Radar | Jun 08,2019

Feb 29 , 2020

By ELIAS TEGEGNE ( FORTUNE STAFF WRITER )

Its positive performance in financial intermediation and non-financial intermediation activities helped the Bank boost both profit and EPS.

Its positive performance in financial intermediation and non-financial intermediation activities helped the Bank boost both profit and EPS. For the second fiscal year in a row, Lion Bank has registered a remarkable performance, increasing its profit by 41pc.

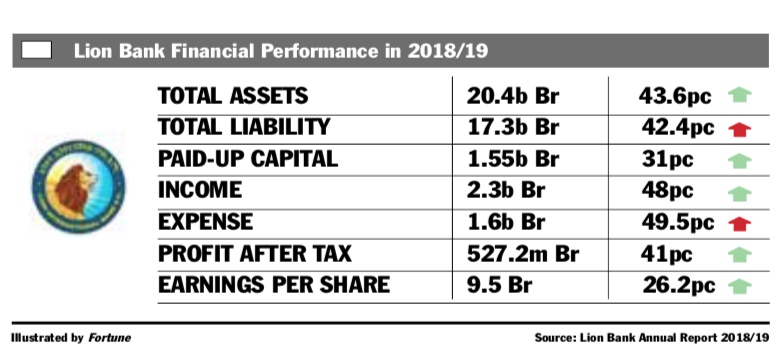

In the reporting period that covers mid-2018 through mid-2019, the Bank netted 527.2 million Br in profit, pushing its earnings per share (EPS) up by two Birr to 9.5 Br.

Its positive performance in financial intermediation and non-financial intermediation activities helped the Bank boost both profit and EPS.

Lion’s income from interest on loans, advances and NBE bonds soared by 43pc to 1.7 billion Br, while fees and commissions went up by 41pc to 221.7 million Br. Gains on foreign exchange dealing soared by 63pc to 86.6 million Br, while other income also soared by 92pc to 237.3 million Br.

This performance is laudable, said Abdulmenan Mohammed, a financial analyst based in London.

“The management should be credited with such good results,” he said.

Commissioning a new strategic plan, rearrangement of the organisational structure and focusing action plans enabled the Bank to retain the momentum of growth registered in previous years, said Getachew Solomon, president of the Bank.

The Bank was able to generate a large amount of foreign currency by maintaining the existing exporters and attracting new ones by offering attractive lending rates, as well as establishing good relationships with NGOs and tour agencies, said Getachew.

The Bank has achieved a strong performance despite the challenges in the local and global economy, according to Tassew Woldehana (PhD), board chairperson of the Bank and president of Addis Abeba University.

"Despite the global and domestic economic challenges that directly and indirectly impact the banking sector," said Tassew Woldehana, "the fiscal year in point was a year of steady and meaningful progress for Lion."

The increase in income was followed by a massive increase in expenses. Interest on deposits spiked by 44pc to 610 million Br. Employees’ salaries and benefits went up by 40pc to 485.6 million Br, and other operating expenses increased by 39pc to 284.6 million Br.

The revised organisational structure and salary scale increased alongside the opening of 39 new branches, all of which forced the Bank to increase its workforce by 941.

This together with the increase in office rent, office equipment, salary and benefits of employees and other administrative costs and operating expenses have forced the Bank to increase expenses, according to the president.

Lion’s provision for loans and other asset impairment soared by 183pc to 142.4 million Br.

“This is a huge increase, and the management of the Bank should closely watch the quality of credit,” said Abdulmenan.

However, the president disputes the need for worry, since the increasing volume of loans and assets forces the Bank to hold provisions commensurate to the assets required in accordance with the International Financial Reporting Standards (IFRS) and NBE’s requirements.

Having adequate provision ensures the Bank’s prudence toward asset management, according to Getachew.

"Though it doesn't face such problems," said Getachew, "the Bank having adequate balance provision strengthens its capacity of managing unforeseen risks and enhances its recovery from problems of uncollected or lost loans."

The balance sheet grew remarkably. Its total assets increased by 42pc to 20.4 billion Br. The loan and advances of the Bank soared by 58pc to 11.6 billion Br. The increase in lending activities also contributed to greater profit performance for the Bank.

The total deposits mobilised by Lion increased by 41pc to 16.4 billion Br, leading the loan-to-deposit ratio to increase by eight percentage points to 71pc.

Such increases in loan-to-deposit ratios have been observed across the industry, according to the expert.

Lion invested 4.2 billion Br in NBE five-year bonds, representing 21pc of the Bank's total assets and 26pc of its total deposits.

Liquidity analysis showed that Lion’s liquidity level increased in value terms but fell in relative terms. It increased its cash and bank balances by 20pc to 3.6 billion Br. The ratio of liquid assets to total assets scaled down to 18pc from 21.1pc, and the ratio of liquid assets to deposits also decreased by four percentage points to 22pc.

The reduction in the liquidity level must have been due to a surge in lending activities, which is shown in the increased loan to deposits ratio, according to the expert.

"Even though increasing the loan-to-deposit ratio brings in more interest income," said Abdulmenan, "Lion should be cautious from pushing it up, as it affects the liquidity of the Bank."

Getachew said that management conducts day-to-day follow up on the liquidity position of the Bank, making sure it is efficiently allocated.

In the reported year, Lion increased its paid-up capital by 31pc to nearly 1.6 billion Br. It achieved a capital adequacy ratio (CAR) of 19pc.

The increased paid-up capital and the achieved capital adequacy ratio indicates that Lion is a well-capitalised bank and needs to use its strong capital efficiently, said the expert.

Abraham Gebreamlak, a founder and shareholder since its establishment, was impressed that, even without strong support from the shareholders, the Bank management achieved remarkable growth and paid a dividend that satisfied them.

“One of the indicators of the satisfaction of the shareholders is their growing interest in investing the dividend in the capital of the Bank,” said Abraham.

PUBLISHED ON

Feb 29,2020 [ VOL

20 , NO

1035]

Radar | Jun 08,2019

Radar | Dec 21,2019

Radar | Aug 17,2019

Fortune News | Jan 19,2019

Radar | Nov 20,2023

Radar | Apr 01,2024

Radar | Jul 29,2023

Advertorials | Feb 26,2024

Radar | Aug 04,2024

Radar | Oct 09,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...