The notion that Ethiopia, as the birthplace of coffee, receives a fraction of what consumers pay for their cups is becoming a thing of the past as farmers' earnings continue to rise. They sell a kilogramme of export-standard coffee, also known as the cherry bean, for as much as 55 Br a kilo, double the amount they used to get a year ago.

Representing thousands of these farmers unionised in Sidama Coffee Farmers’ Cooperative, Zerihun Kamiso could not be happier about this. Established two decades ago, the Union has 50 cooperatives with 80,000 smallholder farmers under its wings. These and thousands of other smallholder farmers produce nearly 95pc of the 584,000tns of coffee Ethiopia produces annually.

But coffee farmers had a much smaller share of the price in the value chain than other coffee exporting countries, according to Zerihun.

"They deserve more," he said.

Zerihun refers to 15pc of the 110 million population engaged in the coffee value chain from farm to export.

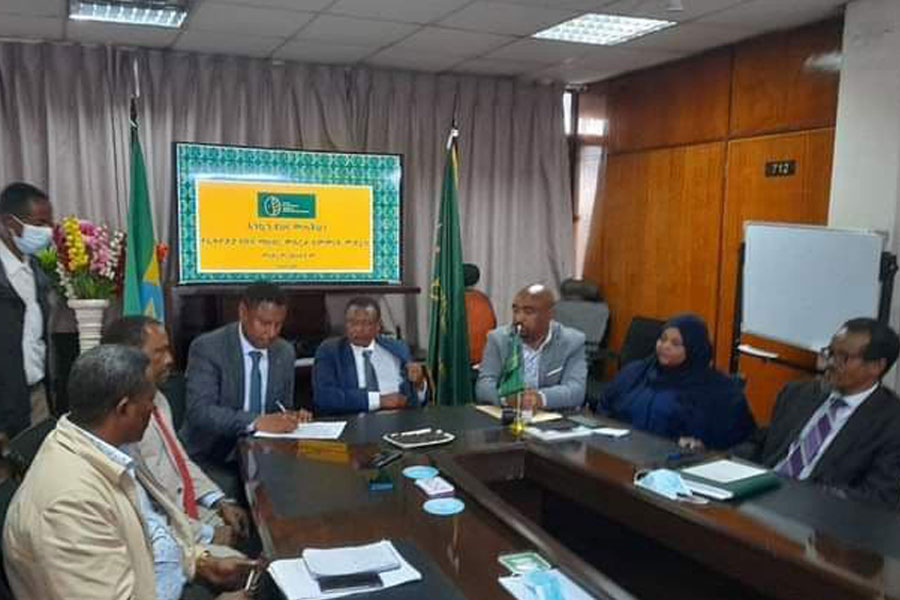

Industry insiders attribute the growing share these farmers have begun to enjoy to the introduction of vertical integration, enabling exporters to source coffee directly from suppliers and farmers. First introduced in 2017 by the Ethiopian Coffee & Tea Authority, the system took off over the past year, attracting many in the industry due to its relative simplicity and low red tape. Officials at the Authority also attribute vertical integration to the record coffee export revenues of 907 million dollars registered last year.

Exports have seen remarkable growth this year, too. Ethiopia has exported nearly 109,000tn of coffee over the past four months, equivalent to 40pc of the total volume sold to the world last year by Ethiopia. The shipments have generated a whopping 417 million dollars.

However, not everyone is keen to praise vertical integration for the recent success.

Gizat Worku, general manager of the Ethiopian Coffee Exporters Association, claims the system has brought more harm than good.

“Prices are negotiated between the seller and buyer; it is difficult to know the true value of the commodity," he said.

Still, improved earnings for coffee farmers have not turned exporters away. Yet, prices for coffee on the domestic market are going higher than in the international market. According to the International Coffee Organisation, the average price of a kilogramme of coffee from Ethiopia goes for around five dollars. A kilo of export-standard coffee sells for about six dollars in local markets, albeit with additional transportation and administrative expenses.

The disparity that appears illogical off the cuff has an underlining rationale that makes sense. Exporters have little interest in making their margin from the exports of coffee as much as they do from accessing foreign exchange to pay for imports. The latter offers them tremendous profits that dwarf earnings from coffee exports.

Anwar Mohammed, a commodity consultant who works with coffee exporters, observes these trends up close. He exports coffee to buyers in the Middle East on his clients' behalf.

He sees that exporters shipping coffee at a loss to earn foreign currency, which they use to import merchandise in demand locally.

“They are compensated selling the imported items at hefty prices,” he told Fortune.

Gizat confirms Anwar's observation. Almost all but those exporting from their own farms sell at a loss.

“Everybody is trying to get forex by hook or crook,” Gizat said.

The authorities were in the know about this long-held practice. Officials of the National Bank of Ethiopia (NBE) issued a rule this year to regulate the unruly market. They want one-third of export earnings and inward remittance transferred to the central bank’s account. Under half of the remaining 70pc is available for the exporters with a retention account; and, the balance should remain with the banks.

Ethiopia has never been a stranger to the severe foreign currency crunch. It is only that the problem has become more pronounced in recent years. The value of Ethiopia's goods and services exported last year was at 3.6 billion dollars, against an import bill of 14 billion dollars in the same year. Although proceeds from remittance fill the deficit in the balance of payments account, an average of five billion dollars has to be covered by officials loans and grants.

Forex is a hard to come by asset even for economic sectors the authorities identified as a high priority and strategic for the national economy. Regulators at the central bank believe many exporters involve in illicit activities, spending their retained earnings on importing non-essential items. They also claim exporters are also engaged in illegal activities such as under-invoicing.

Up to 80pc of the illicit financial outflows leaving Ethiopia, estimated to have reached 30 billion dollars, has been channelled through under-invoicing, according to data from Global Financial Integrity. Known by experts in the field as "trade mispricing", the amount of forex leaving the country represents close to 23pc of the total value of its trade.

Hussein Ambo (PhD) serves as head of the Ethiopian Coffee Growers, Producers & Exporters Association. He is both a coffee farmer and exporter. With his wife, Hussien runs 165ht of coffee farmland and exports between five and 20 containers a year. A single container can hold an average of 19tn of coffee.

Hussien has noted the increasing price of coffee before it reaches the international market. He is confident that losses in the export market will not affect him due to the large supply from his own farm.

"However, coffee exporters should be very careful," Hussien cautions. "We might be left with lots of unsold coffee.”

A similar trend has been observed by sesame exporters in the past. Most buy their sesame from the Ethiopian Commodity Exchange (ECX) for an overpriced value and export the oilseed at lower prices. Much like coffee exporters, players in the sesame industry chose to keep exporting to get their hands on valuable foreign currency.

Experts such as Kiflu Degefe (PhD), a macroeconomist working on trade policy, are worried about the consequences of such activities on the broader economy. Kiflu divides the coffee exporters into "legitimate" that have been engaged in the coffee business only and their "illegitimate" counterparts who are in this business for the sole purpose of generating forex to pay for imports.

"The business of the 'real coffee exporters'," he said, "would be hurt in situations like this."

Undoubtedly, on the receiving end of this unruly market will be the farmers such as those represented by Zerihun in the Sidama cooperative.

PUBLISHED ON

Dec 19,2021 [ VOL

22 , NO

1129]

Commentaries | Apr 30,2022

Fortune News | Sep 04,2021

Sponsored Contents | Oct 25,2021

Radar | May 07,2022

Featured | Jan 07,2023

Fortune News | Sep 26,2021

Fortune News | Sep 26,2021

Commentaries | Jan 31,2021

Agenda | Feb 19,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...