Tasty Foods Plc, a leading manufacturer of popular snack brands "Tasties" and "Jolly Jus", has ceased operations after 24 years of market prominence. The company, a family-owned enterprise under the BekDes Group, has fallen victim to the persistent foreign currency shortages that have hindered its operations in recent years.

Abera Belete, the general manager of Tasty Foods, delivered the unsettling news to the company's remaining 37 employees on December 19, 2023. He attributed the shutdown to the insurmountable difficulty in importing essential inputs due to an acute shortage of foreign currency. The employees have been furloughed until further notice, marking a significant end to a period characterised by creativity in promoting snacks and market leadership.

Tasty Foods' journey over the past five years has been fraught with ordeals. The company had to pass through significant workforce reductions and a drastic decline in production capacity. From its peak in 2020, the production levels for Jolly Jus plummeted to just a fifth, and for the iconic Tasties snacks, to a mere tenth. Despite efforts to stabilise operations, the company had to cease production in June this year, with the last of its products shipped over the preceding two months.

The company's Corporate Managing Director, Eyob Bekele, son of the late founder Bekele Abeshero, remains upbeat about the company's resurgence. Despite the halt in production, he attributed it to a temporary delay in input delivery and firmly stated that the company would not close permanently.

"We won't close down," he told Fortune, rather emphatically.

His words of hope hardly resonate with employees such as Mare Gete, a 35-year-old employee with a 16-year tenure at Tasty Foods. With a monthly salary of 4,300 Br, she questioned the likelihood of returning to work, considering the company's current state.

Workers who most averaged 4,000 Br wages had their mandatory attendance progressively cut down with a final slash to three-day weeks until they were told not to come in last week.

Incorporated in 1993, Tasty Foods is part of a conglomerate that includes other ventures like Desta Plc, Ethiopia's first private plastic shoe factory, along with businesses in fitness equipment and import-export. The company gained overseas recognition, expanding its market to Djibouti and Dubai, propelled by the popularity of its three types of Tasties flavoured snacks. However, financial hardships in recent times compelled the company to sell its Jolly Jus products at reduced prices to settle debts.

The foreign exchange crunch Tasty Foods faces mirrors the broader struggles within Ethiopia's manufacturing sector. The company will be one more addition to the approximately 450 of nearly 5,000 firms ceasing production due to the adversities.

Despite efforts to boost the sector, including the establishment of 13 public and five private industrial parks since 2000, the manufacturing sector has seen a worrying decline, with its contribution to the GDP shrinking by 1.5 percentage points to 4.4pc last year.

Research released a few weeks ago by the UNDP-Ethiopia blamed security deterioration, particularly in the Oromia and Amhara regional states, for significantly affecting business operations. There has also been an exodus of foreign firms from many industrial parks, mainly due to the conflicts, AGOA suspension, and growing insecurity, leading to many firms operating at only around 30pc capacity. The parks have attracted substantial foreign direct investment (FDI) of 740 million dollars and created over 150,000 jobs, particularly for women, with manufactured exports reaching half a billion dollar in 2023.

However, this only accounts for less than one-fifth of Ethiopia's total exports, with only five percent of manufacturers, characterised by small-scale operations, supplying overseas markets. Product diversification is limited in the sector, with over half the total production comprising food products, beverages, non-metallic minerals, and textiles/apparel. The manufacturing sector only meets 38pc of domestic demand, with 62pc of needs being met through imports.

A major importer of raw materials, Tasty Foods primarily sourced maise from South Africa. However, attempts to switch to local produce two years ago faced severe setbacks. Despite being the third-largest maise producer in Africa, with an annual output of 6.5 million tons, Ethiopia's maise varieties are unsuitable for industrial production; farmers consume them.

Yonas Moges (PhD), a botanist at Haromaya University, confirmed the main differences between South African and Ethiopian maise. South African Maise, suitable for industrial processing due to its dry nature, contrasts with Ethiopia's highland produce, which is high in moisture. Tasty Food's attempt to use local maise for production was unsuccessful, signalling the need for further research into viable alternatives for industrial use, according to Yonas.

The company's predicament also raises concerns among its workforce about job security and the impact of inflation. Tasty's Trade Union, led by Fasil Tesfa, expressed these concerns in a letter to the Confederation of Ethiopian Trade Unions (CETU) last month. He revealed his anxieties over impending layoffs and the impact on his members from the rising cost of living. Employees, already facing reduced work hours, now confront an uncertain future.

"There is a prevailing sense of worry," said Fasil.

According to Dereje Waktola, president of the Federation of Food, Beverages & Tobacco Unions, Tasty's difficulties reflect national challenges related to foreign currency, not labour violations. The Union's focus is now on ensuring adequate severance packages in the event of layoffs and preserving job security should operations resume.

"We can't do much to reinstate the workers," he told Fortune.

As the curtain falls on the illustrious journey of Tasty Foods Plc, questions linger about the broader implications for the manufacturing sector and the urgent need for systemic reforms to fortify the resilience of businesses in the face of economic tribulations.

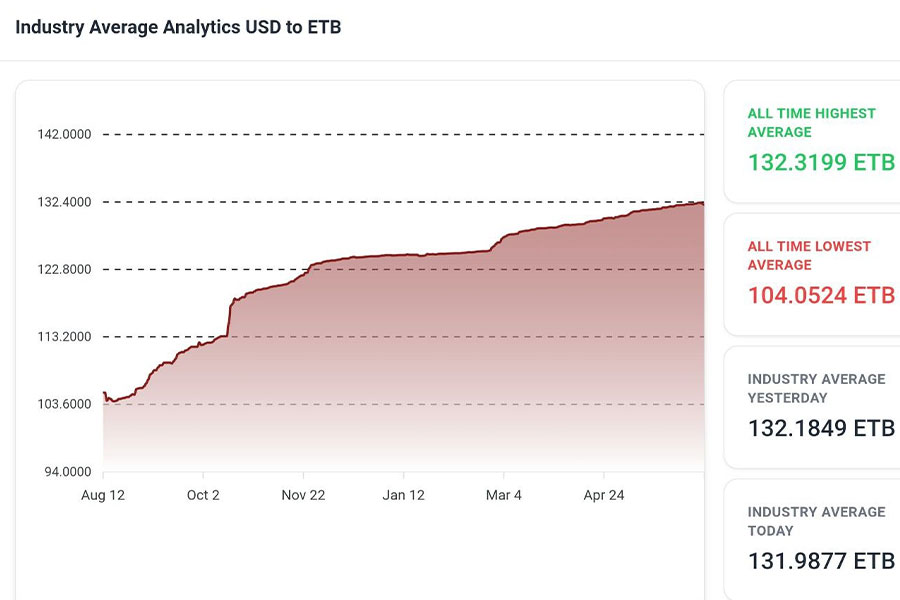

Samson Tsedeke, general manager of MultiLink Consulting, pointed out the importance of addressing the root causes of the foreign currency issues for long-term solutions. According to Samson, strategies are urgently needed to focus on export performance, debt restructuring, and careful management of the foreign currency market. He warned against the hasty devaluation of the Birr, cautioning against macroeconomic instability.

"It [the government] has to find a way to secure forex for a reasonable period," he said.

PUBLISHED ON

Dec 23,2023 [ VOL

24 , NO

1234]

Fortune News | Jan 25,2020

Verbatim | Jul 07,2024

Agenda | Apr 06,2019

Money Market Watch | Jun 15,2025

Agenda | Apr 22,2023

Radar | Aug 06,2022

Editorial | Apr 09,2022

Fortune News | Jun 03,2023

Fortune News | Jun 01,2019

Featured | Jun 22,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...