Commentaries | Jan 07,2024

The federal government unveiled a 971.6 billion Br budget bill for the upcoming fiscal year, while the economy is under dual pressures to ensure stability and achieve growth. Finance Minister Ahmed Shide stressed fiscal discipline and controlled expenditures, but the figures reveal a country in the throes of macroeconomic turmoil. With domestic debt servicing costs skyrocketing and hopes pinned on external debt restructuring after the country's first-ever default earlier this year, the budget’s 21.1pc expansion is overshadowed by a 21.9pc increase in recurrent expenditures, comprising nearly half of the total budget. As officials tout reforms at stabilising the foreign currency regime and aligning the official and parallel exchange rates, critics lambasted the effectiveness of these measures, particularly cautioning against impending devaluation, feared to impact low- and fixed-income households disproportionately.

The broader economic landscape remains a tough nut to crack. High-level negotiations with the IMF over a potential bailout are contingent on reforms, including liberalising the foreign currency market — an area where Ethiopia's track record is less than stellar. Domestic borrowing is at unprecedented levels, with commercial banks stretched thin under mandatory central bank bond purchases and treasury bill auctions. Despite the central bank's strategies to cap credit and hike lending rates, inflation stubbornly hovers at 23pc. As the government juggles infrastructure spending, regional subsidies, and debt management, the success of these efforts will determine whether the administration of Prime Minister Abiy Ahmed (PhD) can navigate the treacherous path toward economic stability or spiral further into economic distress.

You can read the full story here

PUBLISHED ON

Jun 15,2024 [ VOL

25 , NO

1259]

Editorial | Apr 27,2024

Money Market Watch | Nov 16,2024

Radar | Oct 03,2020

Fortune News | Apr 06,2024

Commentaries | Dec 09,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

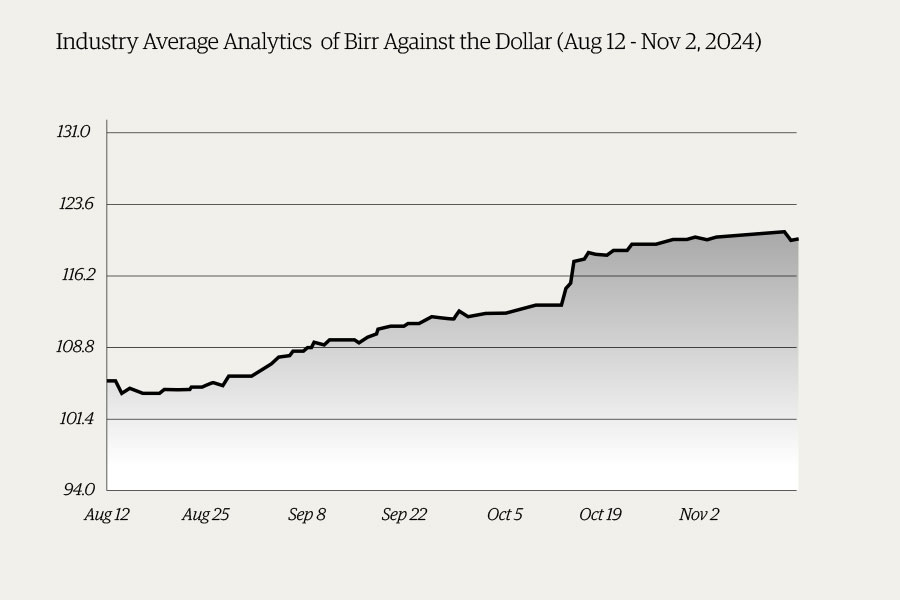

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...