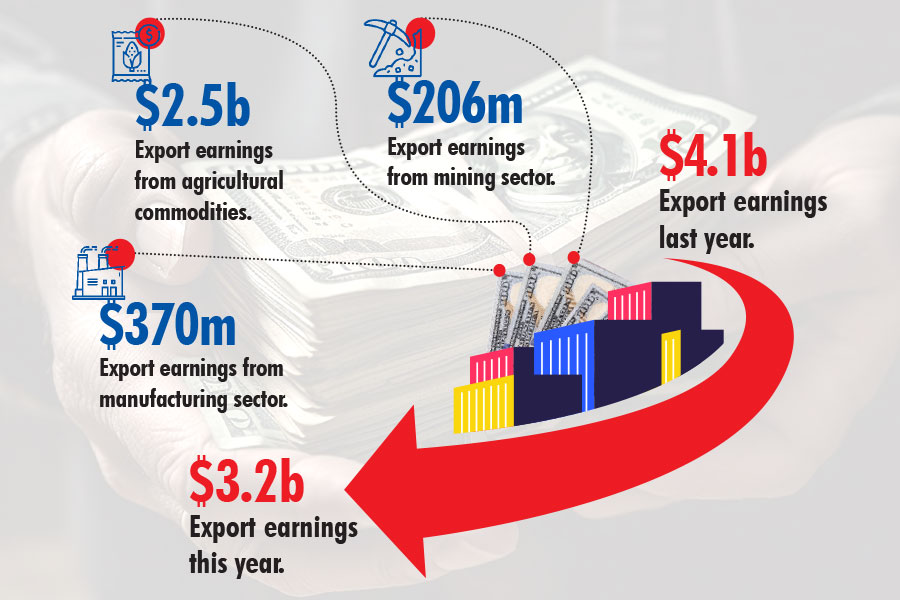

Ethiopian industrial parks have underperformed by half a billion dollars, despite successfully constructing 10 public and five private industrial parks, which are operational. The parks have generated half a billion dollars in revenue, lashed by half the capital invested.

A World Bank report in November 2022 reprehended industrial parks' performance as underdeveloped and poorly integrated with each other and the local market. Export earnings of the industrial parks comprise 95pc garnered through the sale of products from garment and textile manufacturers who are incentivized by low costs of the labour-intensive sector.

The 130-page report spearheaded by Senidu Fanuel reviewed the historical antecedents of the industrial park initiative and the overarching national macroeconomic environment indicating restructuring priorities and gaps in the legal and policy framework. The report indicated several shortfalls in the implementation and development of the parks over the last 15 years.

The first industrial park established in 2007, Eastern Industrial Park (EIP), owned by China, failed to meet the government's expectations. The industrial park at Dukem town in Oromia Regional State, 30Km from the capital, had leased the land at a highly favourable rate of one Birr for a square kilometre for 99 years. Despite its goal and capacity to host 80 investors in its sheds, only nine managed to initiate at the park by 2012, comprising over 100 factories.

The overwhelming performance of EIP back then prompted the government to set up the Ethiopian Industrial Zones Development Corporation, which later in 2014 became the Industrial Parks Development Corporation (IPDC). The corporation then set out to build the Bole Lemi Industrial Park (BLIP), taking more than three years to build on 1.72sqkm. It has been almost a decade after Bole Lemi, and the government has continued to build parks with poor market demand studies and undeveloped market linkages compounded by supply shocks such as the pandemic and suspension from AGOA.

Together with Mali and Guinea, Ethiopia was delisted from the AGOA initiative duty-free trade programme on January 1, 2022, over alleged rights violations and coups.

Karuprayil Purushothaman, operational manager at Jay Jay Textiles Plc at BLIP, said that revenues have fallen by 25pc following the delisting. He saw production drop by three quarters following the suspension leading to the layoff of 10pc of 9,000 employees afterwards. The US accounted for 70pc of all textile exports from Ethiopia in 2020 under the trade opportunity.

Ethiopia's suspension from the act in 2022 jeopardized the livelihood of 56,000 employees directly. The World Bank report expects that the lagged effects of suspension from AGOA have not materialized fully. Despite exports from the industrial parks only contributing five percent to the export sector in 2020 before expulsion from AGOA.

The development of the industrial parks was financed through proceeds from Eurobond secured from the market and concessional loans from the World Bank. A Eurobond is a long-term debt instrument in which government or corporation issues a bond to an offshore creditor to access foreign currency it would not have access to.

Nataniye Kassa, manager at Ethiopian Investment Commission Bahirdar Industrial Park branch, recognizes some of the shortfalls claimed by the World Bank report.

"A plan B option besides AGOA has to be considered," he concurred, recognizing the 2025 expiration date of the act. While giving due recognition to the importance of the dollars earned through export, he suggested an establishment of an intermediary agency between the private sector and government to foster a home-grown trade linkage is vital.

He disagreed with the report's claim that there is an overlap of mandates between government agencies and the business community. Nataniye also agrees the aftermath of the suspension and its impacts are yet to surface fully.

Incorporated with 3.7 million Br capital, one of the AGOA beneficiaries, New-Wing Addis, has been supplying women’s leather shoes to five buyers in the US starting in 2011. The company seems to be heeding Nataniye's suggestion, as it has started exporting wallets to Italy.

Deputy Manager Evano Mesfin told Fortune, "we have sent four containers to Europe following the delisting." According to him, they have invested 85,000 dollars to begin the production of boots to export to Europe.

Ethiopia does not have a national minimum wage law. Around 87pc of all production workers in the parks are women, with three-quarters being between the ages of 18-25, earning an average base pay of 1,800 Br a month. The report also indicated that 60pc of the employees left within three months after being hired, attributed to poor housing, lack of childcare options, personal safety concerns, and fear of rising sexual violence.

"Paying low wages in the short run has long-term costs," said Atlaw Alemu (PhD), lecturer at the College of Business and Economics at Addis Abeba University. The academician contended that the prioritization of textiles might be the driving factor for the large-scale employment of women in industrial parks. Atlaw agreed with most of the conclusions of the WB report, further emphasizing the need for industry linkages.

"Domestic investor involvement is a must for a better trade linkage," he said.

Commenting on the unsatisfactory export earnings, he noted some of the textile factories might sew collars onto shirts without adding enough value to warrant significant foreign exchange revenue.

With AGOA expiring in 2025, heavy reliance on US exports poses a question on the sustainability of a national industrial strategy predicated on one trade corridor, warns the report.

It recommends engagement with the US government on measures to reinstate duty-free eligibility to US markets as of immediate necessity, along with diversification of revenue sources, in the long run.

PUBLISHED ON

[ VOL

, NO

]

Fortune News | Jul 01,2023

Radar | Sep 10,2022

Fortune News | Dec 12,2020

Editorial | Jun 18,2022

Radar |

Viewpoints | Jan 16,2021

Editorial | Jun 07,2025

Delicate Number | Jun 22,2024

Fortune News | Jun 18,2022

Fortune News | Jul 25,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...

Jun 7 , 2025

Few promises shine brighter in Addis Abeba than the pledge of a roof for every family...