Commentaries | Sep 20,2025

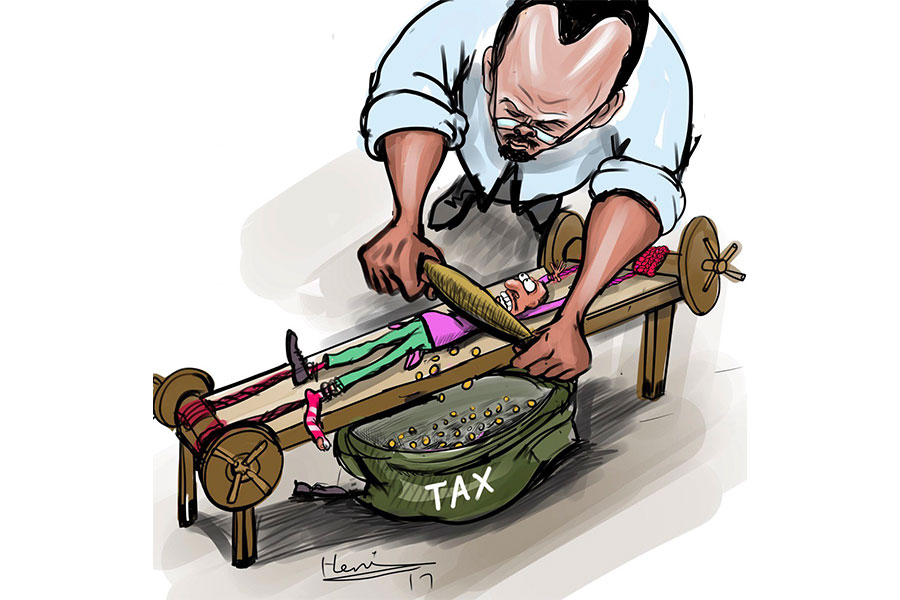

As October and November rolled in, so did the tax season, when tax officials and businesses began an annual ritual of testing one another’s patience. However, the tax bureaus were not as crowded, stuffy and inflexible as in previous years, although businesses were as belated in their filings and demanding of their accountants.

The introduction of a digital portal has made things more accessible than before. Tax can be declared and filed online, and taxpayers pay digitally only to receive receipts in email attachments. However, businesses have their representatives visit tax bureaus to get copies of clearance to renew licenses. The majority of taxpayers chose to take advantage of this opportunity at the East Addis Abeba branch of the Ministry of Revenues. Many taxpayers prefer to settle their tax obligations when the deadline is closer, choosing to keep the amount they have to pay as working capital for as long as possible, although this tendency is declining. That collateralised loans from commercial banks have been frozen has not helped matters this year.

At around 10pc, Ethiopia's tax-to-GDP ratio is low even by sub-Saharan Africa standards. The federal government has all the incentives to make the process smooth. It plans to cover around two-third of its spending this year from taxes. The performance over the first quarter of the fiscal year, at 124 billion Br, shows that the goal is unlikely to be met. Under the threat of sanctions, the impact of the COVID-19 pandemic and the devastating consequences of war, tax officials could have done much worse than collecting over 90pc of the target to cover a large portion of the over half a trillion Birr in the federal budget this year.

You can read the full story here

PUBLISHED ON

Nov 20,2021 [ VOL

22 , NO

1125]

Commentaries | Sep 20,2025

Fortune News | Jan 03,2025

Editorial | Jul 23,2022

Commentaries | Jan 07,2023

Editorial | Jul 19,2025

Radar | Jan 26,2019

Fortune News | Sep 07,2025

Radar | Nov 26,2022

Fortune News | Jun 15,2019

Radar | Jun 03,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 18 , 2025

The political establishment, notably the ruling party and its top brass, has become p...

Oct 11 , 2025

Ladislas Farago, a roving Associated Press (AP) correspondent, arrived in Ethiopia in...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...