Delicate Number | Aug 16,2025

Central bank governor Yinager Dessie (PhD) (centre) shares a lighthearted moment with the founding management team of Ahadu Bank S.C., the latest addition to the banking industry. Mekonnen Semu (left), vice board chairperson; Eshetu Fantaye (second from left), president; Anteneh Sebsebie (second from right), board chairperson; and Tigabu Haileyesus, board director, appeared to be in a good disposition coming out on the other end of a two-year journey since promoters began raising equity from the public.

Ahadu Bank joined the industry with three branches, distinguished for their deep black-and-red layouts, with a plan to open 47 more by October. It has a subscribed capital of 702 million Br, with 80pc paid from around 10,000 shareholders. It plans to reach the five billion Birr minimum paid-up capital threshold in three years, as required by the National Bank of Ethiopia (NBE). The journey to opening its doors to the public has not been without challenges. COVID-19 and political instability have made mobilising equity demanding, according to Board Chairperson Anteneh. The future promises significant challenges to Ahadu, a Ge'ez word for "one". With a slowing economy and inflation pushing real savings rates into the negative, mobilising deposits is a task of the highest order.

A major obstacle will be the shortage of finance professionals as the number of banks grows. Poaching has become standard practice, particularly to fill up senior positions. The competition for limited talent is pushing up salaries and benefits as banks attempt to one-up each other. Given the heavy reliance on physical offices for savings mobilisation, charming the skilled workforce will keep Ahadu's founding management team's nose to the grindstone.

You can read the full story here

PUBLISHED ON

Jul 17,2022 [ VOL

23 , NO

1159]

Delicate Number | Aug 16,2025

In-Picture | Jul 28,2024

Delicate Number | Jun 14,2025

Radar | Dec 15,2024

Fortune News | Aug 18,2024

Radar | Jul 20,2025

Fortune News | Nov 17, 2024

In-Picture | May 12,2024

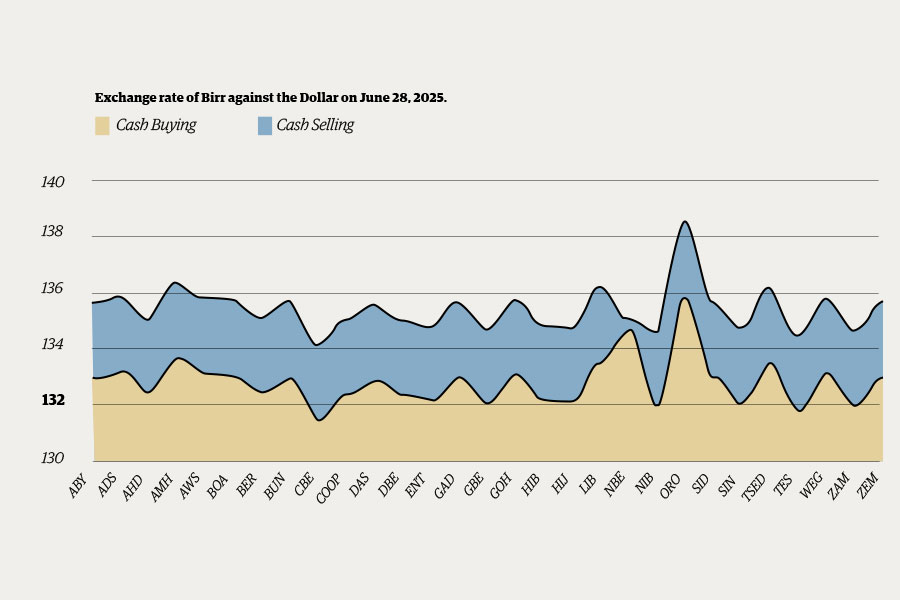

Money Market Watch | Jun 29,2025

Life Matters | May 24,2025

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...