News Analysis | Jul 28,2024

Three weeks ago, Mintesinot Lemma, the general manager of Mintu Plast Plastic Raw Materials Production Plc, imported 22 shipping containers of plastic raw materials from Oman. What should have been a three-day journey turned into a month and a half, as the vessels changed routes navigating the treacherous waters.

"Everything has changed," he told Fortune.

Mintesinot highlights the far-reaching impact of changing routes, citing additional shipping costs, delays in settling payments with banks for letters of credit, and disruptions to production schedules. He elucidated that despite the raw material costs increasing from around 1,000 dollars to 1,350 dollars for a ton in recent shipments, the supply remains only sufficient for a 45-day production cycle.

With 12 years of operation, Mintu Plast specialises in producing up to 10tns of Polyethylene terephthalate (PET) preforms, bottle caps, and PolyVinyl Chloride (PVC) compounds daily, serving various sectors. Water bottlers represent the largest portion of the Company's market share.

"Recent rise in bottled water prices can be attributed to this," Mintesinot remarked, referring to the five Birr increase observed over the past few weeks.

Missile attacks by Houthi militants on vessels in the Bab al-Mandeb Strait, a strategic passage near Yemen, have disrupted over 30pc of the global container trade that transits through the Suez Canal, a crucial link between the Red Sea and the Mediterranean. The recent attack on a U.S. ship took place a couple of weeks ago. The disruption has posed significant difficulties to the international flow of goods and has exacerbated inflationary concerns, particularly for African countries.

Average freight costs have surged by nearly 1,500 dollars for a container over the past few months, nearing levels reminiscent of the COVID-19 pandemic, as ships are compelled to navigate longer routes. This surge is corroborated by the World Container Index, which has soared by 151pc since early October 2023, with rates between Asia and Europe experiencing an alarming 284pc increase.

The profound impact of the Red Sea crisis on global trade, particularly for countries heavily reliant on maritime transportation routes like Ethiopia, has become apparent. For the past two decades, Djibouti ports have served as the primary entry point for goods destined for landlocked Ethiopia, boasting a total of 18 berths. Out of the 7.6 million tons of freight goods transported in the first half of this year, an overwhelming 95.1pc transited through Djibouti which relies heavily on the Suez Canal that facilitates nearly 30.6pc of its trade volume.

The chaos has inflicted severe damage on Ethiopia's commodity exports, with coffee bearing the brunt of the impact. Over 3,000tns of coffee are currently stranded in Djibouti ports, awaiting container ships amidst soaring insurance premiums, which have surged by as much as 2,000 dollars.

Demurrage costs are identified as the primary concern, exacerbating the challenges faced by exporters. The heightened risk of defaults on sales contracts due to the shipping crisis has led to uncertain delivery schedules and additional costs for buyers.

Pulses and oilseeds have fared no better, according to Edao Abdi, president of the Ethiopian Pulses, Oil Seeds & Spices Processors-Exporters Association (EPOSPEA). He expressed concerns about losing customers to competitors in countries unaffected by the crisis, owing to the additional costs associated with importing from East African ports. Edao emphasised that even a modest increase of 100 dollars a ton could significantly influence demand.

"Our competitors will exploit this," he warned.

The Suez Canal, which boasted a record revenue of 9.4 billion dollars in 2023, has been particularly hard-hit by the ongoing crisis. Serving as the primary conduit for 95pc of trade between Europe and Asia, the canal's significance cannot be overstated. According to the UN Conference on Trade & Development (UNCTAD), monthly transits through the Canal witnessed a sharp decline of 37pc year-on-year in January 2024.

Elsabeth Getahun, president of the Ethiopian Freight Forwarders & Shipping Agents Association and CEO of Pan Afric Global, emphasised that all countries bordering the Red Sea corridor have felt the impact. She disclosed that exploratory efforts are underway to use alternative ports in Mombasa or Lamu in Kenya while still leveraging Djibouti ports, as part of the evolving strategy of her 31-year-old company.

"Temporary solutions are paramount," Elizabeth told Fortune.

Pan Afric is among the three logistics companies recently granted regulatory approval to become one of the first privately owned multimodal logistics operators. Elsabeth underscored the global scale of the crisis while expressing hope for its eventual resolution.

"It [Red Sea route] has been severely compromised," she said.

However, amidst these losses, some African ports are experiencing a surge in traffic. Port Mombasa in Kenya, in particular, has garnered increasing attention from Ethiopian authorities. It has seen heightened activity to and from ports in the Persian Gulf as more vessels opt for the Cape Hope route.

Meeting the logistics needs of Ethiopia's 120 million population, spread across a land area of around 1.12 million square meters, calls for diversified port alternatives, regardless of global shipping crises. Abdulber Shemsu, director of the Ethiopian Maritime Authority, underscores the importance of developing logistics capabilities in all directions to mitigate the sensitivity of trade flow disruptions.

"We've not been uniquely impacted thus far," he told Fortune.

Abdulber noted that Ethiopian ships have not been targeted in attacks thus far, with only one shipping liner suspending operations toward exposed ports. Despite major ocean carriers such as Maersk, Hapag-Lloyd, and MSC suspending Red Sea transits and warning clients of prolonged disruptions, Abdulber characterises Ethiopia as being at the receiving end of a global geopolitical deadlock.

He highlights the use of the Lamu port in Kenya, reflecting on its initial establishment to primarily serve the needs of South Sudan and Ethiopia. Currently capable of managing a 28tns weight per container, Abdulber notes the government's lead in importing fertiliser through the port. He anticipates that ongoing road expansions and harmonisation of transport standards between the two countries will position Lamu as a viable port alternative in the near term.

Frustrated with minimum invoice requirements from Djibouti ports in October of last year, some foreign-owned manufacturing companies have already begun diverting their inputs through the Mombasa port.

Hibret Lema, head of the investor association in Hawassa Industrial Park, reveals that most manufacturers are now paying 2,000 dollars for a 40ft container to import inputs through the Kenyan alternative. He stresses that the time-sensitivity of most products has compelled exporters to opt for longer routes to meet delivery quotas, despite encountering new hurdles imposed by customs officials and transport authorities.

"Cross-border drivers require permits from transport authorities," Hibret said. "But the process lacks expediency in its granting."

He also highlights recent restrictions imposed by customs authorities on franco valuta items, further complicating the manufacturers' production cycle.

"In times of a significant crisis," Hibret laments, "we hoped for more cooperation from the authorities." The latest regulatory restriction has resulted in three containers being stranded at the Moyale Customs Branch, incurring nearly 250 dollars in daily fees.

With its substantial capacity, the state-owned Ethiopian Shipping & Logistics (ESL) operates 11 vessels, which cater to nearly 90pc of the country's logistics demand.

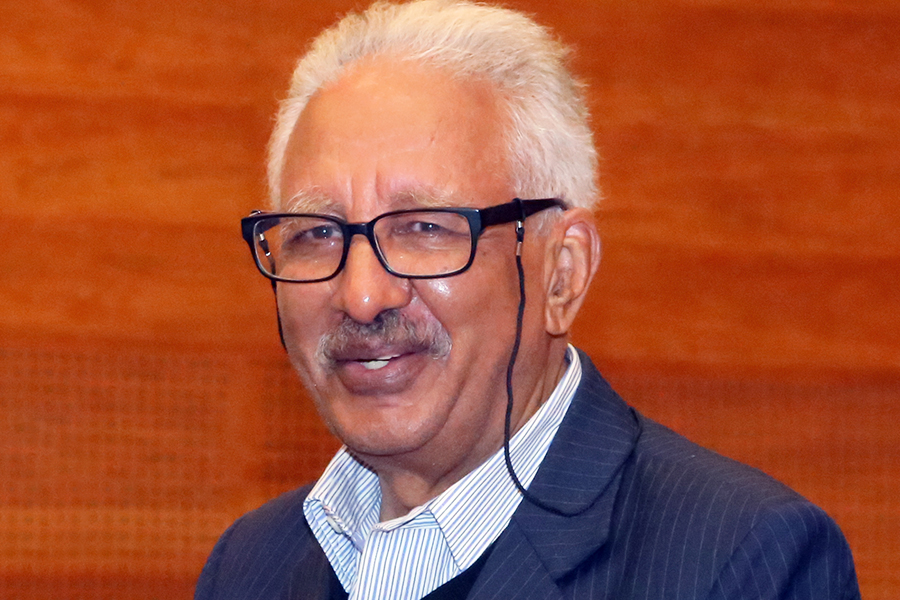

Beriso Amalo (PhD), CEO of ESL, suggested that the Red Sea crisis has had no discernible impact on the enterprise thus far, with no reports compiled on any partners halting operations.

"Business has remained unaffected," he said.

Directives have not been issued from higher officials on the operational modalities for the emerging port alternatives. However, a month ago, several carriers, including partners of state-owned enterprises, totalling nearly 621 container ships, rerouted their operations through the Cape of Good Hope.

In the meantime, Ethiopia is seeking to open up the logistics sector to increase private-sector participation. The Ministry of Transport & Logistics has granted permission for three operators to commence multimodal logistics services within six months.

One such company is Cosmos Multimodal Plc, which was recently formed through a three-way merger involving Gada Transport & Logistics S.C., Tradepath International Plc, and Awash Transport, with a capital of 350 million Br. Getu Hunduma, the Company's general manager, emphasised that international logistics operations are not solely influenced by the preferences of individual governments but necessitate cooperative engagements between multiple countries.

"We depend on peaceful conditions for our service," he told Fortune.

The Red Sea crisis has been compounded by a decrease in transit vessels crossing the Panama Canal due to drought and the blockade in the Black Sea resulting from the conflict between Russia and Ukraine.

Sileshi Ayalew, general manager of the Ethiopian Chemical Products Manufacturers Association, highlighted the increasing complaints about delays over the past few months. Companies importing raw materials are grappling with sub-optimal production and cost overruns. He explained that a significant portion of the input comes from Asian countries such as Indonesia, Malaysia, and China, whose typical shipping routes intersect with the danger area.

"I'm concerned about the potential price surge on food items," he told Fortune.

Rerouting vessels entails additional costs, including fuel expenses, loss of value for time-sensitive cargo, and heightened security considerations, such as the risk of piracy off the Horn of Africa. Consequently, there has been a surge in insurance and legal claims from companies whose vessels experience delays, disruptions in shipments, damages to ships, and spoilage of cargo.

A significant shareholder in one of the leading chemical importing companies who chose to remain anonymous speaks about the challenges faced. He revealed that shipments from Europe, scheduled for January were received just two weeks ago after a staggering 63-day delay.

"The impact has been immense," the shareholder disclosed. He said letters of credit obtained from commercial banks typically have a 90-day window. However, due to the prolonged delay, service charge rates doubled from 19pc within a day.

He revealed that to uphold their delivery schedules, they have resorted to purchasing chemicals from competitors at nearly three times the usual price. This desperate measure underscores the lengths to which businesses are willing to go to maintain operations amidst the disruptions plaguing the shipping industry.

Regrettably, the shareholder stated: "We don't anticipate profits this year."

JP Morgan, the American financial institution with operations in over 100 countries, provided an estimation of the global forecast last month. It stated that the disruptions in the Red Sea "could add 0.7 percentage points to global core goods inflation and 0.3 percentage points to overall core inflation during the first half of 2024."

In response to the challenges posed by the gridlock, some Ethiopian logistics experts advocate for the establishment of an ad hoc committee comprising government logistics stakeholders, similar to the one created to address security concerns in the Amhara Regional State. They believe that such a committee could help mitigate the impact of the crisis.

Matiwos Ensermu (PhD), a highly respected logistics academic, acknowledges the importance of continuing shipments through the Red Sea on Ethiopian ships while concurrently developing capabilities through the ports in Kenya as an alternative solution. He recognises that it will take some time before logistics operations with Kenya become as efficient as those with Djibouti, citing initial challenges such as differences in driving regulations.

"Even if it incurs additional costs, it is imperative to take action," he told Fortune.

He underscores the diplomatic sensitivity of the situation and emphasises the delicate geopolitical balance required to avoid upsetting any involved parties unnecessarily. Meanwhile, Matiwos observes that Ethiopia's internal logistics deficiencies exacerbate the impact of external pressures, foreseeing a slight increase in the prices of certain items.

"Our internal challenges may be even more significant than the issues in the Red Sea," he said.

PUBLISHED ON

Mar 23,2024 [ VOL

24 , NO

1247]

News Analysis | Jul 28,2024

Fortune News | Feb 25,2020

Radar | Jan 11,2020

Fortune News | Aug 27,2022

Life Matters | Mar 25,2023

Fortune News | Oct 23,2018

Delicate Number | Apr 13, 2025

Editorial | Jan 26,2019

Agenda | Jul 30,2022

Radar | Aug 11,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...