Viewpoints | Dec 04,2020

Apr 2 , 2022

By Christian Tesfaye

Inflation is driving consumers in Ethiopia closer to the edge. It is creating an unsustainable situation that could add fuel to the country’s already concerning political crisis. As far as the economy is concerned, no other matter deserves greater attention. It simply cannot keep going like this. Eventually, there will be a reckoning for the Birr as a trusted store of value and unit of measurement, functions it needs to fulfil to continue as a currency.

There are several reasons why inflation is getting out of hand. It ranges from deficit financing and falling productivity at home to volatile global commodity prices and supply chain disruptions. While the National Bank of Ethiopia (NBE) has been printing money recklessly, inflation is also being imported through higher commodity and shipping prices. The latter two challenges, especially costly energy, are why most countries worldwide are experiencing high inflation.

But this is not all. One more culprit is the Birr’s fast crawling depreciation against a basket of major currencies. It is not that long ago that a dollar at a bank could be exchanged for only 30 Br. It is no longer the case. It has edged up four percent to almost 52 Br in the past three months.

We are justified to ask: why does the central bank not provide some relief to consumers by pumping the brakes on the Birr’s depreciation?

It has yet to surrender its power to set the exchange rate, for better or worse. There is no exchange market that it needs to worry about; it can do this through fiat.

What is it good for if a managed exchange rate regime does not come in handy when everything from edible oil prices to consumer goods imports terrorises consumers’ wallets?

No doubt, holding the value of the Birr steady alone will not address the inflationary pressure. If nothing else, inflation is baked into Ethiopia’s economy because of its structural imbalances. But, for a country that imports four times as much as it exports, a strong Birr will have a non-negligible impact fighting inflation.

Why is the central bank so stubborn in allowing the Birr to slide in value?

There are a few reasons that a currency with a lower value is preferred – none of them seems to apply to Ethiopia.

One is to boost exports and limit imports. On the former, a look at the history of devaluations in Ethiopia makes it clear that export revenue spurts never followed those years. Exports have not grown as much as they should because productivity is poor; it is much less because prices lack competitiveness. The case for reducing imports is also weak, especially these days. Items the government might consider luxuries are already highly discouraging to buy as a result of supply chain disruptions – it is overkill at this point. Worse still, much of Ethiopia’s imports are essential goods such as fertiliser and fuel, which cannot be limited.

There are two more reasons why the Birr may be depreciating. There is no International Monetary Fund (IMF) programme running, but the government may still desperately be trying to woo the multilateral institution by showing that its currency is less and less overvalued (like Egypt just did). Another might be to make debt owed to domestic creditors that hold Treasury bills cheaper to pay.

The central bank has shushed on the direction or even purpose of the depreciation – this should not go on any longer. It needs to define its target and drive towards it with consistency. Suppose it continues to be stubborn and not float the exchange rate. In that case, it should use its monetary policymaking power to do the one thing a managed exchange rate is good for: limiting imported inflation by artificially setting the rate lower (in this case, ceasing depreciating until at least commodity prices and supply chain issues are sorted out).

If its priority is addressing the structural problems with the exchange rate (and woo the IMF), it should rip off the bandage and float the Birr altogether. At least this way, it has a better chance of incentivising private transfers to be carried out in formal channels and delivers an improved doing business environment for FDI.

On the other hand, vacillating between two half-measures will force citizens to suffer from an unsustainable cost of living without any of the benefits of a liberalised exchange rate regime.

PUBLISHED ON

Apr 02,2022 [ VOL

23 , NO

1144]

Viewpoints | Dec 04,2020

My Opinion | May 29,2021

Sunday with Eden | Dec 04,2020

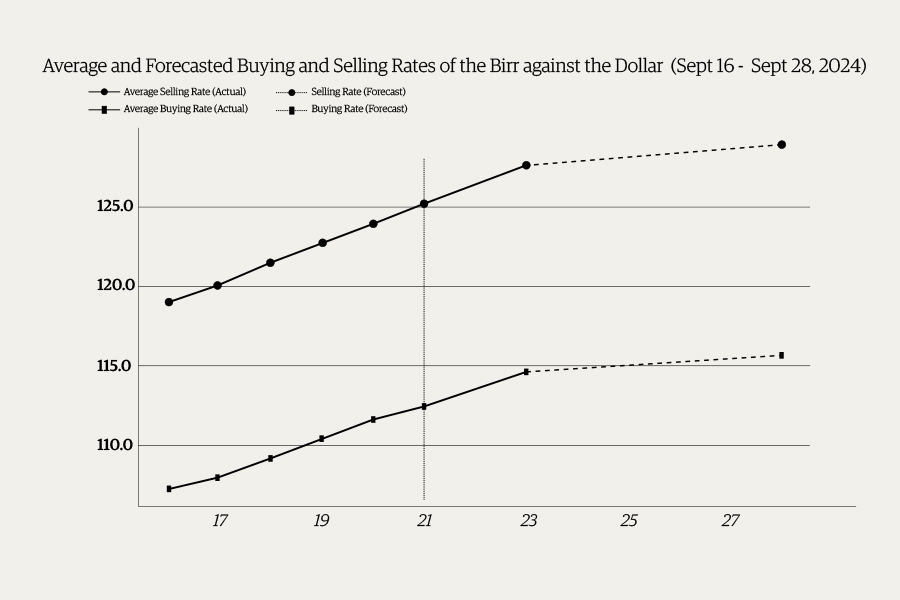

Money Market Watch | Sep 22,2024

Radar | Jun 21,2025

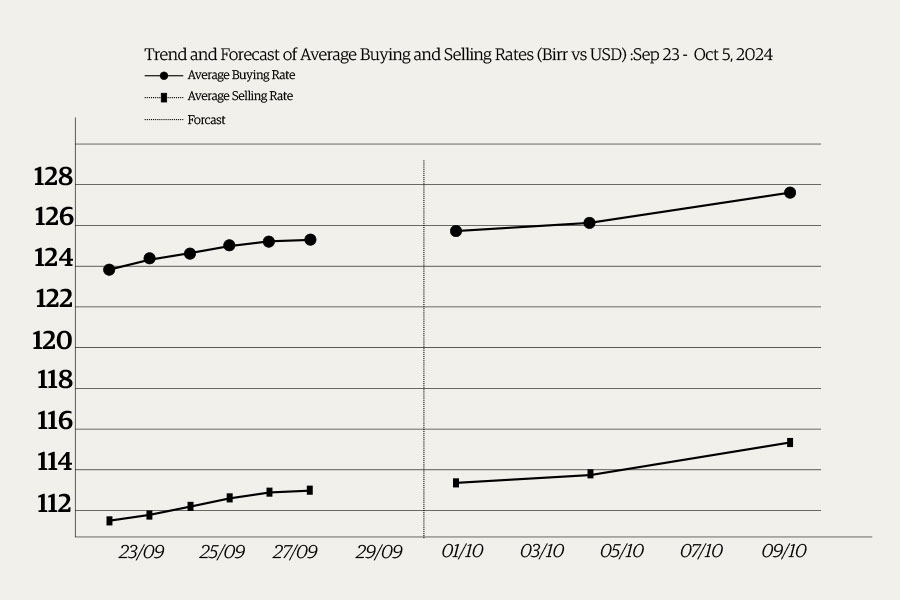

Money Market Watch | Sep 28,2024

Commentaries | Mar 11,2023

Films Review | Mar 09,2019

Radar | Oct 19,2019

Sunday with Eden | Oct 26,2019

Photo Gallery | 176909 Views | May 06,2019

Photo Gallery | 167121 Views | Apr 26,2019

Photo Gallery | 157689 Views | Oct 06,2021

My Opinion | 136936 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Oct 18 , 2025 . By NAHOM AYELE

In a sweeping reform that upends nearly a decade of uniform health insurance contribu...

A bill that could transform the nutritional state sits in a limbo, even as the countr...

Oct 18 , 2025 . By SURAFEL MULUGETA

A long-planned directive to curb carbon emissions from fossil-fuel-powered vehicles h...

Oct 18 , 2025 . By BEZAWIT HULUAGER

Transaction advisors working with companies that hold over a quarter of a billion Bir...