Fortune News | Aug 11,2024

Authorities at the central bank have ordered all banks to immediately terminate business relationships with 65 individuals suspected of foreign exchange fraud valued at 13 billion Br. The list includes three businessmen who were found to transfer, in multiple transactions, from 1.1 billion Br to over three billion Br in three months. The authorities have also notified the banks to cut ties with customers suspected of making repetitious account-to-account transactions.

Sent to the banks on January 22, the letter stated that the due diligence carried out showed that the individuals in question allegedly committed forex trading fraud in values ranging from 21 million Br to 3.2 billion Br. Signed by Solomon Desta, a vice governor at the central bank in charge of financial institutions supervision, the letter stated that the alleged illegal transactions took place at 10 banks.

Almost half of the transactions were reported at Wegagen Bank, followed by Lion International Bank and Commercial Bank of Ethiopia (CBE).

Abyssinia, Awash, United, Berhan, Abay, Addis and Cooperative Bank of Oromia were also included in the list with one to five transactions taking place at each.

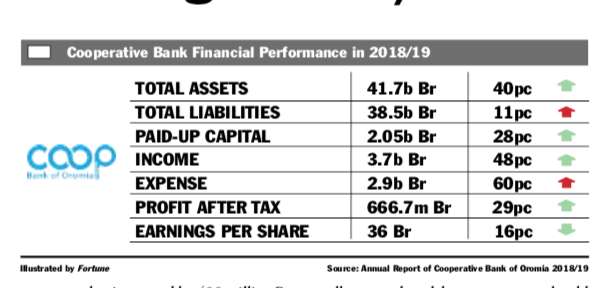

The highest alleged foreign currency fraud was made by an individual named Mohammed Ali, totaling 3.2 billion Br through Wegagen Bank. The second and the third highest values, amounting to three billion Br and 1.2 billion Br, were recorded at Cooperative Bank of Oromia and CBE, respectively.

For the financial sector's safety and soundness, there are basic requirements that banks know their customers and conduct due diligence, according to Solomon.

"However, there were gaps from the banks in complying with these requirements," Solomon told Fortune.

After observing these gaps, the central bank, along with the Financial Intelligence Centre of Ethiopia, carried out the investigation and due diligence in its regular supervision activities, according to him.

Solomon adds that on top of failing to comply with the requirements, the central bank observed that some banks work with unlicensed financial institutions with no physical presence in the country.

"Our mandate is to order the banks to cease services to these individuals," he said. "We left the remaining to law enforcement bodies. We've transferred the list of the individuals and detailed information to the Federal Police for further investigation."

The letter stated that a huge sum of money was withdrawn and credited from and to the banks through illicit transactions in addition to foreign currency fraud. Repetitious daily account-to-account transfers made by a few individuals were traced, according to the letter.

About 531 million Br was debited from banks via illegal transactions, according to the letter. Twenty-three individuals made 30,290 transactions through six bank branches located at border cities, namely Togochale, Qefira, Bullae, Hartishek, Sulul and Jehedin.

The letter also asserted that through 9,580 transactions, 218.2 million Br was credited into the banking system by 33 individuals at different bank branches. Eighteen individuals have also withdrawn 414.8 million Br through 8,047 transactions.

The central bank has also reported that it has identified individuals that made multiple account-to-account transactions between July and September. During this period, 20,178 account holders made more than 1.4 million transactions, according to the central bank.

Last May, the central bank put a cash withdrawal limit on individuals and businesses. Individuals were allowed to withdraw 100,000 Br daily and a million Birr monthly. Businesses were permitted to withdraw 300,000 Br a day and a maximum of 2.5 million Br a month. In October the central bank altered the directive and decreased the daily withdrawal limit to 50,000 Br and 75,000 Br for individuals and businesses, respectively.

Following the currency demonetisation process carried out in September, the central bank has outlawed local money transfer services and the depositing of cash into third-party accounts. It allowed only account-to-account transfers. A few weeks ago, the central bank issued another circular that restricted account transfers to just five a week.

The latest letter from the regulatory bank ordered all of the commercial banks to refrain from opening an account for the listed individuals and from commencing any business relationship with them.

"The customers have been reasonably suspected of engaging in suspicious transactions that include the undertaking of multiple transactions to various recipients for illegitimate and unlawful purposes," reads the letter.

The central bank has also informed the banks to strictly address all shortcomings, including those in technological systems, policies, controls and procedures directed by the anti-money laundering and financing of terrorism proclamation and directive. The banks were notified to rectify the issues by the end of this coming April at the latest.

Other than imposing financial penalties, the central bank will issue "cease and desist" orders to the banks to stop rendering remittance services altogether, as well as suspend and remove members of management if they fail to comply with the guidelines, according to the letter.

PUBLISHED ON

Jan 30,2021 [ VOL

21 , NO

1083]

Fortune News | Aug 11,2024

Fortune News | Dec 19,2021

Radar | Oct 20,2024

Fortune News | Mar 21,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...