Commentaries | Aug 21,2021

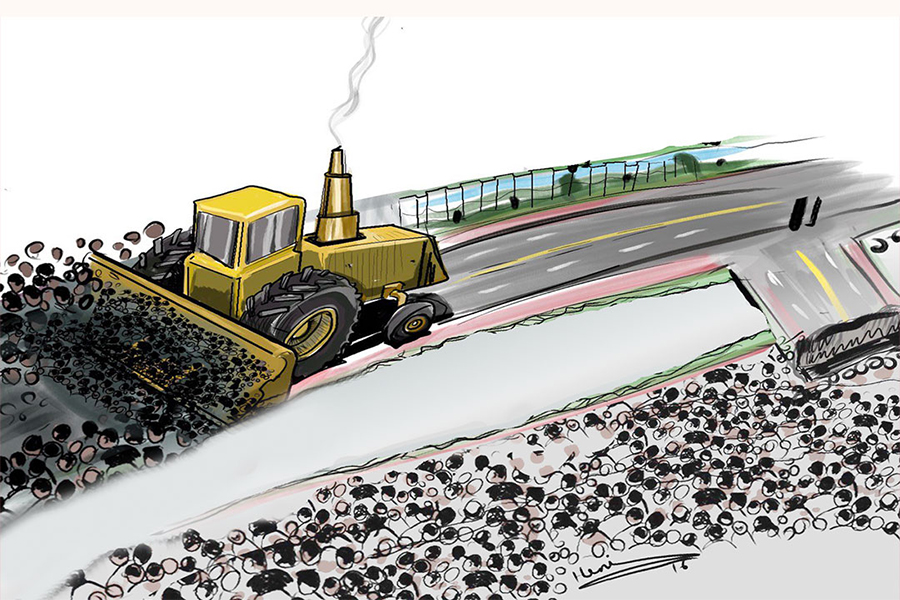

The once-thriving khat trade is unravelling, leaving farmers and exporters trapped between unauthorised checkpoints, rising tax burdens, and a surge in contraband trade.

The leafy stimulant once sustained hundreds of thousands of rural households and generated substantial export revenue. Today, it faces a crisis of shrinking markets, dwindling prices, and a regulatory environment that many in the industry consider hostile to their interests.

A recent Ministry of Trade & Regional Integration (MoTRI) study identified 283 unauthorised checkpoints across the country. Regional and municipal authorities impose additional levies at these roadblocks, leaving exporters hamstrung by rising costs and endless delays. These fees, from 17 Br to 30 Br a kilogram, come on top of formal taxes; they have left traders helpless, complaining that they can no longer compete with the soaring contraband market.

According to Mohammed Abdi, general manager of Biftu Adugna, a major khat exporter to Djibouti, the booming informal market has severely impacted his business. Unauthorised checkpoints and contraband trade have created an uneven playing field, making competition increasingly tricky. He was forced to halt shipments to Somalia due to declining volumes.

The bureaucratic tangle mainly afflicts shipments bound for Somalia, long Ethiopia’s largest khat market, where exports have slowed to a near standstill.

Until recently, Somalia's market absorbed a steady flow of khat shipped from Ethiopia daily. That changed when federal authorities doubled the price threshold to 10 dollars a kilogram. It was meant to bolster revenues, but it yielded a disastrous outcome. Daily shipments to Somalia have plunged by 99.5pc, leaving a trade once measured in thousands of kilograms a day now barely reaching 1,000Kg.

The gap, however, has been filled by illicit traders who skirt the checkpoints and flood Somalia's towns with khat sold well below official prices. As legitimate routes dry up, contraband operations flourish, and regional authorities wrestle for a piece of the trade, the playing field grows irreversibly skewed.

Similar pressures weigh on exports to Djibouti, an important outlet where quality plays a role in determining prices. Second-grade khat fetches eight dollars a kilogram, while top-tier leaves command 10 dollars. But exporters say they factor in the cost of stalled shipments and degrading quality. Transporting a perishable commodity through six checkpoints before reaching Dire Dewa strains the delicate product. The leaves lose their freshness, exporters lose bargaining power, and producers feel the pinch of lower farmgate prices.

Exporters like Anwar Yusuf, general manager of Kulmuye Trading Plc, are unhappy about delays caused by checkpoints and the financial burden of added taxes. His company's shipments face delays at over six checkpoints before reaching Dire Dewa.

"They don't understand the fragile nature of khat," he said.

The financial burden of taxation at these checkpoints is ultimately passed down to the producers, who are forced to accept lower prices for their crops.

For many farmers, the crisis cuts deeper than profit margins or lost market share. In the Hararghe zones, khat has dominated rural livelihoods for generations. With prices squeezed and contraband dealers dictating the terms, growers watch in despair as their incomes shrink.

Jemal Dubaye, a lifelong khat farmer in the east Hararghe Zone, painted a bleak picture of the struggles. Supporting a family of seven on a one-hectare plot, he sold a quintal of khat for 2,000 Br this season, half what he received a year earlier. He struggled to move 1,200Kg of khat at any price.

"I’m at a loss," he told Fortune.

The crisis extends to the West Hararghe Zone, where people like Ashenafi Million, a khat farmer for 20 years, face a similar predicament. He saw the price of khat decline for two years, leaving him to sell bundles of khat for 50 Br, down from 300 Br the previous year. With a family of nine to support, Ashenafi is contemplating giving up khat farming.

"It can no longer sustain me," he said.

Local officials bear out the gravity of the decline. Ahmed Hassen, head of the West Hararghe Zone Agriculture Bureau, described the situation as "a grim reality." For many farmers, khat cultivation is no longer sustainable, and Ahmed attributed this to the absence of market integration.

“Prices have fallen fourfold,” he said.

Ethiopia’s khat export revenue reached only 180 million dollars in the 2023-24 fiscal year, far below the 450 million dollar target and a steep drop from the 402 million dollar peak three years ago. In the past three months, the country earned 28.3 million dollars from 2,580tns of exported khat, down 35pc from the same period last year. Less than 10pc of the 65,817tns earmarked for export left through legitimate channels.

In a desperate bid to enforce order, authorities have launched a relicensing program for khat exporters. Of the 4,900 registered exporters, 300 were recently relicensed, and 600 new licenses were issued in the past four months. Yet, industry insiders see no meaningful improvement on the ground.

Federal officials, including Minister of Trade & Regional Integration Kassahun Gofe (PhD), acknowledged the intensity of the problem. Appearing before Parliament, he told federal legislators last week that the time for half measures had passed. Two new trading centres for khat, each costing half a billion Birr, have been built in Aweday and Bedesa towns in Oromia Regional State. Officials like Kifle Tadele, deputy head of the region's Trade Bureau, hope these facilities will help tamp down contraband routes and restore the supply chain.

However, many in the industry argue that little will change without a fundamental overhaul of taxation and checkpoint policies. Farmers and exporters contend that the tax burden falls heavily on them, eroding competitiveness and discouraging legitimate trade. Agricultural officials in the west Hararghe Zone say production has become unsustainable, citing the lack of integrated marketing channels and plummeting farmgate prices.

Regional government officials have defended the taxes as a means of funding infrastructure development in the Hararghe zones. Revenue bureau officials in Oromia Regional State, however, declined to comment.

Nonetheless, khat producers are trapped between rising costs at home and a rapidly shifting external market. Experts argue that with a sharply devalued currency and capacity for improved productivity, Ethiopia could regain its competitive edge if systemic issues are addressed. But continued inaction, experts warn, will only erode Ethiopia’s foothold in a lucrative regional trade.

Agricultural economist Shimelis Araya (PhD) argued that policymakers should examine whether raising tax revenue and spurring export growth in a price-sensitive sector like khat is possible.

“The government can’t pursue both tax revenue and export growth,” said Shimelis.

He saw parallels to the flourishing flower industry, which benefited from tax-free incentives that helped producers capture global markets. He believes policymakers should explore untapped markets beyond the Horn of Africa.

“Regional exports are no longer viable,” he said.

“Failure to act will cost Ethiopia its position in the lucrative khat market,” he warned.

For now, the impasse remains. Authorities talk of regulatory reforms, while farmers and exporters continue to absorb the immediate financial pain. Oromia’s 600,000 khat farmers understand that the longer the uncertainty persists, the narrower their options become. Minister Kassahun’s urgent call before Parliament for swift intervention reveals that the government recognises what is at stake.

“It needs an immediate resolution,” he told federal legislators.

Editor's Note: This article was updated from its original form on December 9, 2024.

PUBLISHED ON

Dec 08,2024 [ VOL

25 , NO

1284]

Commentaries | Aug 21,2021

Fineline | Nov 23,2019

Verbatim | Jun 14,2025

Radar | Oct 05,2024

Commentaries | Aug 25,2024

Commentaries | Apr 03,2021

My Opinion | Jan 21,2023

Radar | Nov 26,2022

Agenda | Oct 09,2021

Editorial | Sep 01,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...