The banking industry has transformed from traditional branch banking to internet banking. Globally, distinctive types of banking and financial institutions are adopting advanced technologies to keep pace with the era of digital transformation. An increasing number of smartphone users preferring accessing banking services through their mobile devices has led the bank providers to shift from traditional banking to digital banking. However, it is crucial for banking organizations to realize that the capabilities of digital banking are not just limited to online or mobile banking. These capabilities have a broader scope from a customer standpoint.

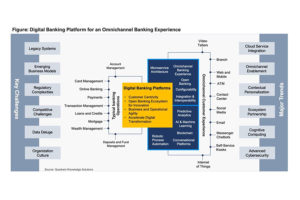

A digital banking platform enables banks to drive their digital transformation initiatives and provide customers with a seamless and cohesive banking experience across all digital touchpoints. The platform serves as a framework for financial institutions to gain full control over their digital strategy and allow them to modify and optimize aspects of their operations across every device and channel. On the other hand, it enables customers to easily manage their accounts, make transfers, and monitor financial status in real-time.

A digital banking platform capacitates to upgrade the traditional banking systems, automate business operations, incorporate channels, and consolidate data for a single view of the customer. The platform also works as a conciliator that integrates with prevailing architecture and links with the banking ecosystem through open APIs. Digital banking platforms are helping banks in strengthening and rebuilding their core banking system. The platform has emerged as a system that is helping banks to thrive in this digital age with a holistic perspective.

The key differentiators for digital banking platforms include ease of deployment and ownership experience, configurability versus customization, comprehensive out-of-the-box capabilities, integration & interoperability, ability to drive real-time personalized engagements, and product strategy and vision to align with future transformational banking models. Open banking is also acting as one of the key differentiators in the digital banking space. A digital banking platform promotes an open banking approach that supports third-party integrations for accessing accounts with customers’ consent, achieving greater financial transparency for consumers, and leveraging open-source technologies through various frameworks.

It is preparing financial institutions for the API economy with features that comprise an API gateway and API management, consent management, developer portal and sandbox, PSD2 compliance, strong customer authentication, and more. Moreover, open banking is empowering banks by driving increased partnership opportunities, accelerating time-to-market, discovering monetization opportunities, and enabling product enhancements by leveraging AI capabilities.

As the banking industry embraces digitization, delivering a secure, reliable seamless digital customer experience has become crucial. The emergence of AI/ML across the banking ecosystem is enabling organizations to introduce new capabilities and transform their processes. Technologies such as robotic process automation (RPA), enabling banking organizations to drive automation for labor arbitrage processes, have gained prominence.

These technologies are helping banks simplify repetitive human tasks, improve customer experience, and optimize end-to-end processes. As a result, several banks and financial institutions are partnering with financial technology providers to leverage the AI/ML, RPA capabilities and gain a competitive advantage by eliminating the operational overheads. Digital banking platform providers are focusing on building in-house AI/ML capabilities, which can be injected into the packaged digital banking platforms. This, in turn, will enable financial institutes and banks to deliver personalized services, achieve optimum STP rates and drive augmented marketing.

The digital banking ecosystem is undergoing a rapid transformation, compelling vendors to expand their R&D budgets and make continuous enhancements to their software value proposition to serve the futuristic customer banking needs. Users should evaluate digital banking platform vendors that offer a robust technology strategy and roadmap for enhancing their software features & functionalities, as well as a SaaS strategy that is aligned with the emerging transformational trends. The vendor's ability to accommodate emerging technology trends, including artificial intelligence, machine learning, cognitive operations, and a truly open & unified platform, is crucial for delivering a sophisticated digital banking solution.

Quadrant Knowledge Solutions’ SPARK Matrix: Digital Banking Platform, 2022 research includes a detailed analysis of the global market regarding short-term and long-term growth opportunities, emerging technology trends, market trends, and future market outlook. The study provides a comprehensive market forecast analysis of the global market in various geographical regions and the overall market adoption rate as well. This research provides strategic information - for technology vendors to better understand the existing market, support their growth strategies; and for users to evaluate different vendors’ capabilities, competitive differentiation, and market position.

The research includes detailed competition analysis and vendor evaluation with the proprietary SPARK Matrix analysis. SPARK Matrix includes ranking and positioning of leading digital banking platform vendors with a global impact. The SPARK Matrix includes analysis of vendors, including Backbase, Coconet, CR2, Data Center Inc, EdgeVerve, Finastra, Fisa Group, Fiserv, FIS, Infrasoft Tech, Intellect Design Arena, Oracle, Sandstone Technology, SAP, Sopra Banking Software, Tagit, Tata Consultancy Services, VeriTran, and Zentity.

Market Dynamics and Trends

The following are the key research findings of Quadrant Knowledge Solutions, Digital

Banking Platform research:

from on-premises to cloud deployment to ensure they achieve greater scalability, security, and reliability.

While most vendors may provide all the core functionalities, the breadth and depth of the capabilities may differ by different vendors’ offerings. Users should evaluate digital banking platforms that offer comprehensive capabilities to provide seamless connectivity to legacy core banking systems, a broad range of out-of-the-box functionalities, scalability & extensibility, omnichannel banking capabilities, 360-degree unified customer visibility, advanced analytics, business process automation, personalized engagement, support for multiple public cloud platforms, and such others.

The vendors' capability to offer a truly open platform is vital for enhancing the customer ownership experience. Additionally, the vendor's customer value proposition may differ in terms of ease of deployment, ease of use, price/performance ratio, support for a broad range of digital banking use cases, global support service, and such others.

SPARK Matrix Analysis of the Digital Banking Platform Market

Quadrant Knowledge Solutions conducted an in-depth analysis of the major Digital Banking Platform vendors by evaluating their product portfolio, market presence, and customer value proposition. Digital banking platform market outlook provides competitive analysis and a ranking of the leading vendors in the form of a proprietary SPARK MatrixTM.

SPARK Matrix analysis provides a snapshot of key market participants and a visual representation

of market participants. It provides strategic insights on how each vendor ranks related to their competitors based on their respective technology excellence and customer impact parameters. The evaluation is based on primary research including expert interviews, analysis of use cases, and Quadrant's internal analysis of the overall Digital Banking Platform market.

According to the SPARK Matrix analysis of the global Digital Banking Platform market, “CR2, with a robust functional capability of its BankWorld Digital banking platform has secured strong ratings across the performance parameters of technology excellence and customer impact and has been positioned amongst the technology leaders in the 2022 SPARK Matrix of the Digital Banking platform market.”

CR2 in the Digital Banking Platform Market

Founded in 1997 and headquartered in Dublin, Ireland, CR2 is a provider of digital, selfservice, and payments solutions. The company offers a digital banking platform BankWorld, that enables banks to optimize end-to-end digital customer journeys across mobile, internet, self-service, and payments in a cost-effective manner. The platform includes an integrated ATM switch, a card management system, an internet banking system, a mobile app, and omnichannel innovation modules.

CR2’s BankWorld platform offers comprehensive capabilities, including servicing multiple lines of business, onboarding and account origination, off-the-shelf banking services, channel technology, single view of customers, digital sales and marketing, digital tooling framework, entitlement and segmentation, convergence of physical and digital channels, and integration and API framework.

The BankWorld platform enables banks to cater to all the operational lines of business, including SME, retail, private, and corporate agencies. CR2’s facilitates banks to serve these lines of business with the adoption of its unified platform, which constitutes native segmentation services, UX design tools, digital tooling, user entitlements, and configuration capabilities.

The BankWorld platform offers comprehensive self-registration, onboarding, and origination capabilities to deliver a frictionless experience for new and existing customers. The platform allows banks to configure these capabilities based on their requirements or select other platforms that offer off-the-shelf self-registration and onboarding options.

The BankWorld platform provides easy and simple user registration/app activation for users. The platform allows users banks’ customers to verify their credentials based on several bank specific validation criteria through automated scanning services during the process of registration. The platform also offers an integrated digital account origination feature that allows banks’ customers to access the account origination service by selecting the product subscription dashboard following the onboarding or registration process.

The BankWorld platform offers configurable off-the-shelf capabilities which enable banks to provide onboarding, payment, and inquiry-related online banking services. The platform provides a built-in digital experience (DX) tool that banks can leverage to customize the responsive design enabled UX as per their requirements. The BankWorld platform is embedded with the BankWorld channel database that offers 360-degree customer-centric visibility from both banks and customers’ perspectives. This database serves as a reference point for banks in understanding customer actions and performing behavioral analytics.

The BankWorld platform enables banks internal users, including support staff, relationship managers, call centers, etc. to leverage administration tools to assist customers from onboarding, transactional to service inquiries process. CR2’s digital banking platform is underpinned by shared channel technology, Integration framework, business logic and user experience layers. The modular platform components are offered as part of core configuration and are capable to manage shared integration services, 24x7 channel database, core business logic and open banking framework.

The BankWorld platform provides banks with digital sales and marketing support to customize products and services and deliver a personalized experience. It enables banks to design and execute actionable and targeted smart campaigns for enhancing crossselling and upselling opportunities.

Banks can utilize the platform’s analytics support or business intelligence module to automatically deliver these targeted campaigns to specific audiences. Additionally, the platform allows banks to provide tailored optimized banking services to every customer and coordinate it with their lifecycle stages.

The BankWorld platform allows banking organizations to singlehandedly build and configure their own systems by leveraging the native digital tooling framework and API services. Banks can expand their products and services by using their own resources internally. Apart from these, the BankWorld platform also enables banks to easily accommodate various existing as well as upcoming products and services that are relevant to their lines of business.

The BankWorld platform offers entitlement and segmentation capabilities that allow banks to manage and provide services only to their designated customer segments. It allows banks to utilize the configuration tools to create and assign segments directly to the users having a defined set of entitlements. The user entitlements include several consents pertaining to products and services. These entitlements govern the services available to each user within the user experience layer of the platform.

The BankWorld platform supports the convergence of digital and physical channels such as mobile apps, internet, SMS, USSD, and self-service channels, including ATMs and kiosks to deliver exceptional customer banking and payments experience.

These channels help banks and their customers to seamlessly connect and engage with the banking services on the most critical banking channels. The BankWorld platform offers an integration and API framework that enable banks to deploy the platform in any banking ecosystem. The platform offers seamless integration to a very wide range of existing core and middleware systems for quick deployments.

Analyst Perspective

Following is the analysis of CR2’s capabilities in the digital banking platform market:

digital, self-service and payment channels that enables banks to quickly design and launch new products and services and deliver an enhanced customer experience. The platform's key competitive differentiators include the widest range of banking channel software, the ability to merge digital and physical banking channels, flexibility and control, configuration, and digital tooling capabilities, the ability to target customers with relevant banking services, and integration with any banking environment. The CR2 platform is used to serve both B2B and B2C customers, with a focus on payment capabilities.

banking and financial expertise, CR2 is poised to expand its market share in the global digital banking platform market.

tooling capabilities, digital wallet proposition, and advanced analytics to provide a comprehensive understanding of end customers. In addition, CR2 is focused on service innovation to support zero-touch/cardless ATMs across various countries.

PUBLISHED ON

May 03,2022 [ VOL

23 , NO

1149]

Radar | Jul 31,2021

Radar | Nov 20,2023

My Opinion | Dec 25,2021

Films Review | Sep 26,2021

Fortune News | Aug 24,2019

Radar | Jun 04,2022

Year In Review | Sep 10,2021

View From Arada | Feb 20,2021

Radar | May 29,2021

Fortune News | Oct 23,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...