Commentaries | Apr 24,2021

Oct 30 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Banks are on edge about a central bank directive in the making demanding them to invest in treasury bonds with long-term maturities.

Regulators at the National Bank of Ethiopia (NBE) have drafted a directive that obliges banks to buy treasury bonds with a maturity date of five years. The draft, expected to come into effect in a few months, was distributed to all commercial banks to give feedback.

Industry insiders say that the new T-bond is similar to a directive issued over a decade ago forcing the banks to put aside 27pc of their loans and advances to buy bonds from the state policy bank, the Development Bank of Ethiopia (DBE). The bond had a maturity period of five years and a three percent interest rate, adjusted to five percent after seven years. The unpopular directive was repelled three years ago after the administration of Prime Minister Abiy Ahmed (PhD) came to power.

Designed to serve a different purpose, the directive makes a comeback, redirecting deposits banks mobilise to channel to the federal government through T-bond. Treasury bonds are long-term debt obligations governments enter into financing budget deficits, more than a year maturity periods. The federal budget runs a budget deficit of four percent of the GDP, the highest in decades.

"The T-bond is necessary to bridge the gap in the budget deficit," concedes Fikadue Degafe, deputy central bank governor and chief economist.

The budget deficit has reached 125.6 billion Br. The central bank plans to finance 57 billion Br from foreign finances, excluding loans and grants. Federal officials plan to cover 61pc of the government budget from tax collections.

"Local sources like T-bond will cover the rest," Fikadu told Fortune.

The total outstanding T-bills sold to banks amounted to 116.6 billion Br at the end of the last fiscal year, about 391pc higher than the previous years. The participation of commercial banks in the T-bill auction market has shown a significant jump in recent years. They accounted for 52 billion Br, 44pc of the total outstanding T-bills, whereas other buyers, such as pension funds, bought 64.5 billion Br.

The authorities do not seem to budge. The directive regulators write demands banks to invest 20pc of their new loans and advances in buying T-bills yielding an interest rate two percentage points higher than what the banks pay depositors.

However, industry players fear the new directive to fuel the liquidity crunch they are struggling with. Last year, the central bank instructed commercial banks to invest one percent of their loans and advances in buying bonds issued by the DBE, which collected 10.5 billion Br.

Markos Alemu, head of fund management at Wegagen Bank, would like to see the authorities reconsider the proposed ratio by half, considering the DBE bonds private banks buy. Wegagen Bank spent 1.18 billion Br buying T-bills, half the amount it purchased 28-day and 91-day bills a year ago. These are short-term bills the central bank regularly sells, with a maturity time from 30 days to one year.

Experts say that the average maturity time for loans is three years, urging regulators to set this as a benchmark for the bond's maturity period.

The fourth-generation Ahadu Bank is one of several to join the industry over the past year. It enters the market with over 564 million Br in paid-up equity raised from 10,000 shareholders. The President, Eshetu Fantaye, believes that raising revenues from efficient loan disbursements helps to cope with the regulatory requirement. However, forcing banks new to the industry to spend their deposits on various bonds erodes their liquidity base and undermines their position to disburse loans, according to Eshetu.

"The impact will be seen on the profit and lower dividends which won't attract new shareholders," said Eshetu, who has vast experience in the domestic banking sector.

Ahadu commenced its operation two months ago after securing the operational permits following the footsteps of Amhara Bank, entering the industry with six billion Birr in paid-up capital from a little over 160,000 shareholders.

Birhanu Balcha, head of finance at Awash Bank, echoed Eshetu. Domestic banks need to enhance their capital base by offering shares to the public to consolidate their position in a market that foresees the arrival of foreign investment in the financial sector.

"The new bill will not be helping," he told Fortune.

Awash Bank is a highly capitalised private bank, surpassing the minimum threshold capital requirement central bank set. It has reached a paid up capital of 8.2 billion Br.

For Atelaw Alemu, an economist, the introduction of the new treasury bond shows the inability of the government to settle its public debt in a short period and face a large budget deficit.

In the current inflationary economy, demand for long-maturity bills from private banks could undermine their liquidity position unless the return is high and more compensating, said Abdulmenan Mohammed, a financial analyst based in London.

PUBLISHED ON

Oct 30,2022 [ VOL

23 , NO

1174]

Commentaries | Apr 24,2021

Election 2021 coverage | Jan 13,2020

Radar | Nov 06,2021

Fortune News | Jun 24,2023

Viewpoints | Jan 09,2021

Agenda | Nov 09,2019

Commentaries | Sep 17,2022

Radar | May 23,2021

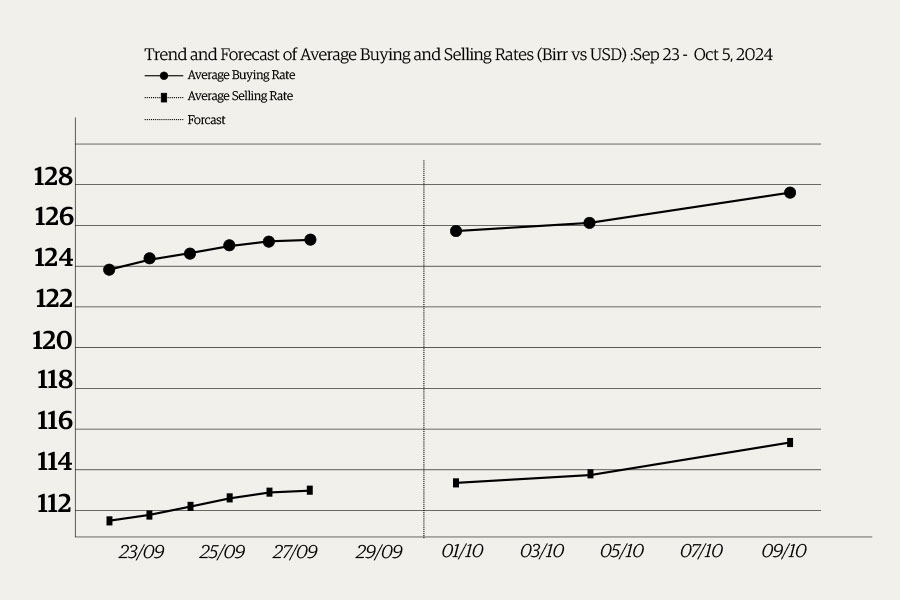

Money Market Watch | Sep 28,2024

Viewpoints | Jul 26,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Nov 1 , 2025

The National Bank of Ethiopia (NBE) issued a statement two weeks ago that appeared to...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...