Featured | Aug 29,2020

Inflation has been on the rise in recent years both globally and within Ethiopia, registering an inflation rate of 33.5% in July of 2022 (Central Statistics Agency, 2022). Given the impact of this abrupt increase, businesses must reevaluate their strategy, introduce mitigation plans and streamline business plan process if they wish to retain a profitable position.

To help address this concern, Grant Thornton Ethiopia has drawn on the breadth of experience and market knowledge of its network to develop the ‘Essential action plan for managing operations in inflationary times.’ The plan comprises five actions we believe all businesses should consider taking to deal with this challenge.

Action 1: Take action to limit internal and external cost increases

Inflationary pressures have been driving costs up, but not all suppliers are reacting as expected. To take advantage of these asymmetric reactions, businesses should consider renegotiating terms with suppliers, changing suppliers, locking in prices, and bulk buying while keeping storage space availability in mind and maintaining healthy working capital.

Companies can also consider outsourcing certain business processes to reduce internal costs while also addressing the skills crisis in order to achieve the required flexibility to fulfill business demands

Action 2: Improve your understanding of the true cost to serve clients

Most companies throughout the world do not regularly and accurately analyze the expenses and earnings of individual consumers and products. Businesses need to put in programs and systems in place to better understand their actual customer segments and the profitability of each segment.

Action 3: Change your pricing strategy so it is more in line with cost increases

In order to cope with inflation, enterprises should look at boosting prices in parallel to increases in cost. However, this comes with increased risk of client loss and competitiveness.

If prices must be raised, several elements must be considered such as current contractual conditions, timing, type of previous increases, target groups, link of the increase with new product features, and customer’s willingness to pay.

Action 4: Take action to improve capital structure

Companies must optimize their cost of capital while also considering scaling up or down the level of working capital to meet their demands.

In the short term, if businesses are healthy and have plenty of cash, then they can consider strategies like bulk buying to beat inflation. If the opposite applies, then they may need to look at sourcing additional capital and managing debt. If additional capital is needed, companies should address the capital issues earlier since banks will inevitably become more cautious about lending in inflationary times.

Action 5: Take steps to improve internal efficiency and costs, and/or reduce waste

An additional action that companies can take is increasing the internal efficiency of operations and reducing wastage during production. For example, improving internal cost efficiency may help offset higher prices charged to customers. Businesses should also consider investing in modern technologies to drive internal efficiency.

Grant Thornton International is one of the world's largest professional services network of independent accounting and consulting member firms that provide assurance, tax and advisory services; with offices in Ethiopia.

We are discussing with several clients on how we can support their plans and business reviews. If you’d like to join the conversation, please reach out to us:

Grant Thornton Building 4th Floor, Guinea Conakry Street, Kazanchis, Addis Ababa, Ethiopia

E: Info@et.gt.com

T: +251 (0) 11 553 6364

PUBLISHED ON

Aug 22,2022 [ VOL

23 , NO

1165]

Featured | Aug 29,2020

Radar | Feb 24,2024

Fortune News | Apr 22,2023

Fortune News | Jul 13,2024

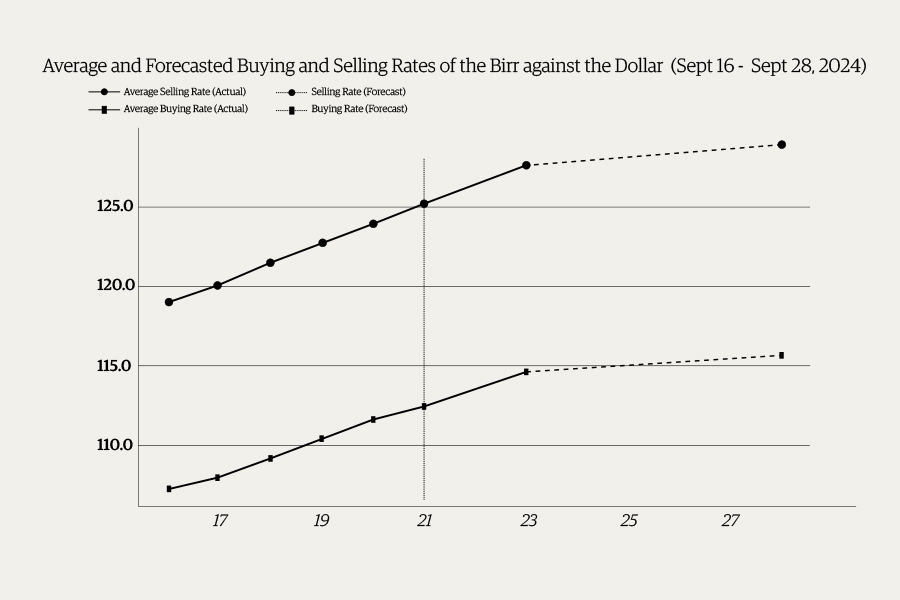

Money Market Watch | Sep 22,2024

Radar | Jul 29,2023

Commentaries | Jun 07,2025

Radar | Jun 07,2025

Radar | Jul 13,2024

Radar | Feb 18,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...