Fortune News | May 31,2025

Jun 19 , 2021

By SAMUEL BOGALE ( FORTUNE STAFF WRITER

)

Three banks navigate troubled waters following failure to settle advance payment guarantee bonds issued to grade-one contractors.

Wegagen, Berhan, and Enat banks have been asked to settle 751.5 million Br after the construction companies defaulted on their contracts on four building projects in Addis Abeba under the Federal Building Construction Project Office.

Even though the banks have already settled a part of the amount owed, the advance payment guarantees are equivalent to 47pc of the aggregate profit they made in the last fiscal year. This is hardly the first time commercial banks find themselves in a precarious position due to unserviced bonds; several financial institutions were delisted by the Ethiopian Roads Authority (ERA) earlier this year for allegedly failing to discharge their obligations in a timely manner.

Wegagen Bank has issued a whopping 224.5 million Br guarantee bond to Afro-Tsion Construction Plc, contracted to build 11 storeys in the premises of the National Theatre. The grade-one contractor, awarded to undertake the construction for 1.5 billion Br two years ago, was expected to complete the project next year. However, less than a tenth of the construction had been completed by the time contract was terminated in March 2021 due to the slow pace, Tekletsadik Teklearegay, head of the Project Office, disclosed to Fortune.

The Project Office has only managed to collect 8.8 million Br from the Bank, less than five percent of the total amount.

“Our office has submitted all documents and reports to the Attorney-General," said Tekletsadik. "They can take the legal issue up with Wegagen Bank.”

The Vice President of Wegagen Bank, Desaley Embza, cited "customer confidentiality” for declining from providing details on the guarantee his Bank provided to Afro-Tsion Construction and make comments.

“We can't discuss customers’ loan and guarantee information because of bank policy,” Desaley told Fortune.

Enat Bank has managed to pay 71.1 million Br of the 241.4 million Br provided as a guarantee bond on behalf of Tekleberhan Ambaye Construction Plc (TACON).

TACON was hired to undertake a 16-storey building initially planned to serve as the now-defunct Government Communication Affairs Office headquarters. Before the contractor completed the project, forecasted to cost 1.2 billion Br, the Project Office scrapped the deal in November 2020. It will soon house the Ministry of Trade & Industry when construction work awarded to the state-owned Ethiopian Construction Works Corporation is completed. Managers at TACON were not available for comment, despite repeated attempts from Fortune.

Berhan Bank is in more precarious circumstances as it is liable for advance payment guarantees worth more than a quarter of a billion it provided to contractors for two separate projects in the capital.

The Bank guaranteed a 20pc advance payment made out to Afro-Tsion Construction Plc, for a 1.1 billion Br project involving two buildings, a diplomatic residence and a training centre in the Kazanchis area, for use by the Ministry of Foreign Affairs. The Bank has only settled 34.2 million Br of the total of 227.1 million Br it owes.

Afro-Tsion Construction received a notice of termination from the Project Office in March 2021, due to alleged sluggish performance, while the buildings were at 14.3pc progress. The work was scheduled to be completed next month. Managers at Afro-Tsion Construction were not available for comment, despite repeated attempts from Fortune.

Girum Tariku, marketing and communications director at Berhan Bank, says the Bank is not aware of the termination of the contract, hence the Project Office is in talks with the contractor.

Berhan Bank has yet to receive payment claims from the Project Office, said Girum.

Beha Construction is another firm Berhan Bank issued a 20pc advance payment guarantee bond to construct an office building project to cost 292.5 million Br inside the Civil Aviation Authority compound of Bole International Airport. The Project Office claims, of the 58.5 million Br bond the Bank issued, only 39.4 million Br has been settled. The management at Berhan Bank differs on the numbers, insisting that the Bank has received a claim for 35.1 million Br, and it has already settled 17.2 million Br.

“The Bank is living up to its commitment,” said Girum. “We're under discussions with the contractor to reclaim the amount paid for the guarantee.”

The Civil Aviation project was suspended after only a third of the construction was completed in February 2021, the same month it was supposed to have been completed. Beha Construction has taken the case to court, claiming that the project was terminated unfairly, which has prevented Berhan Bank from paying the remaining amount, according to Tekletsadik.

Berhan's Communications Director says the Bank uses its internal procedures to solve the contractors' issues.

“The Bank provides guarantees in a way that reduces the risks," Girum told Fortune. "There are ways it reclaims the guarantees paid.”

Contract owners have been turning to the central bank recently when facing issues such as delayed guarantee payments from the banks, and a few have even declined to accept guarantees issued by specific banks. Price escalations on construction inputs and the forex crunch are factors mentioned for the crisis in the construction industry, according to Frezer Ayalew, director of banking supervision at the National Bank of Ethiopia (NBE).

“The banks have their own terms and conditions when it comes to paying guarantees,” says Frezer. “They pay the guarantees to employers and later make the contractors liable, changing them to loans.”

The three banks have requested the Project Office to shortlist contractors to work with. However, officials at the Office were seen reluctant and referred the case to the Ministry of Urban Development & Construction.

Representatives from the Bankers' Association, the Ministry, and the Ethiopian Roads Authority have begun discussing the mounting problems with guarantee issues.

“We're looking for options such as banks taking over the projects and choosing other contractors," Ermias Andarge, president of Enat Bank, told Fortune. "Providing the banks with a longer period to pay the refunds is another idea.” He explained that it is common practice to provide guarantee bonds without collateral, citing that his bank provides guarantees to the contractors on a one percent commission for a period of three months.

Though the contractors and the banks find themselves in troubled waters, project owners suffer most from projects not delivered upon schedule. It is no different for the Project Office.

Project owners take long periods to hire new contractors, delays in court litigations, inflation, and failure to do fast inventory are the reasons for buildings stand unfinished for so long, according to Tibebu Assefa (PhD), a lecturer at the Ethiopian Institute of Architecture & Building Construction.

“The moment a contract is terminated, employing organisations should act immediately hiring new contractors because they're more affected by such delays than the other parties involved,” says Tibebu. “The law should allow them to go ahead with the construction despite litigations at the courts."

PUBLISHED ON

Jun 19,2021 [ VOL

22 , NO

1103]

Fortune News | May 31,2025

Radar | Jun 01,2019

Fortune News | Apr 17,2021

Fortune News | Nov 06,2021

Fortune News | Feb 06,2021

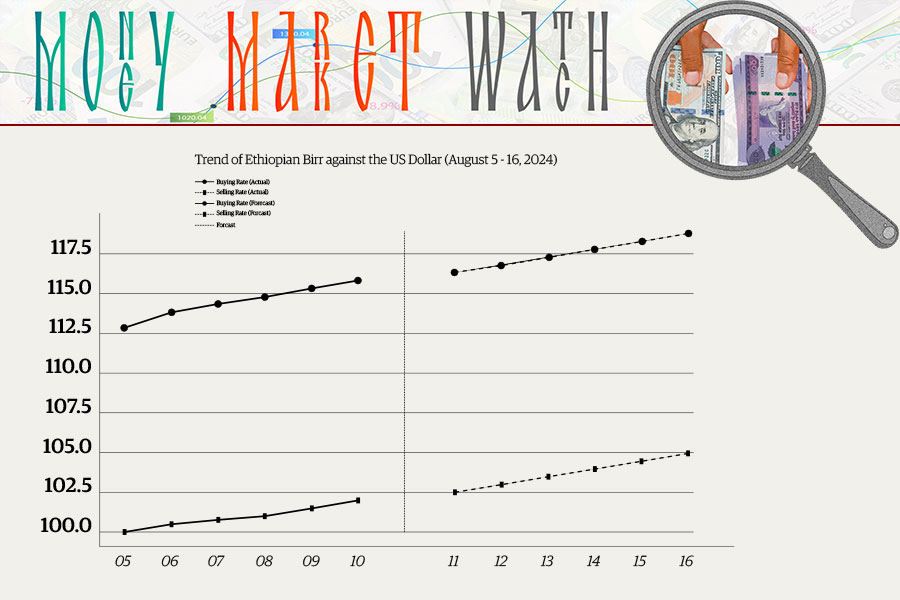

Money Market Watch | Aug 11,2024

Fortune News | Aug 07,2021

Fortune News | Mar 19,2022

Fortune News | Jun 08,2025

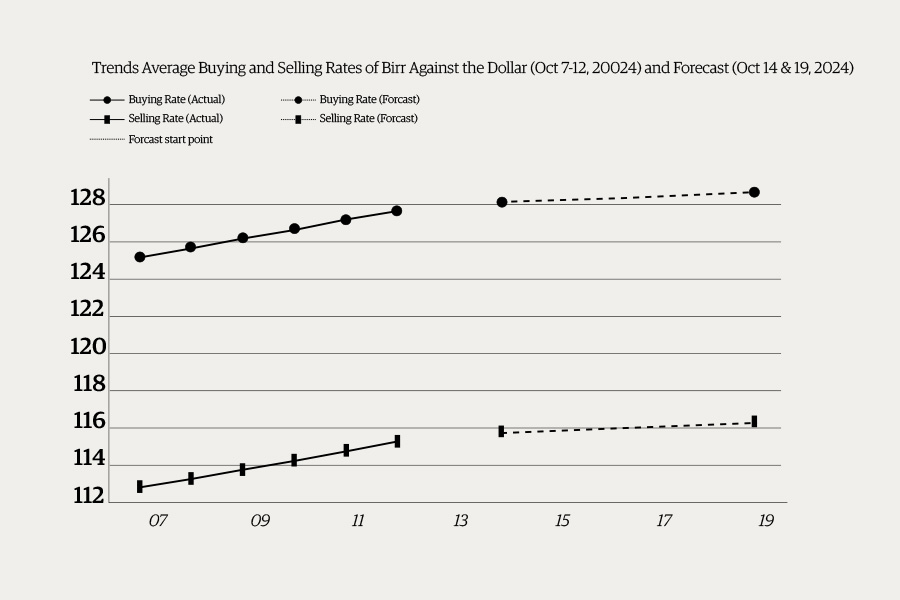

Money Market Watch | Oct 13,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...