Radar | Aug 26,2023

Abay Bank has reported a substantial surge in net profits, reaching an impressive 1.55 billion Br for the fiscal year 2022/23. This significant growth course stands out in an industry often dominated by long-established banking giants, displaying Abay Bank's rapid ascent in the competitive banking landscape.

Its financial performance reflects resilience and adaptability in the face of global and domestic headwinds. Its focus on operational efficiency, revenue enhancement, and strategic expansion has yielded significant financial gains. However, analysts warn that the rising expenses and potential risks in the loan portfolio call for careful management and strategic oversight.

Board Chairman Amlaku Asres, addressing shareholders who met at the Inter-Luxury Hotel two weeks ago, acknowledged the impact of global and domestic turmoils, including the ongoing Russian-Ukraine war and Ethiopia's monetary policy aimed at curbing high inflation rates.

Despite these headwinds, Abay Bank reported a substantial increase in interest income from loans, advances, and central bank treasury bonds, which climbed by 56.8pc to 5.55 billion Br. The Bank experienced a significant surge in service charges and commissions by 91.3pc, amounting to 1.19 billion Br.

Complementing this remarkable financial performance is the Bank's Earnings Per Share (EPS), which saw an increase of 65 Br to 360 Br. This notable rise occurred amidst escalating operational expenses and a strategic boost in the Bank's paid-up capital, which grew by 19.1pc to 4.73 billion Br. This approaches the five billion Birr minimum capital requirement set by the National Bank of Ethiopia (NBE) for 2026, reflecting the Bank's proactive leadership posture in regulatory compliance.

Abay Bank has maintained a robust Capital Adequacy Ratio (CAR) of 16.7pc, significantly exceeding the regulatory minimum, signalling a strong capital base and financial health.

The President of Abay Bank, Yehaula Gessese, credited the financial success to strategic efforts in improving operational efficiency.

"Our bank recorded growth across all key parameters," he told Fortune.

His tenure, which followed Mesenbet Shinkute, the current President of the Addis Abeba Chamber of Commerce & Sectoral Associations (AACCSA), brought over two decades of banking experience, including a vice-presidential stint at the state-owned Commercial Bank of Ethiopia (CBE). His tenure is seen as a crucial factor in driving the Bank's success.

Despite being relatively young, the Bank has adeptly navigated the complex economic environment, delivering impressive financial results.

Its aggressive market penetration and service diversification strategies brought a 66.1pc jump in net profits, doubling not only its growth rate for the previous year but also much higher than the 26.2pc industry average recorded for the fiscal year 2021/22. The Bank posted a 360 Br EPS, demonstrating its success by rewarding shareholders significantly larger than the industry's average of 32.7pc for last year, against a backdrop of rising operational costs and capital increases.

The increase in shareholders' returns is also in sharp contrast to Dashen's, one of Ethiopia's leading banks, posting a declined EPS for the second time this year despite a record net profit of 3.5 billion Br. Dashen's asset management also overshadowed Abay, with a total assets nearly three times that of Abay's. However, although trailing in sheer profit and asset size, Abay Bank excelled in operational efficiency and maintaining a higher net profit margin, exceeding the industry standard.

The Bank's operating expenses also saw a 53.9pc increase, reaching 1.07 billion Br, mainly paid to interest on deposits and wages as well as staff benefits. The latter two registered a significant surge of nearly 81pc to 1.97 billion Br. These rising costs, particularly the hike in loan and asset impairments provisions to 219.3 million Br, reveal potential risks in the Bank's loan portfolio.

Industry analysts warn that the 121pc increase in provision for impairment of loans and other assets raises potential risks in asset quality, which could affect future profitability. While the Bank has shown an increase in liquidity in absolute terms, the decline in liquidity ratios – including cash and bank balances to total assets and total deposits – should be a concern, according to industry analysts. They note Abay Bank is growing in size, but its liquid assets are not keeping pace, potentially limiting its operational fluidity.

Yehaula acknowledged these rising costs, attributing them to increased rental expenses and salaries compelled by the Bank's expansion. Over the year, Abay Bank opened 110 new branches, bringing its total to 483, and expanded its workforce by 1,636 employees, totalling 8,626.

"We do this to fuel growth," Yehuala told Fortune.

Branch managers like Mahteme Girma have noted the impact of the political situation on savings and the restricted mobility of goods due to regional conflicts, which have adversely affected the performance of some branches.

"Customers are only consuming what they've saved," said Mahteme, who runs the Beqlo Bet branch.

He revealed that the tightening of foreign currency had impacted exporters' performance, further exacerbating the branch's slumped activities.

Despite these challenges, Abay Bank has achieved significant gains in foreign exchange dealings, increasing by 37.1pc to 154.93 million Br. This performance was lauded by London-based financial analyst Abdulmenan Mohammed (PhD), noting it as a positive shift from the previous year's declining trend.

One of the 4,430 shareholders, Yonas Mekonen, has expressed satisfaction with the growing EPS. A businessman and among the 823 founding shareholders when the Bank was incorporated 13 years ago, he remains apprehensive about the impending competition as new players are expected to enter the financial sector.

"I hope they start investing in technology," he told Fortune.

The Bank's total assets also saw a significant increase, amounting to 55 billion Br, a rise of 35.2pc from the previous year. While the central Bank's recent credit growth cap, limiting increases to no more than 14pc, could potentially impact Abay Bank in the years to come, the Bank managed to grow its loan portfolio by 37.2pc, disbursing 36.47 billion Br.

Abay Bank's total deposits rose to 41.7 billion Br, marking a 28.9pc increase and pushing its loan-to-deposit ratio up by 5.3pc to 87.3pc. Yehuala and his team have positioned themselves to earn more from interest income, although they may face lowered liquidity levels. The Bank's liquidity, in absolute terms, improved, with a cash balance increase of 3.8pc to 8.25 billion Br. However, Abdulmenan noted that relative liquidity indicators, such as the ratios of cash and bank balances to total assets and deposits, showed declines.

"Further reduction of liquidity will affect its daily operation," warned Abdulmenan.

Yehuala, who helmed the bank for the past eight years, reassured that Abay Bank has strategies to maintain healthy liquidity levels, despite temporary year-end declines. He emphasised his management's commitment to sustaining operational stability.

"Temporary declines at the end of the year might occur only to return to normal soon enough," the President told Fortune.

PUBLISHED ON

Nov 25,2023 [ VOL

24 , NO

1230]

Radar | Aug 26,2023

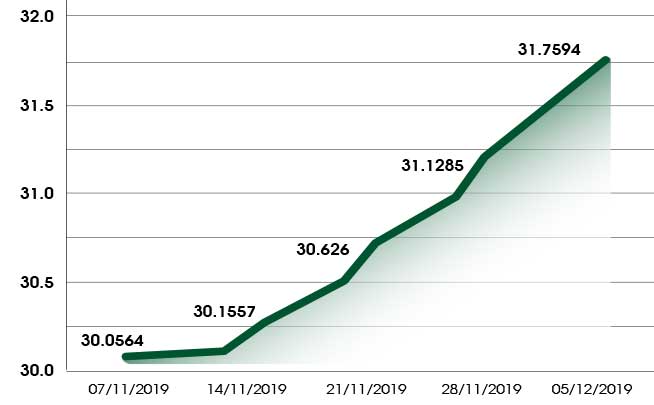

Fortune News | Dec 28,2019

Editorial | Jan 28,2023

Fortune News | Dec 07,2019

Fortune News | Dec 27,2018

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 25 , 2025

The regulatory machinery is on overdrive. In only two years, no fewer than 35 new pro...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...