Jul 21 , 2025

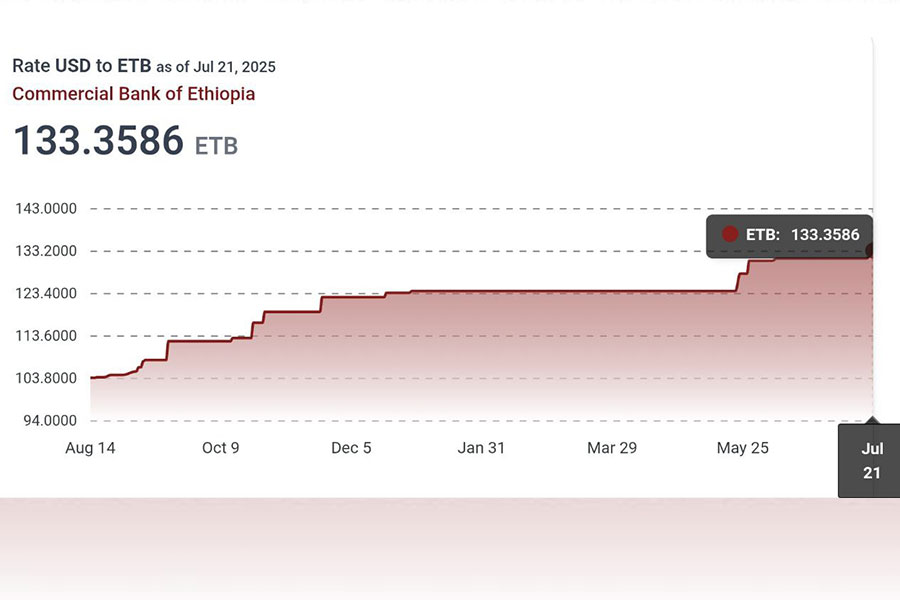

The Commercial Bank of Ethiopia (CBE) ended a three-month standstill in its foreign exchange pricing today, July 21, 2025, lifting its dollar rates in a move that brought the state-owned giant back in step with the Central Bank’s official fixing.

After holding its position since late June 10 at 131.50 Br to buy and 134.13 Br to sell, CBE posted new rates of 133.35 Br and 136.03 Br, almost a two-Birr increase on both ends of the spread.

Today’s adjustment closes a pricing gap that had puzzled traders and bankers. While the Central Bank maintained an official rate of 133.36/136.03 Br, CBE had undercut it for months, effectively offering the dollar at a discount. That strategy diverged from other commercial banks, which incrementally nudged their rates upward as the Birr continued its slow depreciation.

Oromia Bank, for instance, on Saturday quoted 137.59 Br to buy and 140.34 Br to sell, more than five Birr above CBE’s previously fixed prices. Even smaller banks such as ZamZam Bank, which listed 132 Br and 134.64 Br for buying and selling respectively, maintained more competitive spreads. Berhan International Bank, last week’s cheapest buyer among private lenders at 132.47 Br, contrasted sharply with Oromia’s wide bid-ask, signalling varying appetites for liquidity risk across the banking industry.

CBE’s recalibration came against the backdrop of a mild weakening of the Birr. Between July 14 and July 19, average cash market buying prices edged from 134.9 Br to 135.2 Br, while selling quotes climbed modestly from 137.5 Br to 137.7 Br. The parallel market, hovering around 155.5 Br to the dollar, showed no dramatic swings but continued a steady depreciation despite mounting demand for foreign currency.

The Central Bank sent a clear signal of convergence earlier this week by eliminating the spread between its interbank and cash rates on July 17, a move interpreted as a push for greater price uniformity. CBE’s rate shift appears to echo that posture, potentially reinforcing the Central Bank’s policy anchor at a time when inflationary pressures and chronic forex shortages are testing the resolve of monetary authorities.

If today’s fixing proves stable, it could suggest the brewedbuck’s current pace of depreciation is likely to remain gradual. However, private banks’ diverse pricing strategies revealed differing levels of risk tolerance and expectations about near-term liquidity conditions.

While some market watchers may see CBE’s delayed adjustment as a capitulation to macro pressures, others interpret it as a show of alignment with regulators, a calculated step to restore consistency in an increasingly fragmented forex market.

Editorial | Apr 24,2021

Agenda | Oct 01,2022

Fortune News | Apr 10,2023

Fortune News | Jun 04,2022

Radar | Mar 16,2024

Fortune News | Aug 01,2020

Featured | Aug 29,2020

Radar | Oct 20,2024

Covid-19 | Mar 21,2020

Radar | Nov 12,2022

My Opinion | 133550 Views | Aug 14,2021

My Opinion | 130065 Views | Aug 21,2021

Photo Gallery | 128049 Views | May 06,2019

My Opinion | 127863 Views | Sep 10,2021

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...