based on its plan.

Dashen has capital and non-distributable reserves of 5.1 billion Br and a capital adequacy ratio (CAR) of 15.9pc.

This shows that Dashen is a well-capitalised bank, according to Abdulmenan.

PUBLISHED ON

Feb 15,2020 [ VOL

20 , NO

1033]

Radar | Jun 11,2022

Radar | Sep 11,2020

Fortune News | Jun 05,2021

Agenda | Oct 16,2021

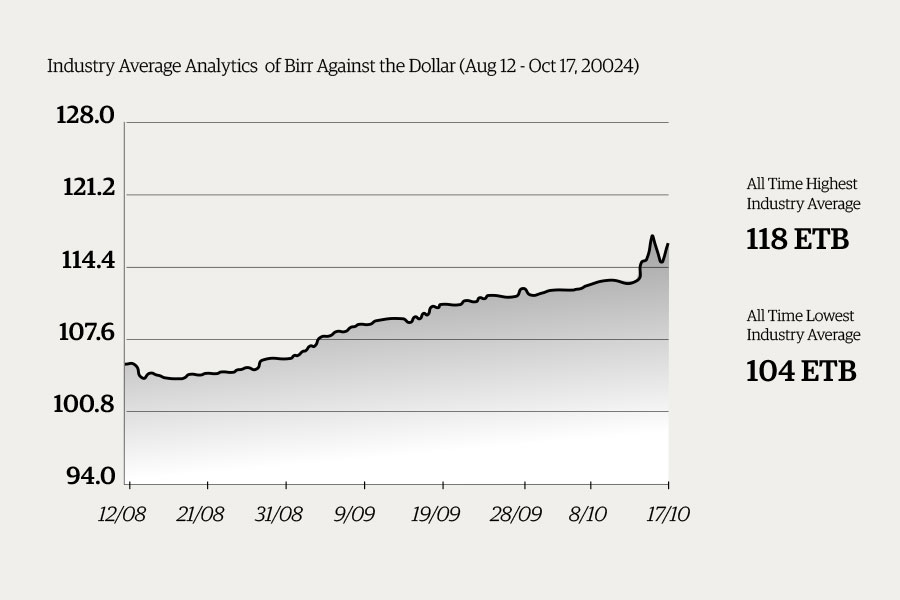

Money Market Watch | Oct 20,2024

Fortune News | Mar 28,2020

My Opinion | Jan 03,2021

Fortune News | Dec 07,2019

Radar | Mar 14,2020

Agenda | Apr 13,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...