Radar | Aug 07,2021

Jan 11 , 2020

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

Earnings per share still falls short of three years ago

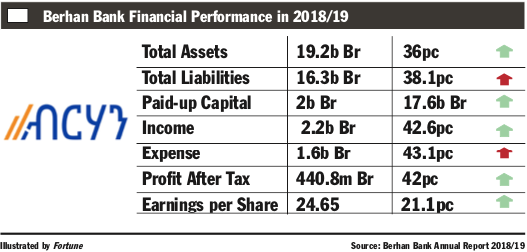

Berhan Bank Financial Report For The Fiscal Year 2018/19.

Berhan Bank Financial Report For The Fiscal Year 2018/19. Berhan Bank, which celebrated its 10th year of establishment recently, achieved an impressive performance last year by boosting profit by almost half.

The Bank netted 440.8 million Br in profit, a 42pc increase from the previous year. Earnings per share (EPS) clocked in at 24.65 Birr a share, up from 20.36 Br. Yet EPS still fell below the level the Bank achieved three years ago, 30.44 Br a share, mainly due to a huge increase in its paid-up capital.

The Bank designed a strategy of passing the two Billion Br paid-up capital level before June 2020, according to Abraham Alaro, president of Berhan.

"It is to ensure the long-term competitiveness of the Bank instead of focusing on the short term gains," Abraham said.

In the reporting period, the Bank achieved growth in both financial and non-financial intermediation activities.

However, Gumachew Kussie, the chairperson of the board of directors, asserted that the Bank's positive performance is even more commendable when viewed in light of the industry's challenges.

"The macroeconomic environment can be well explained by numerous challenges encountered," wrote Gumachew in his address to the shareholders.

The economic and political transitions, the tense political situation, the chronic forex currency shortage on top of global development having a negative bearing on international trade are the major challenges Gumachew mentioned.

The Bank generated more than 1.5 billion Br in income from interest on loans, advances and NBE bonds, a growth of 38pc. Revenues from service charges and commissions also increased by 58pc to reach 543.3 million Br. Foreign exchange earnings also showed a marked rise of 31pc to 81.5 million Br.

“The growth in income at Berhan is impressive,” remarked Abdulmenan Mohammed, accounts manager for the Portobello Group Ltd, a London-based holding company.

Abraham states that the management of the Bank has employed a successful marketing strategy to increase the Bank’s foreign currency earnings.

He also noted the Bank efficiently used the foreign currency allocation it received from the National Bank of Ethiopia (NBE). The NBE allocated a new pool of foreign exchange currency to the commercial banks last year based on each bank's transfer of 30pc of their foreign currency earnings to the central bank. Berhan received 12.2 million dollars from the allocation.

The Bank had more than 10,000 registered customers on its waiting list at the time, according to Abraham.

The surge in income is also accompanied by a huge increase in expenses. The 45pc increase in interest expenses reached 605 million Br, while salaries and benefits also shot up by 42pc, hitting 623 million Br. General administration expenses have also shown a 38pc increase, exceeding 324 million Br.

“Expenses expansion is alarming,” the expert cautioned. “The management should keep an eye on the growth of expenses.”

Aggressive branch expansion led to the opening of 18 new branches and the recruitment of 620 new employees. This was the main contributor to the rise in expenses.

Office rent and increased salaries also contributed to the massive expansion in expenses, according to Abraham.

The Bank’s assets increased considerably by 36pc to 19.2 billion Br. Berhan increased its provision for impairment of loans and other assets by 68pc to 66.8 million Br.

In the reported period, over 10 billion Br of loans and advances were disbursed, marking a 42pc increase. The Bank mobilised 38pc more deposits in the last fiscal year, reaching 15 billion Br. The increment pushed the Bank’s loan-to-deposit ratio up to 67pc, up about two percentage points from the previous year.

This result was achieved by reversing the reduction in the loan-to-deposits ratio noted in the previous two years.

Berhan also increased its investment in NBE bonds by 40pc to reach 4.3 billion Br, which now represent 22pc of the total assets and 25.4pc of the total liabilities of the Bank.

Berhan’s liquidity level has shown an incremental rise both in terms of value and relative terms. Its cash and bank balances went up by 19pc to 3.9 billion Br, while the ratio of liquid assets to total assets declined by three percentage points to 20pc and liquid assets to total liabilities went down to 23.1pc from 27pc.

"This must have been due to an increase in the loan-to-deposits ratio," said Abdulmenan.

The Bank’s paid-up capital increased by 17pc to reach the two billion Br threshold, achieving the highest paid-up capital compared to its midsize peers.

Achieving a capital adequacy ratio (CAR) of 24pc, Berhan proved to be a well-capitalised bank.

Hence, it is recommended that it should effectively use its strong capital base to generate more income, according to the expert.

PUBLISHED ON

Jan 11,2020 [ VOL

20 , NO

1028]

Radar | Aug 07,2021

Agenda | Feb 01,2020

Radar | Dec 08,2024

Fortune News | Oct 31,2020

Radar | Jun 22,2024

Fortune News | Feb 16,2019

Radar | Aug 25,2024

Radar | Jul 13,2024

Agenda | Aug 14,2021

Commentaries | Apr 30,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...