Fortune News | Apr 03,2021

Ethiopian diaspora who are interested in putting money to work in the financial industry can only invest in foreign currency, according to a new directive that is in the making.

Drafted by the National Bank of Ethiopia (NBE), the directive proposes the Ethiopian diaspora, organisations wholly-owned by diaspora and companies jointly-owned by Ethiopians and diaspora only invest in existing and the under formation financial institutions in foreign currency.

The draft directive, which aims at bringing foreign currency into the country, requires the diaspora community to transfer their investment through the SWIFT system. It also stipulates the financial institutions open a blocked foreign currency account for the share sales and report these transactions to the central bank.

The foreign currency that is generated from the share sale will then be fully surrendered to the central bank once the share subscription is completed, according to the draft directive.

“It has become important to attract foreign currency by opening the financial sector to the diaspora," reads the draft directive, "and also strengthen the capital base of financial institutions."

The foreign currency crunch has been the major problem of the economy over the past couple of years. The foreign reserve coverage has been dwindling and even once reached a level that can only cover 1.8 months of import bills.

Showing some improvement, foreign reserve coverage reached 2.7 months of imports as of March 31, 2019. Until the end of the third quarter of the last fiscal year, the net foreign assets of the National Bank of Ethiopia increased by 229.8 million dollars, while that of commercial banks decreased by 105.7 million dollars.

The draft directive came onto the scene following a proclamation that allowed the diaspora community to invest in the financial industry. The proclamation that was legislated by the parliament a few months ago highlighted the need for strengthening the participation of diaspora in the economy, including investment in the financial industry.

The government estimates there are about three million Ethiopian diaspora, but the exact number is not identified. The Ministry of Foreign Affairs has recently announced a plan to conduct a diaspora census in a bid to determine the exact figure of the diaspora community.

Before the legislation of the proclamation, the financial sector was closed for the diaspora community. Three years ago, the central bank ordered all of the private banks and insurers to return the share certificates of non-national shareholders and auction off the shares for public subscription. The central bank has also stated that the amount of money offered above par value has to go to the national treasury.

The new draft directive also proposed the dividends of the shareholders to be paid in the local currency, and it cannot be repatriated. The shareholders can reinvest their dividends, according to the draft directive. The minimum amount of shares to be subscribed to by a member of the diaspora shall be determined by the respective bank, microfinance or insurance company, proposes the directive.

However, Abraham Sium, chief executive director of the Ethiopian Diaspora Association, believes that there are points that are not addressed in the draft.

"How about the returnee diaspora community?" he asked. "Are they expected to invest in foreign currency, while they are living in Ethiopia?"

Abraham also says that the central bank has to involve them in such kinds of lawmaking processes to avoid confusion and to properly address all areas.

The draft received a warm welcome from one of the under formation banks, whose promoters believe it could potentially increase the forex flow into the country and help the financial institutions generate capital.

"It'll help the financial institutions generate the capital, which will not be generated locally," said Munir Husein, promoter and project manager of Zad Bank S.C., which is selling shares to form an entirely interest-free bank.

However, Munir says that the financial institutions will not benefit from the foreign currency, since all of the forex earning will be surrendered to the central bank.

"It will have no benefits for the financial institutions, instead, only benefits for the government," he added.

Habib Mohammed, an expert in the banking sector, also shares Munir’s argument, saying that financial institutions should be benefited by the foreign currency.

He also argues that the new directive could discourage the diaspora community from investment.

"There are many diaspora who have cash and property here and want to invest in the financial industry," he said, "so because of the new directive, they can’t invest."

PUBLISHED ON

[ VOL

, NO

]

Fortune News | Apr 03,2021

Commentaries | Mar 30,2019

Radar | Nov 04,2023

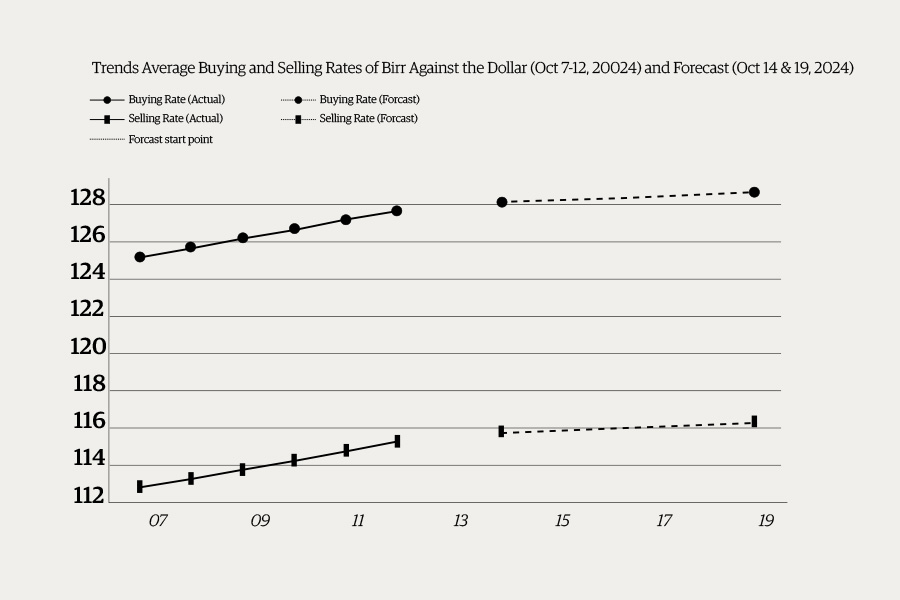

Money Market Watch | Oct 13,2024

Sponsored Contents | Jul 24,2022

Radar | Sep 26,2021

Agenda | Jan 11,2020

Editorial | Aug 19,2023

Radar | Mar 27,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...