Agenda | Oct 18,2025

Jul 29 , 2024

In a momentous departure from its erstwhile tightly controlled policies, the National Bank of Ethiopia (NBE) has granted permission to commercial banks to freely negotiate foreign currency exchange rates with clients and amongst themselves.

They are granted, effective today and alongside exporters the liberty to hold onto their foreign exchange earnings, which is a departure from the prior obligation to surrender forex to the central bank. Non-bank foreign exchange bureaus have been given the nod to conduct business, armed with the capability to trade foreign currency cash notes at market rates.

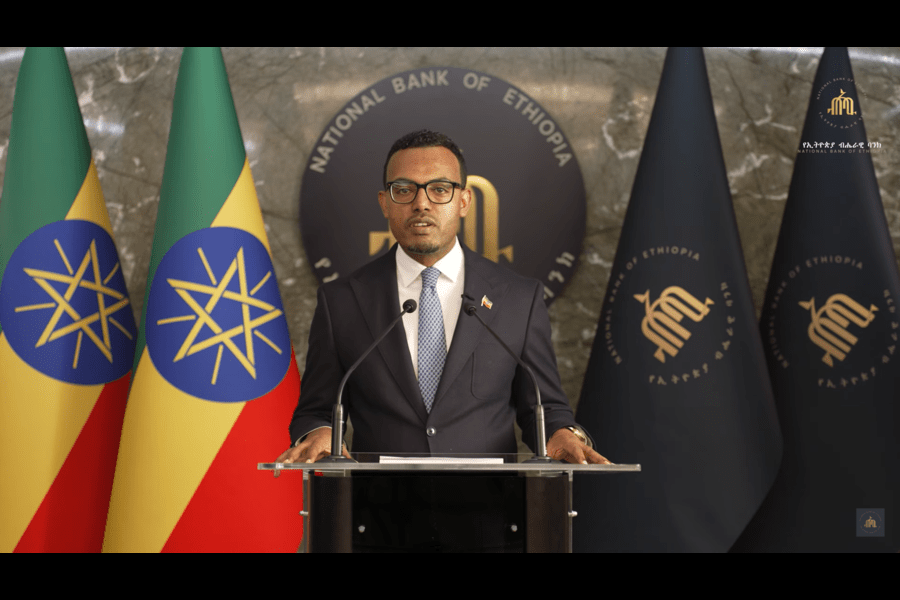

A part of an extensive overhaul of the country's foreign exchange regime by the Central bank Governor Mamo Mehiretu, the NBE has committed to limiting its interventions in the forex market, primarily to maintain order. A shift to a market-based determination of exchange rates was announced by Governor Mamo, marking an epoch-making crucial from the historical inflexible policies. Yet, capital account outflows will continue to be under control.

Exporters have now been permitted to hold onto 50pc of their foreign exchange proceeds, a noticeable increase from the earlier 40pc. The waiting list system for banks' allocation of forex has been done away with, making it easier for importers to gain access. Ethiopian residents can now revel in the simplified rules on foreign currency accounts, which permit them to open accounts based on incomes in forex, inclusive of remittances and salaries. They can open these accounts for disbursements related to foreign transactions. The ceiling on interest rates for foreign loans to private entities has also been removed, a step in the direction of attracting more investment, according to the Governor.

The NBE has also done away with an array of import restrictions, notably the ban on 38 categories of products, thus liberalising foreign exchange access for importing a broad spectrum of goods and services. Firms within special economic zones have been allowed to keep 100pc of their foreign exchange earnings, courtesy of the special privileges granted to them. Neither will restrictions on franco valuta imports stay in place.

According to Governor Mamo, who made a public statement earlier morning today, these measures will augment Ethiopia's economic competitiveness, unlock export potential, and pull in foreign direct investment (FDI).

"These bold steps aim to rectify long-standing economic distortions and promote a more dynamic and inclusive economic environment," said the NBE in a statement issued today, July 29, 2024. “There is a strong expectation that the economy will be on a trajectory of robust growth in years to come.”

Agenda | Oct 18,2025

Editorial | Dec 21,2019

Fortune News | Jul 18,2020

Viewpoints | Jun 28,2025

Viewpoints | Oct 12,2019

Fortune News | Nov 27,2018

View From Arada | Feb 22,2020

Viewpoints | Aug 03,2019

Radar | Feb 16,2019

Fortune News | Jan 22,2022

Photo Gallery | 179452 Views | May 06,2019

Photo Gallery | 169648 Views | Apr 26,2019

Photo Gallery | 160569 Views | Oct 06,2021

My Opinion | 137178 Views | Aug 14,2021

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...