An Israeli-ventured Tal Flower Farms had witnessed eight years of blooming success, exporting millions of stems that graced tables around the world. A once vibrant 30hct flower farm in Bahir Dar city, Amhara Regional State, stands empty, as its journey took a bitter turn facing a series of difficulties that eventually led to its closure, leaving 230 employees without jobs.

At its peak, the company could ship seven million stems in six months. Yet, with a dwindling market share and a shortage of crucial inputs, it was forced to close its doors two months ago. Zena Muluneh, who had been the farm manager since its inception, recounted the struggles that chipped away at the company's foundations.

"Security concerns were the final nail in the coffin," Zena told Fortune, his voice tinged with the disappointment of watching years of hard work unravel.

He vividly recalled the shock of discovering the 2017 incident when their farm in Sebeta, Oromia Regional State, was set ablaze during nationwide protests in 2017. A subsequent market crash, compounded by the challenges posed by the COVID-19 pandemic, pushed the company to the brink.

Zena expressed that with security guarantees and a modest injection of capital, the farm could revive its operations. Adding to the woes, the labour union representing the workers alleged that the company was withholding three months' worth of wages, setting the stage for a potential legal battle. The very foundation on which the once-thriving farm stood now trembled under the weight of financial disputes.

A stone's throw away, Tana Flora faces similar predicaments. It was targeted by armed insurgents last August. Since then, the farm has been engaged in the painstaking task of rebuilding, determined to breathe life back into its operations.

The future of these farms, remains delicate, much like the petals awaiting a chance to bloom once again. The timing could not have been more unfortunate – as December unfolded its festive charm marked by Christmas, followed by the romantic allure of Valentine's Day and the heartfelt celebrations of Mother's Day. Both flower farms missed out on the seasonal upsurge in revenues that these occasions usually bring.

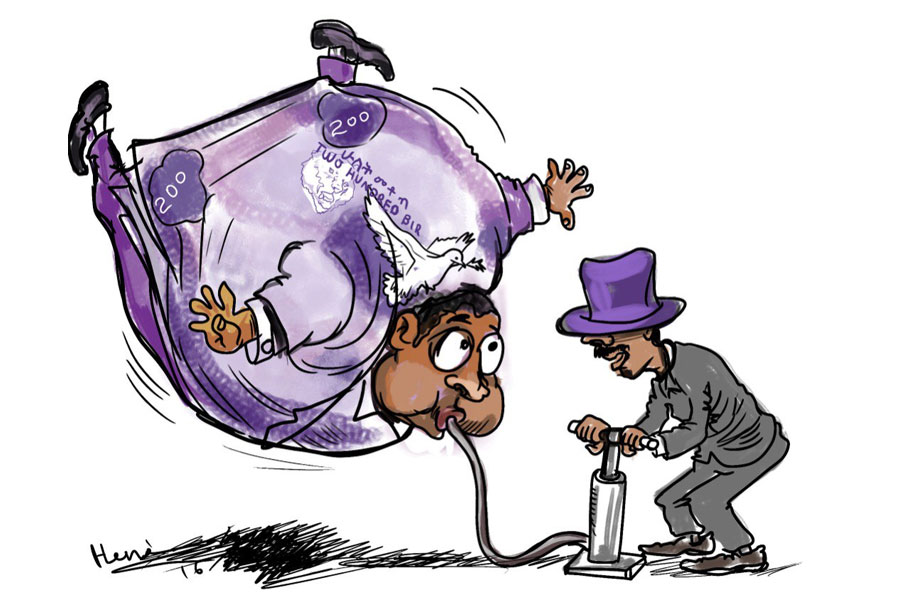

Flower exports from Ethiopia went through a significant decline in the fourth quarter of last year, dropping by 27.2pc to 123 million dollars from the same period in the previous year. This abrupt downturn was marked by a staggering 23.5pc reduction in volume and a 4.6pc dip in international prices.

Mekonnen Solomon, the senior horticulture coordinator at the Ministry of Agriculture, shed light on the issue. According to him, a waning demand for ornamental products from both the Middle East and Europe, coupled with the challenges posed by security issues are the reasons behind this decline.

However, amidst the gloom, Mekonnen sees a glimmer of hope in the industry's potential shift towards sustainable practices. He highlighted the recent inaugural shipments by sea for European markets as a step towards managing logistics costs and improving overall export performance.

"The Red Sea issue will need a resolution," Mekonnen said, acknowledging its impact.

Addressing prior obstacles faced by exporting farms, particularly the shortage of foreign currency for essential inputs like chemicals and fertiliser, Mekonnen noted a positive change. He said the central bank's revision of forex retention rules in August has resolved these issues, creating a more conducive environment for collaboration between banks and exporters.

"Banks have a clear incentive to work with exporters," Mekonnen said.

He anticipates a revival in the production volume, with the growing use of maritime tools for exports seen as a key component.

"Ships offer lower costs and decreased carbon footprints," Mekonnen said.

Amidst the changing agriculture sector, the Ministry has hoisted the banner of sustainable practices as part of a broader green economy initiative. This shift comes in the wake of increased competition from global players like Kenya, Colombia, and Ecuador in the flower export market.

Against this backdrop, companies such as Joytech Plc, a seasoned player in the industry operating from a sprawling 100hct expanse in Bishoftu (DebreZeit) town, Oromia Regional State, are strategically reshaping their focus. Over the past few years, the Israeli company that employs over a thousand people has been gradually phasing out its flower plantations in favour of herbs and vegetables.

Bisrat Hailselassie, the farm manager, emphasises the advantage of engaging in the edible commodity business, citing its perennial year-long market compared to the flower industry's seasonal nature.

The strategic decision to shift towards herbs and vegetables is marked by the untapped potential. With the ability to harvest multiple times a year, exporting leafy greens, plants, and herbs provides a sustained market potential that aligns with evolving consumer preferences.

"There are several players in the flower business," Bisrat told Fortune, "and smaller margins."

According to Bisrat, unlike flowers which take around 60 days to become market-ready, herbs, when properly cared for, boast a quicker turnaround time, taking only a third of that period.

"Herbs require more work but are more rewarding," he said.

Ethiopia's floriculture industry has experienced stellar growth over the past decade. Successive governments recognised the export potential of the commodity. It has become the country's second-highest foreign currency earner after coffee fetching 541 million dollars.

Founded by Ryaz Shamji in 2000, British-owned Golden Roses holds a significant place in Ethiopia's floriculture history. With a bold investment of 60 million Br, the company became the pioneer that set the stage for the industry's success. It secured access to land, tax incentives, duty-free imports, and long-term financing – elements that would define the sector dominated by foreign companies for the next two decades, although Golden Roses is no longer operational.

The unique agroecology has played a pivotal role in fostering the flourishing flower industry. The long sunny days, courtesy of its proximity to the equator, coupled with highlands above 1,500m sea level, have provided an ideal environment for the growth of flowers for nearly 100 export companies.

While roses take centre stage as the primary product, other varieties such as gypsophila, hypericum, carnations, and chrysanthemums also contribute collectively reaching over two billion stems each year.

In the flourishing sector, success stories abound, with companies like Desa Plants Plc from Belgium standing out. Since its establishment in 2007 on a modest four-hectare farm in Ejersa town, Oromia Regional State, 83Km from Addis Abeba, Desa has more than quadrupled its operations.

Ronald Vijverberg, the general manager, radiates optimism about the company's journey. Providing around 60 million ornamental and pot plants, the company has not only weathered potential disruptions but has experienced an actual surge in demand.

"Business is booming," he said.

However, the impending implementation of standards by the European Union in May adds an element of anxiety for flower exporters in both Kenya and Ethiopia. These standards involve the raising of inspection of to 25pc for flower exports from these countries to check for False Codling Moth (FCM) at the Union's borders.

A farm manager from Bishoftu, Oromia Regional State, who insisted on anonymity, suggested the high likelihood that a significant percentage of exports will not make it past inspection as several minute larvae of FCM will be present in the produce.

"Technical capacities should be shaken up," he said.

The farm manager explained that FCM only became an issue in Ethiopia's flowers recently despite having persisted as a problem in Kenyan exports for several decades. He also pointed to the added burden of preliminary preparations necessitated by the growing requirement by European companies for produce with a lower carbon footprint through sea vessels as an impending headache.

"The problem is not just the insects but everything that will be uncovered in the process," he said.

Export to European markets carries cost differentials and environmental considerations. While transporting flowers by aeroplane costs nearly 1.6 dollars for a kilogram, the maritime route offers a 37pc cost reduction. The disparity reflects the trade-offs between speed and economy, with ships providing a more cost-effective but time-intensive option.

The shifting of trade policies, particularly in alignment with the European Green Deal, aims to reduce greenhouse gas emissions by at least 55pc by 2030 compared to 1990 levels, prompting industries worldwide to reassess their practices to meet environmental standards.

At the heart of the international flower trade is Aalsmeer, a city in North Holland, where over 30 million flowers and plants from across the globe are traded daily.

Europe plays a pivotal role in Ethiopia's export receipts, with nearly a third coming from the continent. The Netherlands, in particular, accounts for a significant portion of these exports, making it a crucial destination for Ethiopian flowers.

Those that fail to make it are distributed to local consumers.

Initially entering the business to capitalise on excess supply from farms and the demand for fresh cut ornaments in the capital, florist and business owner Brook Fenta has adapted to market changes. Transitioning into a strictly digital marketplace, he reflects on the seasonality of the flower business. Prices surge, doubling as Valentine's Day approaches, with a rose stem, constituting 90pc of his sales, fetching around 10 Br during the holiday. The revenues experience wild variations throughout the year, peaking up to 20,000 Br.

With increasing competition among countries vying for a share of international flower markets, optimism persists regarding growth prospects. Yohannes Abebe, a technical advisor at the Ethiopian Horticulture Producer Exporters Association, highlights several factors that contribute to this positive outlook.

One significant factor is the revision of foreign exchange rules by the central bank, which has doubled retention rates to 40pc, providing more financial flexibility for exporters. This policy change is expected to support the expansion of Ethiopia's floriculture industry by facilitating improved access to funds for businesses.

Yohannes points to the efforts of Ethiopian Airlines to accommodate the industry's growth.

"Additional 14 planes are available for the pending holiday market," he told Fortune.

He hopes ongoing negotiations to revisit the strict stipulations of the False Codling Moth (FCM) standard before its implementation in May address issues and create a more favourable environment.

A more cautious tone is struck in academia where researchers such as Assefa Sintayehu, a plant pathology lecturer at Gonder University, emphasise the necessity for comprehensive assessments to gauge exposure levels for commercial production across various climatic conditions in the country.

Assefa advocates for a shift to more specialised testing procedures to meet the increasingly stringent standards set by developed countries.

"Targetted insecticide use needs to become customary," he said.

He stresses the need to update greenhouse cultivation practices to align with emerging global trends. In an industry where high-value agriculture commodities are at stake, even slight defects can have significant repercussions on transactions, according to Assefa. He said the global market for flowers is projected to surpass 40 billion dollars, underscoring Ethiopia's growth in this industry will hinge on its ability to adapt to technology and implement sustainable practices.

PUBLISHED ON

Feb 10,2024 [ VOL

24 , NO

1241]

Sunday with Eden | Mar 09,2024

Fortune News | Dec 09,2023

Editorial | Dec 09,2023

Fortune News | Sep 09,2023

Fortune News | Jul 21,2024

Exclusive Interviews | May 11,2024

Radar | Apr 15,2023

Fortune News | Apr 13,2024

Editorial | Sep 06,2025

My Opinion | Sep 28,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...