Radar | Nov 19,2022

Apr 3 , 2021

By KIDUS DAWIT ( FORTUNE STAFF WRITER )

It was a good operating year for Addis International Bank (AIB), despite the public health crisis, economic slowdown and political uncertainties.

In a statement for the annual report, Hailu Alemu, the Bank's president, acknowledged this as "a year full of unprecedented challenges." Severe liquidity crunches besieged the Bank in the first half of the fiscal year, where inflation and a foreign currency shortage defined the economic landscape.

"Despite all the challenges, the overall performance of the Bank has been encouraging," reads Hailu's statement.

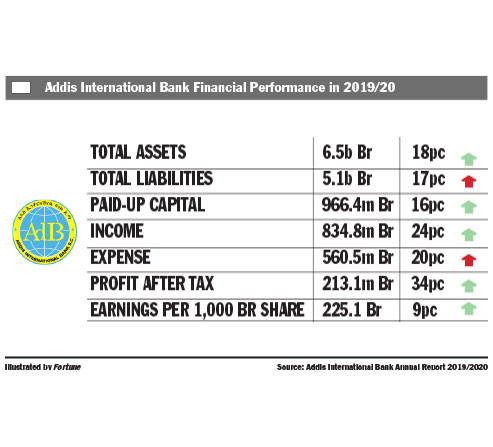

Addis International Bank has seen jumps both in net profit (213.1 million Br) and earnings per share (225.1 Br) for the fiscal year ended June 30, 2020. This represents an impressive increase of 34pc in profit, part of an outcome that should delight shareholders of the Bank, according to Abdulmenan Mohammed, a financial statement analyst.

The Bank has invested a little over half a billion Birr in buying bonds from the central bank, recording an increase of 27pc. However, the largest income growth, 43pc, came from foreign exchange dealings at 43.7 million Br, while service charges and commissions went up by 20pc to 258.3 million Br.

This is a performance Abdulmenan described as "remarkable."

The Bank's total capital swelled to 1.4 billion Br over the reporting period, registering a 22pc growth during the ninth year of operation for Addis International Bank.

The expansion of business at Addis was followed by an increase in expenses. The largest jump, at 23pc, was recorded in interest paid on deposits of 256.5 million Br. However, the provision for impairment of loans and other assets plummeted by 91pc to 1.1 million Br, a reduction Abdulmenan finds "impressive."

"Addis International should keep up its strong credit management system," said Abdulmenan.

Addis's loan-to-deposit ratio increased to 74pc from 67pc, a trend Abdulmenan said requires caution against further increases as this may undermine the liquidity level.

It is advice the Bank should pay close attention to as its liquidity level declined in relative terms although increasing in value. Its cash and bank balances increased by 12pc to 1.5 billion Br, while the ratio for liquid to total assets dropped to 23pc from 24pc. Similarly, the liquid-assets-to-deposits ratio went down by four percentage points to 32pc.

Despite the reduction in the level of liquidity, Addis was still a liquid bank at the end of the fiscal year, enabling it to disburse loans and advances of nearly 3.5 billion Br, an increase of 30.2pc from the preceding year.

The modest expansion of branches seen last year could have been of some help. The Bank opened seven new branches over the reporting period, bringing its total branch network to 75, with well over half of its branches located in the capital. It boosted the deposits Addis International mobilised by 17pc to 4.6 billion Br, representing half that of the preceding year.

The Bank's total assets have also increased, registering a growth of 18pc to 6.5 billion Br, much lower than the preceding year’s growth rate of 31pc. Its paid-up capital inching close to a billion Birr, a far cry from many of its peers in the industry, gives it a capital adequacy ratio (CAR) of 35pc. It shows Addis International is a sufficiently capitalised bank for its size compared to the over 90pc ratio seen in the industry. Abdulmenan sees room for efficient use of its capital to increase shareholder returns.

Despite the "remarkable" performance, the bank's branch network, capitalisation and share in the market make Addis International a fairly small bank in the league of Debub Global and Enat banks.

However, shareholders are happy. Yilma Belay is one of these shareholders who is satisfied with the Bank's performance.

"I can't say that it was a bad year," he told Fortune. "The Bank is still growing."

PUBLISHED ON

Apr 03,2021 [ VOL

22 , NO

1092]

Radar | Nov 19,2022

Fortune News | Dec 19,2021

Viewpoints | Jan 09,2021

Exclusive Interviews | Nov 21,2018

Commentaries | Jul 17,2022

Fortune News | Apr 06,2024

Fortune News | Jan 27,2024

Radar | Sep 06,2020

Fortune News | Aug 11,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...