Agenda | Jul 18,2021

On the eve of Gena, aka Ethiopian Christmas, the capital was bustling with the holiday spirit as the Christian citizenry made preparations for the following day's festivities.

Banks were among the hot spots during the holiday's eve, since many people stopped in to withdraw cash to shop for last minute items, while others collected money sent from relatives living abroad.

There were long queues at many of the private and commercial banks by customers who wanted to withdraw cash and process remittances.

The peak time for the flow of remittances is Gena, the Ethiopian New Year and Fasika, aka Easter. The popular currencies are the United States dollar, the UAE dirham and the Saudi riyal.

Remittance recipients usually go to their nearby bank branch or their client bank to withdraw a remittance sent from a relative or a friend from overseas.

This trend puts the banks in an intense competition to collect as much foreign currency as they can through a lottery system that awards clients through a raffle. They offer gifts ranging from cars to washing machines and smartphones to mobile cards.

The lotteries aim to attract people who change money in the parallel market and to motivate the growth of the formal market. This approach is one of the mechanisms used by the Banks to address the shortage of forex.

Over the past couple of years, the foreign currency crunch has been severe at the banks and the economy in general. The gross international reserves as of September 30, 2018, were sufficient only to cover 2.6 months of import bills.

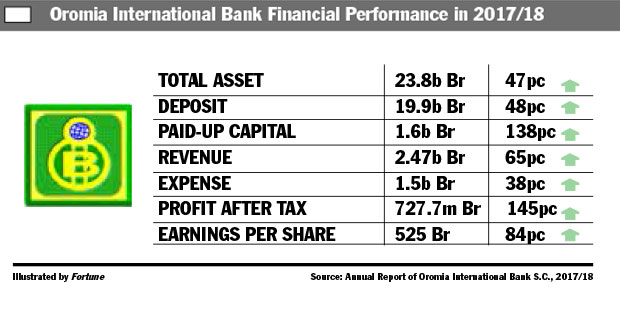

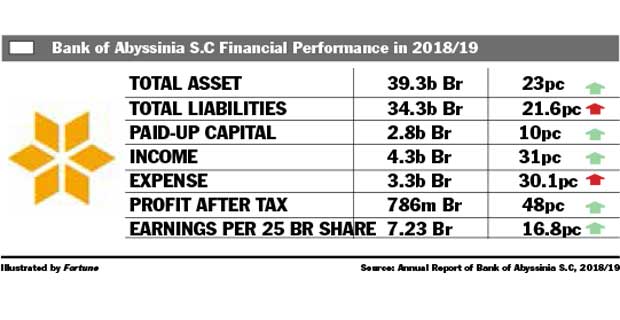

On the eve of the holiday, Mezgebu Birhanu, in his mid-20s, was at Bank of Abyssinia's branch near National Stadium to receive the money his big brother sent him from the United States. The Bank gained 80.9 million Br from foreign currency dealing in the last fiscal year.

Mezgebu, who is a second-year student of mechanical engineering at Adama Science & Technology University, gets at least 100 dollars every two months from his brother.

This time his brother sent him 150 dollars for the holiday through Western Union, one of the prominent money transfer agents.

“Even though I haven’t won the lotto that is run by the Bank for processing remittances yet, it keeps motivating me to use their services,” Mezgebu said.

Awash Bank attracts customers' foreign currency deposits by giving them a chance to win gifts that include smartphones, televisions, water dispensers and Isuzu cars.

Shemsdin Abedi, 33, who is engaged in private business was at the Stadium branch of Commercial Bank of Ethiopia (CBE), the biggest bank in the nation that gained one billion dollars in the first quarter of this fiscal year from remittances and exports.

Born in Harar but living in the capital, Shemsdin gets remittances at least four times a year from his brother.

To win the hearts of people to collect remittances like Shemsdin and Mezgebu, banks use lotteries as a promotional tool after getting permission from the National Lottery Administration.

Awash Bank, the leading private bank, uses a lottery system to attract customers in this way. The Bank started running the lottery in 2016 and is now holding it for the eighth time during this Gena season.

Awash offers recipients of remittances a chance to win gifts that include smartphones, 32-inch televisions, water dispensers and Isuzu cars. The total cost of the prizes Awash offers is close to 3.4 million Br.

Those who receive remittances through Awash from December 30, 2019, to April 2020 will automatically go into a series of drawings to win prizes. A client that exchanges foreign currency worth over 50 dollars at the bank will receive a raffle number with a chance of winning a prize and 25 Br of mobile airtime.

Awash made 2,043 remittance transactions during the week before Gena, according to a person familiar with the issue.

Pioneering the service, the giant state-owned Commercial Bank of Ethiopia (CBE) has held 18 rounds of its lottery raffle. It currently offers automobiles and Bajaj vehicles, which have a capacity of caring six people, for the 19th round of the raffle.

The Bank’s latest round began in December 2019 and will be staying until February 2020.

The lottery lures people to use the bank for processing remittances, according to Yeabsera Kebede, CBE's corporate communications acting director.

“During the holiday season, the amount of remittance will double,” Yeabsera adds.

Most of the remittance is generated from the Middle East, the US and Europe.

The lottery system also attracted more banks such as Wegagen Bank, which recently joined the service on August 15, 2019, and it will remain active until February 2020.

The Bank is offering recipients of remittances the chance to win many gifts including 50 smartphones, five washing machines and an automobile. The value of the gifts that Wegagen is giving out is three million Br.

Unlike the other banks, Wegagen did not set the minimum amount of remittance to be part of the lottery, according to Bahiru Demissie, manager of product development and the branch expansion division at Wegagen.

The lottery system has not only been adopted by the leading commercial banks but also by the youngest banks. One of these institutions is Abay Bank, which began the service in 2017/18.

Abay started the third round of the raffle on December 30, 2019, and it will last for three months. Abay awards prizes like smartphones, laptops, refrigerators and cars to recipients of remittances.

The lottery is becoming an efficient strategy to gain customers’ attention, according to Belete Dagnew, vice president for corporate service at Abay.

“The lottery aims to maximise profit, generate forex and prevent the informal market transactions that do not pass through officially regulated businesses when they are sent and received,” Belete adds.

The cost of the Bank's promotional activities reached nine million Br, including the cost of the prizes. The Bank works with money transfer agents including Western Union, Money Gram, Xpress Money and Dahabshiil.

In Ethiopia, remittances represent approximately 7.4pc of the country’s GDP. There are three to five million estimated Ethiopian diaspora living abroad, and most of them are in North America and Europe, according to the Ethiopian Embassy in the UK.

Currently, the country receives over four billion dollars in remittances from its citizens every year, which is 1.4 billion dollars more than its earnings from the export of goods during the 2018/19 fiscal year.

While many of the banks have rushed into the lottery system, Dashen stopped the service after witnessing no significant changes in forex remittance.

"While having regular customers, the lottery winner would be a random person who isn't our client," said Asefaw Alemu, CEO of the Bank, explaining why Dashen stopped offering prizes through a lottery system.

The Bank currently gives out mobile cards for recipients of remittances on the spot.

Alemayehu Geda (Prof.), a prominent macroeconomist and a university lecturer, agrees with Asefaw that the lottery system will not bring a significant change in terms of generating forex.

"Almost all of the banks are offering prizes through lotteries year after year," said Alemayehu, "but it has brought no significant change in the value."

However, Ebisa Derbe, director of marketing and communications at Awash, believes that the lottery brings a significant impact, especially in tackling the shortage of forex.

Due to the expansion of the parallel market, the amount of remittance which comes via Awash has been declining, according to Ebisa, mentioning Ghana for having a difference of one cent between the parallel and the formal markets.

"If we didn’t provide the prizes, people would not be coming to us," he adds. “The government should closely monitor the parallel market to narrow the gap,” he said.

Experts in the sector agree with Asefaw that the lottery system will not bring a significant change in terms of generating forex.

However, Alemayehu says allowing the commercial banks to adjust the margins for foreign exchange rates could attract more remittances flowing into the economy.

He is also against the forceful acts the government takes to control the parallel market, saying that it will not bring a long-lasting solution.

"Comprehensive policies which concentrate on restricting capital flight and controlling devaluation should be applied," he said.

PUBLISHED ON

Jan 11,2020 [ VOL

20 , NO

1028]

Agenda | Jul 18,2021

Fortune News | Nov 14,2020

Fortune News | Nov 26,2022

Editorial | May 27,2023

Fortune News | Oct 30,2022

Fortune News | Dec 07,2019

Agenda | Mar 05,2022

Fortune News | Mar 07,2020

Radar | Sep 11,2020

Radar | Jun 15,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...