Commentaries | Jun 12,2021

Feb 19 , 2022

By HAWI DADHI

The federal government has partnered with over half a dozen financial institutions to pilot a National Identification Card (ID) Programme initiated more than a decade ago.

The idea of a national ID was first introduced in 2009 by the Information Network Security Agency (INSA) and the former Ministry of Information & Communication Technology, but the initiative has withered, unable to leave the drawing board. In 2012, a proclamation that governs the registration of vital events and the national ID paved the way for establishing a National Identity Agency to oversee the programme's implementation. The Agency is yet to be set up.

However, under the auspices of the Prime Minister's Office, the National ID Office was established last year, tasked to register 70 million citizens by the end of 2025. The Office has struck deals with public and private institutions to speed up registrations and availed its database to its partners.

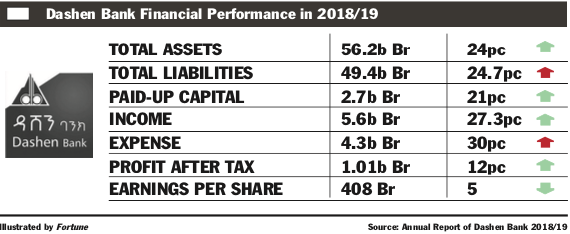

Among these are financial institutions, including the Commercial Bank of Ethiopia (CBE),

Cooperative Bank of Oromia (CBO), Dashen Bank, Bank of Abyssinia and the National Bank of Ethiopia (NBE). They are tasked with dispensing the registrations. It involves gathering primary data and biometric information such as photographs, fingerprints and scans.

The Office holds 40 registration kits with computers or tablets, fingerprint pads, scanners, printers, cameras and light-emitting diode (LED) accessories. Supported by the World Bank, it is awaiting the arrival of an additional 800 kits to be distributed to some of its partners. A kit costs between 2,000 and 3,500 dollars.

The Office has no intention of opening up branches and doing the registration all on its own, according to Yodahe Zemichael, executive manager of the programme. He has previously served as a technical advisor at the Prime Minister's Office.

"Outsourcing the registration work is key to its success," Yodahe told Fortune. "[The partners] are authorised to procure registration kits on their own."

The CBE has decided to buy the kits and conduct registrations at nearly all of its branches, disclosed Fikresilassie Zewdu, vice president for branch and digital banking at the state-owned Bank. The CBE operates 1,900 branches, over a quarter of all branch networks. It plans to acquire up to 2,000 kits, according to the Vice President.

"The primary beneficiaries will be banks,” said Fikresilassie. “We wanted to be the main player in this, and we're working to engage extensively."

The lack of a unique identification system has been challenging for the financial sector, mainly identifying borrowers with default records and a growing concern in combating money laundering. Six months ago, the central bank passed a "know-your-customer" KYC directive, compelling all banks to verify their customers' data and consolidate multiple accounts under one unique ID. Yet, the task has been challenging for banks that have had to scramble to contact customers and collect individual data. The mandatory requirement also applies to emerging fintech companies such as mobile money providers and e-commerce platforms.

The national ID Office has made an interface available for application programming, allowing computer programmes with multiple software to interact as a data source for KYC verification. It features the personal information of over a million registrants, collected by institutions such as the Ministry of Education, which has been collecting data on students and teachers. The Ministry owns around 200 kits.

The strategy to incorporate financial institutions in the registration process is feasible considering the banks’ wide branch networks, according to Endashaw Tesfaye, a digital financial services expert. A former CEO of MOSS Technologies Plc, a technology provider for M-Birr, Endashaw leads digital programming at the United Nations Capital Development Fund (UNCDF).

"However, there need to be additional channels for registration, such as ICT centres," the expert said.

Yodahe's Office is also partnering with microfinance institutions and micro-lending service providers, with over five million customers, of which the majority reside in rural areas. A deal has been struck with Michu, an uncollateralised digital lending platform launched by the Cooperative Bank of Oromia and Kifya Technologies.

Attempting to phase out the old manually-issued cards, a few cities, including Addis Abeba and Adama, have begun issuing electronic IDs.

Residential cards issued by wereda authorities remain the primary instruments for personal identification but are open to forgery and alteration. Other markers such as driving licenses, pensioner cards, community-based health insurance booklets and tax identification numbers (TIN) are also widely used. Around 40 million rural residents and low-income urbanites are under the community-based health insurance scheme, while close to 2.2 million people and 44,000 companies hold TINs.

The integration and interoperability of the various ID systems are almost nonexistent.

A bill governing the issuance and administration of the national ID is in the making. If Parliament approves, the project office will establish a framework to collect revenues, availing data to users, Yodahe disclosed to Fortune.

Rolling out a national ID program takes a minimum of three years. Botswana, Kenya, and Rwanda have national ID systems that are relatively advanced in coverage and integration. The World Bank supports national ID projects in three-dozen countries with the financing of over one billion dollars. Countries like Chad, Nigeria, and Tanzania are developing while civil registers remain paper-based elsewhere in the continent.

PUBLISHED ON

Feb 19,2022 [ VOL

22 , NO

1138]

Commentaries | Jun 12,2021

Radar | May 28,2022

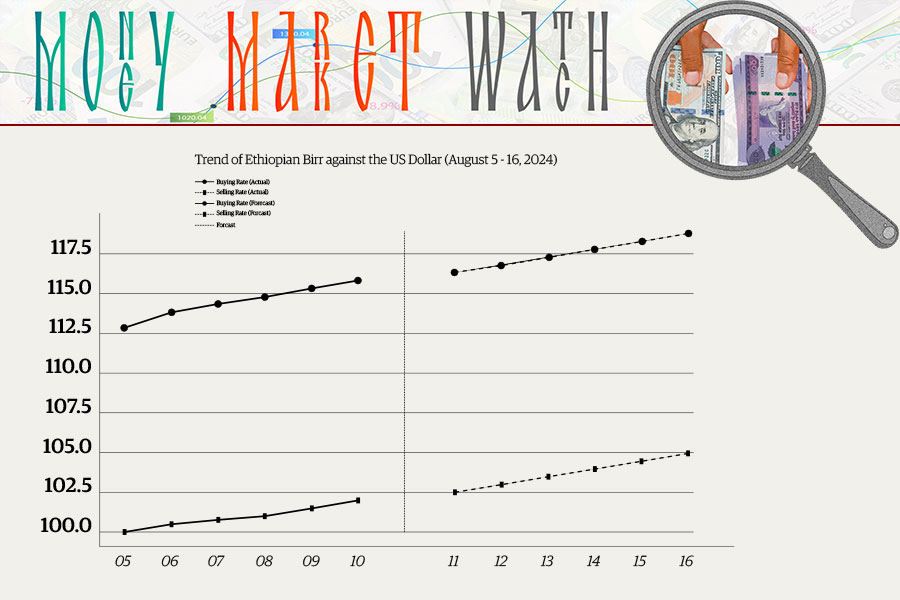

Money Market Watch | Aug 11,2024

Viewpoints | Jan 03,2021

Radar | Nov 12,2022

Featured | Jul 27,2019

Radar | Oct 03,2020

Fortune News | Feb 15,2020

Viewpoints | Feb 09,2019

My Opinion | Aug 08,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...