Fortune News | Dec 27,2018

Dec 28 , 2019

By MESAY BERHANU ( FORTUNE STAFF WRITER

)

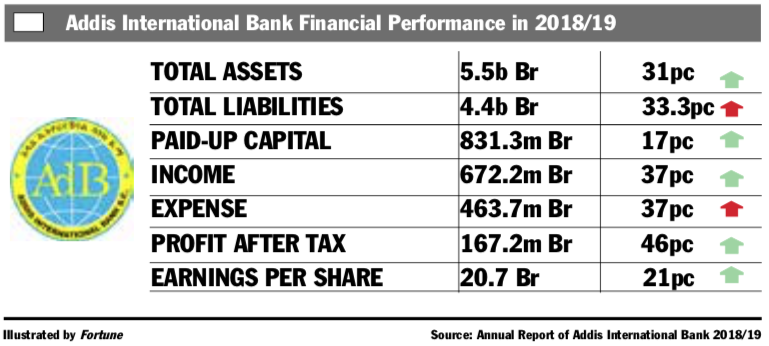

The Bank's expenses significantly soared by 37pc.

The profit growth of Addis, which netted 167.2 million Br, is more than double the industry average, which stands at about 20pc. The earnings per share (EPS) of the company went up by about three Birr to 20.7 Br.

The profit growth of Addis, which netted 167.2 million Br, is more than double the industry average, which stands at about 20pc. The earnings per share (EPS) of the company went up by about three Birr to 20.7 Br. Though shareholder returns remain lower, Addis International Bank, one of the late entrant banks, had an impressive financial performance last year, raising its profit by 46pc.

The profit growth of Addis, which netted 167.2 million Br, is more than double the industry average, which stands at about 20pc. The earnings per share (EPS) of the company went up by about three Birr to 20.7 Br.

Considering the young age of the Bank, the performance of Addis is satisfactory, according to Abdulmenan Mohammed, a financial statement analyst.

The considerable increase in the total income of the Bank contributed to the growth in profit after tax. Interest on loans and investments in the NBE bond reached close to 407.8 million, showing a 41pc increase. Service charges and commissions went up by 36pc to 216 million Br.

However, income from foreign exchange dealings showed a slight decline by one percentage point to 30.7 million Br.

Even though the forex earnings of the Bank is better than some banks, Hailu Alemu, president of Addis, says it is still less than their expectations.

“The forex crunch in the economy posed a huge challenge to the banking sector as a whole,” Hailu told Fortune.

In tandem with the remarkable growth in total income, the Bank’s expenses also increased markedly at about the same rate as that of income. The total expenses of the Bank increased by 37pc to 463.7 million Br.

Interest paid on deposits showed the highest rate of increase by 54pc, reaching 208.1 million Br.

The higher interest rates the Bank paid on time deposits was the reason for this, according to Hailu.

"We were paying 12pc to 13pc on time deposits, since we did not have a strong base in the current or deposit accounts that required much lower interest rate payments," Hailu said.

Salaries and benefits also rose to 124.5 million Br, showing a 29pc growth, while general administration expenses spiked by 20pc to reach 119 million Br.

In a bid to attract competent and qualified human resources to be more profitable in the industry, Addis increased salaries of employees, according to the President.

"We also recruited additional staff members for the new branches we opened," Hailu said.

In the reported period, the Bank opened nine new branches, pushing its total branch network to 68.

As Addis is relatively new to the industry, the expansion of expenses is expected, according to Abdulmenan.

“Still the management needs to keep an eye on expenses,” he added.

Last year was the year where the Bank focused on digital banking services, according to Hailemelekot Teklegiorgis, chairperson of the board of directors of the Bank, in his address to the shareholders in the performance report.

Addis introduced the Kuteba Lehulu savings product that particularly targets those segments of the society without identification cards by using a biometric verification system.

About 11,823 new users started using the service last year, pushing the total number of customers to 24,667.

Addis's total assets showed a massive increase of 31pc exceeding 5.5 billion Br. It disbursed nearly 2.7 billion Br in loans and advances while mobilising almost 4 billion Br in deposits.

The loan-to-deposit ratio declined by two percentage points to 67pc, which was still not far below the industry average of 70pc.

Addis increased provisions for doubtful loans and advances by 48pc reaching 12.1 million Br.

The Bank’s investment in the NBE bond reached 1.1 billion Br, representing 19.3pc of total assets and 26.9pc of the Bank's total deposits, both of which remained pretty much the same over the years.

The liquidity level of Addis increased by 28pc in terms of cash and bank balances, which reached 1.3 billion Br. However, the ratio of liquid assets to total assets declined by just a percentage point to 24pc, as the ratio of liquid assets to deposits also fell by one percentage point to 34pc.

“As Addis is a very liquid bank, it should use its liquid resources for more income-generating activities,” the expert observed.

The 17pc increase in its paid-up capital reached 831.3 million Br with a capital adequacy ratio of 37.6pc.

“This shows that Addis is a highly capitalised Bank. Addis should employ its capital to increase shareholders’ returns,” the expert suggested.

Shimeles Gedlegiorgis, a shareholder of Addis and CEO of Ethio Life & General Insurance Company, says he is satisfied with the performance of the Bank despite the challenging external business environment that constrained foreign exchange earnings.

However, he suggests the management of the Bank consider a more cost-effective approach to maximize profitability in the long run.

PUBLISHED ON

Dec 28,2019 [ VOL

20 , NO

1026]

Fortune News | Dec 27,2018

Radar | Apr 02,2022

Fortune News | Oct 30,2022

View From Arada | Jun 07,2020

Commentaries | Oct 22,2022

Sunday with Eden | Feb 06,2021

Fortune News | Jul 07,2024

Fortune News | Mar 16,2019

Editorial | Mar 26,2022

Fortune News | Mar 09,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...