Radar | Jul 17,2022

Apr 19 , 2025

By Daniel Gros

With imports constituting approximately 14pc of the US GDP, the stakes of a global tariff skirmish are considerably elevated. As bilateral negotiations unfold under asymmetric expectations from the US administration, the risk of larger economies choosing retaliation looms, potentially shaking global economic stability. In this commentary provided by Project Syndicate (PS), Daniel Gros, director of the Institute for European Policymaking at Bocconi University, urges the world to avoid this outcome, with diplomatic finesse, to steer clear of past mistakes.

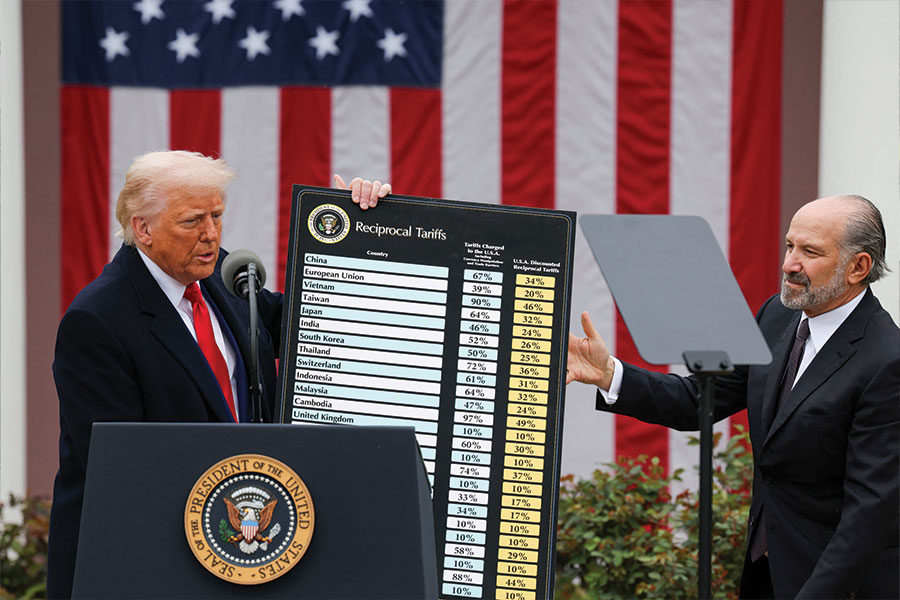

On April 2, US President Donald Trump proposed sweeping tariffs on nearly all of America's trading partners, wiping more than five trillion dollars from the value of global stock markets, and fueling recession fears. In the face of the impending financial meltdown, the "reciprocal" tariffs were then "paused" for 90 days, but the tit-for-tat retaliation with China continued, leading to absurd rates exceeding 100pc on both sides.

The pause on the rest of Trump's "Liberation Day" tariffs will lead to three months of febrile negotiations. But if the rest of the world responds wisely, the damage could be circumscribed entirely to the United States (US), with even a small dose of liberalisation for everybody else. The European Union (EU) will be the key actor in making this benign outcome possible.

This is not the first time the US has suddenly embraced protectionism. In 1930, the US Congress passed the now-infamous Smoot-Hawley Act, which increased tariff rates on a large share of US imports by 40pc to 60pc. While unemployment reached double-digit rates following the Wall Street crash of 1929, foreign competition was hardly the reason.

Unlike today, the US was running a trade surplus (which the tariffs would do nothing to expand). But, the US agriculture sector, beset by overproduction, was demanding protection, as were some industrial sectors, despite America's emergence as a manufacturing powerhouse. The new tariffs would prove highly damaging to the global economy and trading system, not so much because of their direct impact – trade accounted for less than five percent of US GDP at the time – but because of how the rest of the world reacted.

While most smaller countries could protest only diplomatically, many larger economies introduced retaliatory tariffs against the US. Some – such as France and the United Kingdom (UK) – raised tariffs on all imports, partly because their existing bilateral commercial treaties with the US generally included a "most-favoured nation" clause, which prevented them from imposing tariffs only on American goods. (The Smoot-Hawley Act did not violate these treaties, because the tariffs were the same for all countries, varying by product.) With the onset of the Great Depression, countries were looking for ways to protect their economies, and retaliating against the US gave them political cover to do just that.

The Smoot-Hawley Tariff were not in place for long. They were effectively reversed through a series of trade-liberalisation measures, beginning, crucially, with the Reciprocal Trade Agreement Act of 1934. But the damage was done. World trade had contracted sharply, and the global geopolitical climate had worsened significantly, complicating reciprocal tariff reductions.

Today, trade is far more important to the global economy than it was in the 1930s. Imports amount to about 14pc of GDP for the US, nearly 18pc of GDP for China, and more than 48pc for the EU. For exports, those shares are roughly 11pc, 20pc, and 52pc, respectively. The economic fallout of a global tariff war could thus be much larger than in the 1930s.

The pause announced on April 9 has only postponed the problem. The outcome of the many bilateral negotiations is highly uncertain because the Trump Administration expects an asymmetric result. Its trading partners should open their markets, but the US would offer only somewhat lower tariffs.

But, accepting asymmetry is politically difficult, and retaliation if there is no agreement is politically tempting, especially for larger countries that want to flex their geopolitical muscles. That is why China has retaliated immediately against the US. But there is no economic benefit to this approach, and the EU should accept an asymmetric agreement (or at least one that Trump can present as a victory).

One might counter that, whereas small economies might feel compelled to capitulate to the US – Vietnam, for example, has offered to eliminate tariffs on all US imports – a major economic power like the EU should stand up to it. But pragmatism, not ego, should guide Europe's response. After all, "standing up to the bully" would do nothing to increase Europe's geopolitical influence, and the Trump Administration is unlikely to be impressed by European grandstanding. European consumers would pay the price.

European policymakers should also resist the temptation to react to the "flood" of cheap Chinese goods that are diverted from the US market to Europe.

In the 1930s, efforts to stem the flow of imports redirected from the US – manifested by the UK's Abnormal Importations Act of 1931 – helped to transform US protectionism into a global trade war. An EU effort to limit Chinese imports would be all the more inappropriate today, because European exporters will enjoy a massive tariff advantage over their Chinese competitors in the US market, totalling more than 80 percentage points. Given this, increased EU exports to the US, together with increased profits from European plants there, may well offset the impact of higher Chinese imports.

The good news is that, while the Trump Administration appears determined to repeat the mistakes of the 1930s, the rest of the world can still avoid them. Given that US imports account for less than one-sixth of the global total, and US exports even less, what matters is that trade among the rest of the world remains free.

Instead of taking short-sighted steps to protect its domestic market or playing counter-productive power games with the US, the EU should rally a coalition of like-minded countries to uphold the open, rules-based global trading system that the US has abandoned. That would be true global leadership.

PUBLISHED ON

Apr 19,2025 [ VOL

26 , NO

1303]

Radar | Jul 17,2022

Fortune News | Nov 13,2021

Commentaries | Oct 07,2023

Fortune News | Jul 13,2025

Sunday with Eden | May 09,2020

Viewpoints | Aug 10,2025

Viewpoints | Apr 19,2025

My Opinion | Apr 01,2023

Commentaries | Jan 26,2019

Fortune News | Nov 20,2021

Photo Gallery | 169939 Views | May 06,2019

Photo Gallery | 160186 Views | Apr 26,2019

Photo Gallery | 149779 Views | Oct 06,2021

My Opinion | 136219 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...