Radar | Jan 07,2023

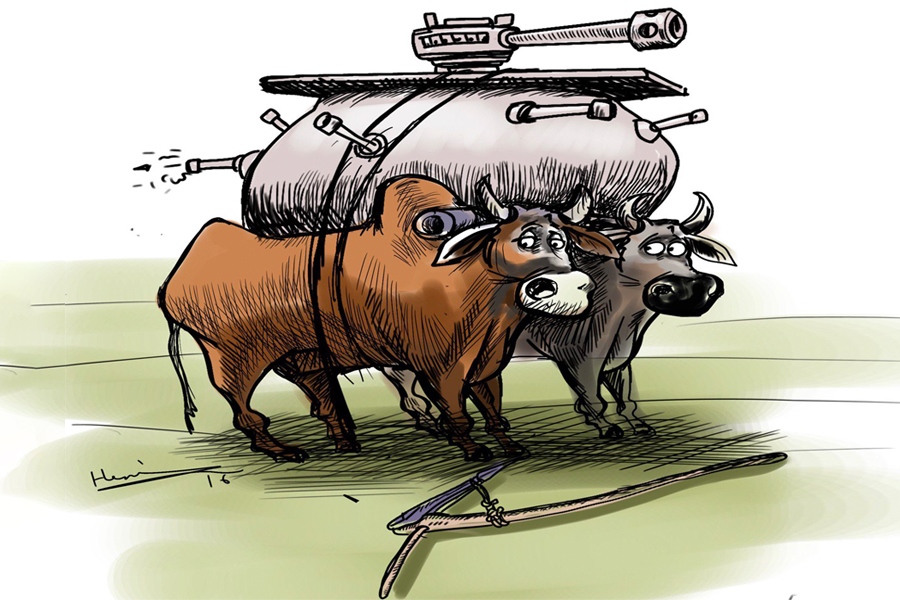

For years, the construction skyline of Addis Abeba has hinted at a promise of an industrial future. But beneath the scaffolds, domestic metal manufacturers face intense pressure from contraband trade and input shortages, threatening to slow the nascent industry. Industry leaders are raising the alarm over a deluge of untraceable reinforcement bars flooding the market, eroding their sales at a delicate time of an already depressed construction industry.

Leaders of the Association of Basic Metal & Engineering Industries (ABMEI), representing 76 steel and metal companies, convened an urgent meeting last month to respond to this grey market, which they believe is hitting their bottom line. Solomon Mulugeta, the Association’s general manager, painted a dire picture of plummeting sales resulting from supply constraints, cumbersome customs procedures, and, most prominently, a sharp increase in contraband steel.

“Despite operating at just 20pc capacity, there is excess supply in the market,” Solomon told Fortune.

Such an imbalance raised eyebrows. Ethiopia’s domestic manufacturers churn out around two million tonnes of steel annually. They retain the industrial capability to boost output six times larger should the conditions be right. Yet, the source of the contraband steel remains shrouded in mystery. People familiar with the industry point their fingers at 70/30 housing initiatives, particularly those under the Addis Abeba City Administration, serving as a cover for the shadowy imports. The alleged misuse of duty-free privileges, intended to encourage investment, also draws Solomon’s ire.

“Domestic producers are increasingly sidelined,” he asserted. “This warrants an investigation.”

Seeking redress, the Association urged officials of a triad of federal agencies - ministries of Mines, Industry, and Trade & Regional Integration for intervention.

Manufacturers’ inquiries date back to over a year ago when an ambitious directive had been in the making by the Ministry of Mines that required justifications for producing at less than total capacity. Although officials indicated the draft would be tabled for discussion, it was a shortlived ambition that vanished into thin air. Meanwhile, the problems persist.

Previous efforts to stave off input shortages saw the Ministry of Mines, under Takele Uma, the former minister, allowing manufacturers direct access to scrap metals from public institutions and the open market. A gesture that, at the time, the steel sector heralded as a significant stride forward. This move was vital for firms like the E-Brothers Steel Factory, a 15-year industry veteran.

Relying heavily on scrap metal for its substantial operation — a 350 million dollars annual revenue at full tilt — the company finds itself in dire straits, operating at a mere five percent of capacity. A two-year drought in foreign currency allocations to the company is attributed to the under performance. The Managing Director, Wondyifraw Belete, owes the factory’s lackluster existence to the limited availability of scrap metals in the local market.

“It’s the only lifeline keeping us afloat,” said Wondyifraw.

The hiatus in large-scale housing projects by the government has further eroded demand. A stockpile of 4,000tn of rebars, valued at about 480 million Br, remains unused. The competition appears formidable compared to steel imported through contraband — 15pc cheaper than its locally produced counterpart. A kilogram of reinforcement bars from the plant with 550,000tn annual capacity has a factory gate price of 120 Br.

“We’re struggling to remain competitive,” Wondyifraw told Fortune.

Managers of Dire Steel Plc, another company in business for a decade, echoed these sentiments. Despite operating at only 20pc of its 360,000tn annual capacity, sales have plunged by 60pc in two years. Sewnet Abeje, the company’s CEO advisor, observed even with a slow construction sector, the decline in sales does not match up unless the grey market is accounted for.

The state’s coffer, Sewnet contended, is feeling the pinch. Without the burden of overhead costs, the grey market can claim a broader profit margin, all while undercutting established players. It caused potentially hundreds of millions in lost tax revenues.

Industry insiders warn more than economics is at play. Safety is at stake, as Sewnet keenly observed. The rebars imported through contraband routes, which increasingly find their way into construction projects, come with no quality assurance.

Academic circles suggest eliminating the duty-free import benefits while focusing on supporting domestic industries.

Mesfin Gizaw (PhD), a notable voice in the industry and lecturer at Addis Abeba University, is a proponent of such a strategy. He believes domestic manufacturers should be prioritised and backed to meet market demands. He also proposed tighter controls on importers seeking duty-free privileges. Yet, he stressed a fundamental challenge.

“Without identifying the source, it’s a leap to label contraband metals as substandard,” he said.

Recent data from the National Bank of Ethiopia (NBE) displayed the weight of the construction sector, which accounted for 72pc of total industrial output and a share of 42pc of the investment projects operational in 2021/22.

While the Ministry of Mines acknowledged receiving whistleblower tips about the rise of contraband steel, formal communication with the industry is pending. Guta Leesse (PhD), head of the Mineral Industry Development Institute (MIDI), emphasised the need for a comprehensive inquiry. Although willing to discuss the issue with the industry’s representatives, regulators have limits to their capabilities.

“Our hands have been full dealing with the illegal gold trade,” he told Fortune.

For now, as the skyscrapers continue to rise, albeit slowly, the foundation of the steel industry seems shakier than ever.

PUBLISHED ON

Oct 21,2023 [ VOL

24 , NO

1225]

Radar | Jan 07,2023

Editorial | Jun 22,2024

Fortune News | Oct 08,2022

Fortune News | Sep 13,2025

Agenda | Sep 10,2022

Fortune News | Apr 30,2021

Fortune News | Apr 22,2023

Fortune News | Jul 30,2022

Fortune News | Sep 01,2024

Fortune News | Jun 15,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...