Editorial | Sep 24,2022

Oct 5 , 2024.

Not long ago, the sight of exchange bureaus in Addis Abeba was as rare as a cloudless day in the rainy season. But a recent decision by the Central Bank to grant five non-bank entities permits to trade foreign exchange promises to change the grey scene that has been overshadowing the capital lately. Soon, exchange bureaus will mushroom across the capital, chasing the most coveted commodity today: foreign currency.

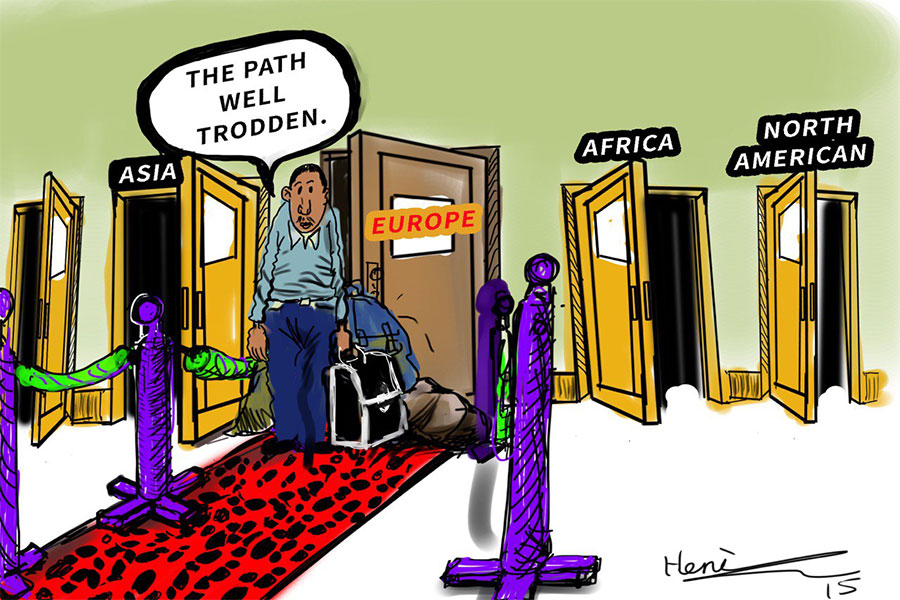

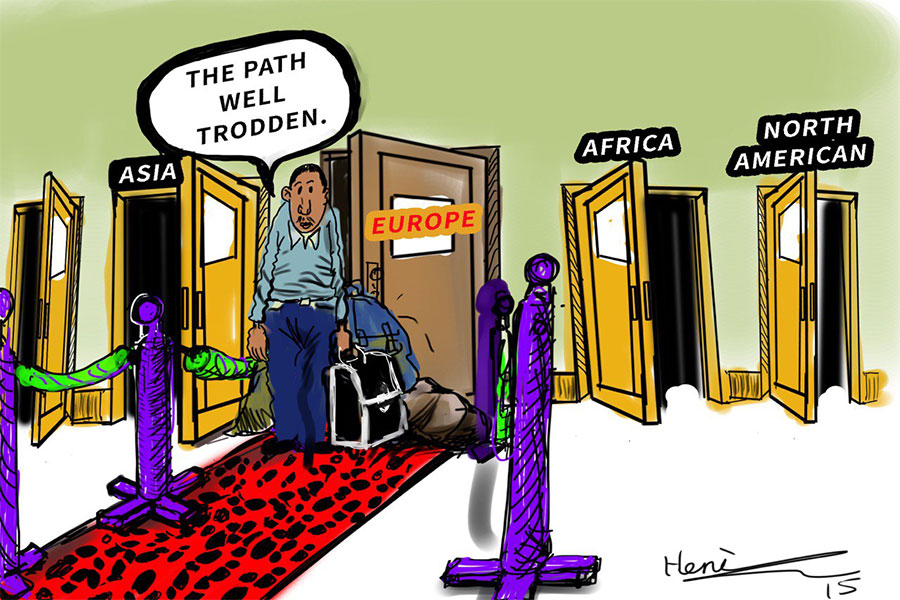

It marks a seismic shift from over half a century of strict state control over the exchange market. It also heralds an era of economic policy liberalisation, a milestone of the Prosperitian's recent deal with the International Monetary Fund (IMF). In exchange for a four-year, 3.4 billion dollars credit arrangement, the authorities have accepted a series of reforms to attain macroeconomic balance. Opening up the exchange market is one of these prescriptions, a bold attempt to address deep-rooted economic fault lines.

At the heart of the economic malaise lies a convoluted interplay of public debt, Birr's depreciation, inflation, and a widening budget deficit. Over the past decade, the country's public debt portfolio has undergone a tremendous transformation. What was once a debt structure dominated by external borrowing has shifted towards greater reliance on domestic debt. This change has been driven by chronic foreign exchange shortages and an increasing dependence on domestic credit to pay for fiscal deficit.

As of last year, total public debt stood at 40.2pc of GDP, with external debt accounting for 18.1pc. This represents a considerable reduction in the external debt ratio from previous years, when large-scale public infrastructure investments propelled external borrowing to dominate the debt level. The decline is mainly due to the suspension of new non-concessional external borrowing and the constrained capacity to service existing debt, a consequence of scarce foreign exchange.

However, domestic borrowing has surged to plug the fiscal gaps.

The state-owned Commercial Bank of Ethiopia (CBE) has been the source of finance, funnelling credit to state-owned enterprises (SOEs) and worsening the domestic debt burden. In response, the federal government established the Liability & Asset Management Corporation (LAMC) three years ago to take over the domestic debt of SOEs that have controlled the commanding heights of the economy, such as the Ethiopian Electric Power (EEP) and the Ethiopian Sugar Corporation (ESC). LAMC's acquisition of debt amounting to approximately 10.3pc of the GDP has eased immediate liquidity pressures on these corporations.

Nevertheless, it has also worsened the sovereign's overall debt profile, while quasi-fiscal activities such as subsidised credit and fuel price stabilisation continue to obscure the extent of the federal government's fiscal liabilities.

The authorities' decision to float the Birr in July 2024, opening the foreign exchange market, has added another layer of complexity. For years, the Birr's value was tightly controlled, resulting in an overvalued official exchange rate that distorted the economy. The float was intended to address chronic foreign exchange shortages and close the currency's official rate with market realities. But it proved to be a double-edged sword.

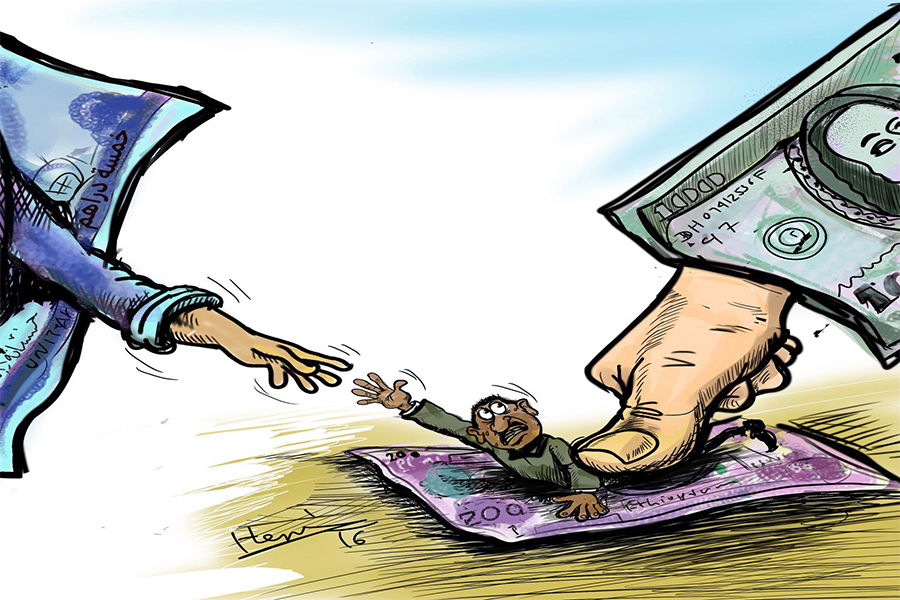

In the months following the float, the Birr depreciated by over 100pc against the US Dollar, a sharp depreciation that has inflated the local currency value of external debt. It has reversed some of the gains achieved in reducing the external debt-to-GDP ratio. While necessary to address the foreign exchange crisis, the depreciation of the Birr has amplified the cost of external debt and driven inflation higher, making domestic borrowing more expensive. This cycle poses a threat to fiscal stability.

The external debt, composed mainly of loans from multilateral institutions such as the World Bank and the IMF, and bilateral creditors such as China, has become more burdensome. The depreciation has increased the cost of servicing dollar-denominated debt, straining government resources and placing additional pressure on the budget deficit. External debt is projected to rise to 28.3pc of GDP in 2024/25, up from 15.4pc in the preceding year. The recent Eurobond default in December 2023 and the accumulation of 1.2 billion dollars in arrears to official creditors illustrate the gravity of the liquidity crisis the economy currently suffers from.

Already persistently high, inflation has been further stoked by the currency depreciation. Averaging above 30pc annually in the years leading up to 2024, inflation has been driven by rising import costs and domestic supply constraints. The float of the Birr has exacerbated this trend, as the cost of imports of essential goods like fuel, food, and medicine has soared.

Policymakers have increasingly relied on domestic borrowing to finance their fiscal needs, issuing treasury bills and government bonds. However, this dependence has become more expensive. Investors demand higher yields to compensate for inflation and currency risk. Central Bank's Governor Mamo Mihretu's shift to an interest-rate-based monetary policy framework introduced a 15pc policy rate and open market operations to absorb excess liquidity, targeting to stabilise inflation expectations. Yet, the effectiveness of these measures is limited by structural imbalances in the financial sector. Commercial banks show low appetite in treasury bill auctions, as yields remain below inflation, undermining the monetary policy transmission mechanism.

The rising cost of domestic borrowing adds to the federal government's fiscal headache. Outstanding treasury bills hover around four percent of GDP, revealing the limited appetite for government securities. Domestic interest payments are projected to exceed one percent of GDP over the next three years, up from 0.5pc in previous years. Combined with the impact of the depreciated exchange rate on external debt repayments, Ethiopia’s debt sustainability remains precarious.

Ironically, the public and publicly guaranteed external debt excludes expected relief under the G20 Common Framework and ongoing negotiations with Eurobond holders. This exclusion masks the true extent of the debt burden. The sharp divergence between the real and nominal effective exchange rates, driven by differing inflation rates with major trading partners, uncovers persistent macroeconomic imbalances.

The budget deficit, which stood at approximately 3.7pc of GDP in the years leading up to 2024, is expected to widen in the wake of Birr's float. Its depreciation has increased the cost of servicing external debt, while inflation has driven up domestic borrowing costs. Despite efforts to implement fiscal consolidation, including spending cuts and tax reforms to beef up domestic revenues, the federal government remains constrained by its need to finance ongoing development projects and maintain affordable public services.

The broader economic context is also characterised by a fragile post-conflict recovery in Tigray Regional State and continued militarised conflicts in the two largest regional states. The cessation of hostilities in Tigray in November 2022 provided some stability, but persistent insecurity in these regional states, coupled with the productivity and logistics disruptions they cause and global commodity price volatility, continue to weigh on growth prospects.

The IMF projects real GDP growth strengthening between 7.5pc and eight percent over the medium term, predicated on the successful implementation of reforms. State Minister for Finance, Eyob Tekalegn (PhD) shared IMF's bullish prospect on growth, claiming the economy will expand by 8.1pc.

However, any slippage in policy execution, whether due to domestic political considerations or external shocks, could derail this fragile recovery. No less is it critical to resolve the ongoing insurgencies in several areas, lest the Amhara and Oromia regional states, through negotiated settlements, should be viewed as indispensable for any meaningful relief, reform and recovery.

Ethiopia's situation is further complicated by anomalies and outliers that unearth economic volatility. A sharp increase in debt service payments in 2023, due to currency depreciation and maturing external loans, exceeded projections by a large margin, placing immense pressure on public finances. A substantial surge in domestic borrowing in the latter half of last year, necessary to cover a revenue shortfall from slowed economic growth and declining foreign direct investment, further fueled inflation and increased debt servicing costs.

The authorities' handling of the budget deficit illustrated these anomalies. The decision to phase out off-budget fuel subsidies and raise domestic revenues through a new VAT regime and excise taxes is expected to provide some fiscal relief. However, these measures are unlikely to offset the full impact of the floating exchange rate on import costs, exerting additional inflationary pressures. As the economy adjusts to the new exchange rate regime, the authorities face the daunting task of keeping inflation at bay, reducing the budget deficit, and managing debt obligations. Domestic reforms to improve revenue collection and reduce dependence on external borrowing are the most likely path they will follow.

PUBLISHED ON

Oct 05,2024 [ VOL

25 , NO

1275]

Editorial | Sep 24,2022

Editorial | Jul 27,2024

Radar | Jul 25,2020

Fortune News | Dec 02,2023

Commentaries | Apr 28,2024

Radar | Jun 08,2019

Viewpoints | Aug 13,2022

Viewpoints | Jul 13,2025

Viewpoints | Jul 20,2024

Radar | Mar 09,2019

Photo Gallery | 173555 Views | May 06,2019

Photo Gallery | 163776 Views | Apr 26,2019

Photo Gallery | 153778 Views | Oct 06,2021

My Opinion | 136533 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 12 , 2025

Tomato prices in Addis Abeba have surged to unprecedented levels, with retail stands charging between 85 Br and 140 Br a kilo, nearly triple...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of electric vehicle (EV...

Oct 12 , 2025 . By NAHOM AYELE

A simmering dispute between the legal profession and the federal government is nearing a breaking point,...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km east of the capital, in...