Radar | Oct 23,2021

Sep 6 , 2020

By MAYA MISIKIR ( FORTUNE STAFF WRITER )

The city's housing bureau has prepared a directive that enables all private and government commercial banks to participate in financing the new cooperative housing scheme, where organised associations build, own and operate residential buildings. The bureau has already selected four sites for the scheme, which will prioritise registrants of the middle and low-income housing schemes.

Featuring four to 16 storeys, the designs of the buildings, which will be built in central neighbourhoods, are ready, according to Senait Tassew, head of the Addis Abeba Housing Development & Administration Bureau. The directive also enables home seekers to build houses after the City Administration provided them with land and necessary construction input materials.

This follows the decision of the City Administration's Cabinet under the new Deputy Mayor, Adanech Abebie, to avail land and construction input materials with the aim of alleviating a housing shortage in the capital. During its meeting held a week ago, the cabinet prioritised registrants of the middle and low-income housing schemes who did not receive houses thus far.

The Bureau proposed this following an assessment carried out by the Ministry of Urban Development & Construction intended to address the rising need for housing in the city. Land for the houses, necessary materials for construction and the provision of basic infrastructure like water, sewage, electricity and roads will be facilitated through the Bureau.

The government will play a minimal role in the process, according to Senait, who stated that this was one of the 10 modalities under the 10-year plan of the Ministry to address housing in the country.

"It'll be limited to facilitating financial support from banks, providing the initial designs as options, and availing a list of contractors," she said.

The previous middle and lower-income housing schemes involved only the Commercial Bank of Ethiopia (CBE). Whereas, now all private banks in the country will be included.

The Banks are expected to start announcing their competitive interest rates once the directive becomes activated, she said.

The Bureau, which has built over 300,000 houses since the lower and middle-income housing scheme registration in 2013, currently has 643,000 people still on the registration list. However, only 200,000 of these are still saving on a regular basis.

The Bureau is looking toward five other options that will be availed shortly, according to Senait.

“This is an option that we've provided for those who are financially able to carry out the construction cost themselves,” she said.

Other solutions that will come into play will include joint ventures with investors, public-private partnerships, and those involving contractors and real estate agents to be announced with the coming of the real estate law.

Registrant priority was decided based on various criteria, according to the head of the Bureau.

It was based on how many were waiting on houses, how many were living in the city or outside, how many had paid in full but have been unlucky in the previous raffles thus far, as well as the number of people who have consistently saved over the years.

Prior to the directive, there was extensive work done on building the capacity of the Addis Abeba Building & Design Agency in order that it will, besides providing initial designs for the units, follow up and supervise in a minimal role. Extensive workshops and awareness-raising work with homeowners on the details of the directive are part of the implementation.

As a primal city with complicated problems, the housing in the capital needs to employ different solutions, according to Imam Mahmoud, a lecturer at the Ethiopian Institute of Architecture, Building Construction & City Development and chairperson of the housing department.

The merits of the initiative lie in that it provides one more solution to a problem, according to him.

"There will be a sense of ownership under this project as homeowners are the ones building them, and resources are less susceptible to waste," he said. "Owners of the houses may have in initiative what they lack in experience."

This will also eliminate the need to demolish and redesign public houses that they receive from the government if they do not align with their designs, according to him.

But the government must be careful not to repeat past mistakes made in cooperative housing, according to Imam. These include financing, provision of basic infrastructure and professionals.

"The financing provided by banks needs to be affordable in order that people actually use it," said the expert, "as financing is a critical point that will dictate the success or failure of the project."

It must also ensure that the houses get basic infrastructure like water, electricity and roads just like condominiums, according to him. He also suggested that the government's role is important when it comes to supervision to fill the gap in management.

PUBLISHED ON

Sep 06,2020 [ VOL

21 , NO

1062]

Radar | Oct 23,2021

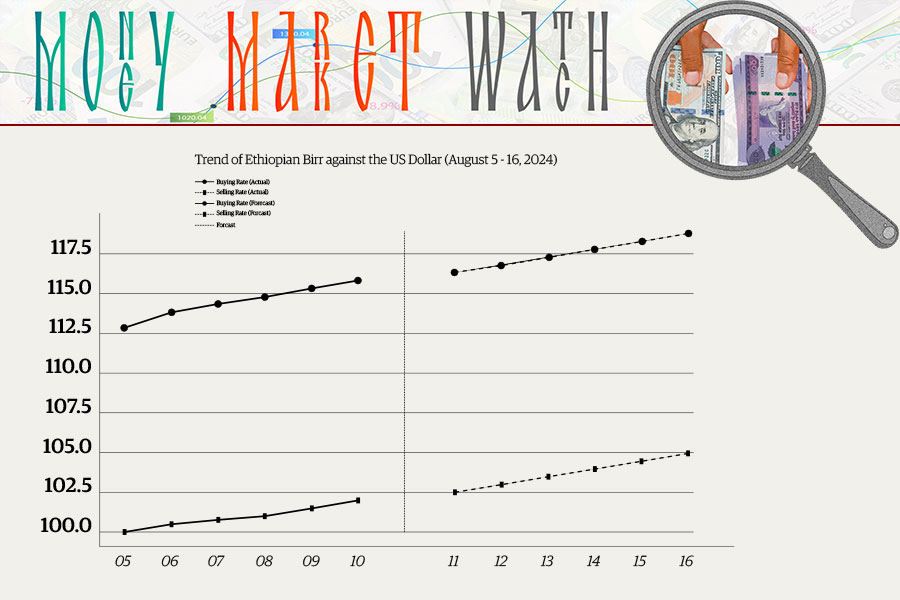

Money Market Watch | Aug 11,2024

Radar | Apr 26,2019

Fortune News | Sep 10,2021

Covid-19 | Jan 30,2021

Covid-19 | Jan 31,2021

Fortune News | Nov 04,2023

Fortune News | Sep 24,2018

Commentaries | Jan 01,2022

Radar | Jan 19,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...