Radar | May 21,2022

Sixty-year-old Alemnesh Nigussu had a dream—to secure three apartments for her children. With a considerable sum of 4.5 million Br, she invested in Purpose Black, a relatively new real estate company that promised a sky-high return.

Led by Fisseha Eshetu (MD), Purpose Black unveiled an ambitious plan to build a 115-storey tower, “Ke’Geberew Tower.” To fund this colossal project, the company offered shares to the public, each valued at 1.5 million Br. The enticing part of the deal was a “gift” clause entailing that for each share, investors would receive a three-bedroom apartment.

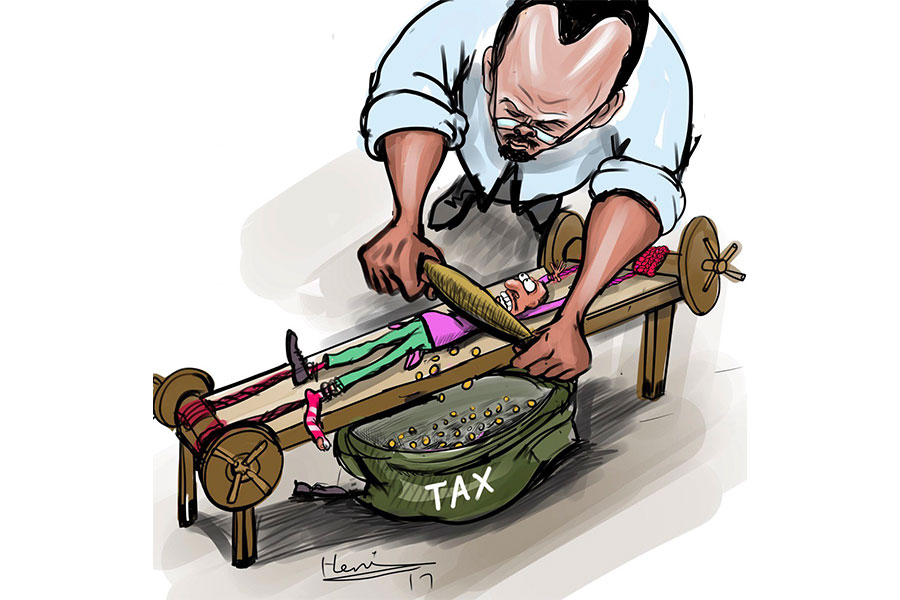

As the project gained momentum, Purpose Black announced that the price of remaining shares would increase for latecomers, potentially reaching up to 55 million Br. However, two years later, Alemnesh and around 1,750 shareholders' dreams were shattered. Allegations of fraudulent marketing practices and misuse of funds surfaced against Purpose Black's executives, and the promised development remained a distant mirage.

Unfortunately, this was not Alemnesh's first encounter with a failed real estate venture. Six years ago, she had invested 2.3 million Br in Access Real Estate, only to be left empty-handed.

"I've lost everything," she lamented.

For some, it was life-altering. Eyersualem Shewangizaw, 46, sold her house in Dukem town, Oromia Regional State, for 2.5 million Br, longing for a better future for her family in Addis Abeba. She invested the entire savings with Purpose Black, signing a seven-page contract.

However, when the promised apartment failed to materialise, she found herself living with her mother and five children in a cramped space.

"I'm devastated," she told Fortune.

The real estate sector has long been beset by a lack of oversight. To address the shortcomings, Ministry of Urban & Infrastructure has introduced a draft real estate development and immovable property bill. This long-awaited legislation aims to regulate marketing practices, property evaluations, and developer competency.

Tsegaye Mushe, housing development lead at the Ministry, noted the urgent need for such a framework. He said that without proper regulation, some developers have exploited investors' trust, misusing funds and delivering substandard projects.

"There has been a lack of accountability," he said

Previously, the real estate sector was only partially covered by existing investment and trade proclamations, leaving important gaps in regulation. Tsegaye expressed optimism that the draft bill would provide the much-needed oversight and transparency.

"It's a long-awaited step towards a more regulated and trustworthy real estate market," he said.

Currently passed to the Standing Committee of Infrastructure & Transport Affairs at Parliament for consultation, the bill proposes to bring clarity and protection to buyers, introducing strict rules on how developers can market and sell their properties.

It requires that 80pc of a project be completed before ownership can be transferred unless contractually agreed upon by all parties. According to Tsegaye, this measure seeks to ensure that developers do not take buyers’ money without following through on their promises.

Advance payments are to be deposited in closed accounts where withdrawals would be strictly monitored by the authorities. Tsegaye believes this involvement of a third party—the government—will prevent money laundering and embezzlement issues.

The new proposed proclamation also prohibits misleading promotions and public issuances.

Operators must construct at least 50 housing units to be recognised as real estate developers and obtain a competency certificate from the Ministry. Tsegaye recalls instances where real estate companies collected more funds from buyers than the land could support, leading to disputes.

The prospective law also looks to set an enabling environment for developers, including preferential access to land for developers planning to construct over 5,000 apartments in Addis Abeba and over 500 units in regional states.

The proposed bill aims to address price fluctuations in the real estate market by establishing a property valuation system for fixed assets to help tax assessment, claims, bank loans, legal disputes, and rental service undertakings. Authorities would research real estate sales and rental prices and publish the results publicly. Base and ceiling rental service prices for cities every two years will also be made public.

Recently, officials have proposed outsourcing property valuation services to private valuators with the hopes of streamlining the process and ensuring accurate and efficient property assessments.

While the bill offers hope for a more regulated market, the nearly 300 real estate developers have observed crucial provisions need to be included.

With over 17 years of experience and a track record of delivering over 2,500 homes, Flintstone Engineering & Homes is a major player in the real estate sector. Brook Shimelis, a board member, acknowledges that the bill is long overdue.

"Regulation was desperately needed," Brook concurs.

Brook notes the need for clearer guidelines on contract disputes between developers and buyers and expresses concerns about the qualification of valuators, accentuating the severe implications of inaccurate valuations.

Beyond regulatory issues, developers say recent land-use regulations including the set-back rule have introduced uncertainty while supply chain bottlenecks and access to raw materials remain worries.

Minase Hailu, a lawyer with a decade of experience in property disputes, notes the critical role of regulation in addressing the issues plaguing the real estate sector. He notes that underperforming developers often lead to legal conflicts, citing cases where buyers have not received their properties due to operational inefficiencies and fraud.

While Minase supports the 80pc transfer law, he argues against extending it based on consumer agreement, as this could create loopholes and undermine the regulatory framework. He believes that such an approach provides no real restrictions and could compromise the integrity of the market.

Another area of concern for Minase is the issue of property valuation. He said that inaccurate valuations can affect prices and potentially contradict free market principles. "This goes against the constitutional mandate of a free market," he said.

Minase believes that lower prices could increase demand if there's sufficient cash flow and economic activity. However, he cautions that buying property for quick resale is no longer a profitable venture.

According to the Centre for Affordable Housing Finance in Africa's 2023 annual report, meeting Ethiopia's housing demand would require building approximately 486,000 new urban homes each year. However, Ethiopia has only managed to complete around 50,000 homes during the years of highest economic growth over the past two decades.

A feasibility study conducted by the Ministry, aimed at exploring private-sector partnerships for constructing a portion of its ambitious 79,800 housing unit plan, has fallen short of its goals. Only 37,000 homes have been completed in the past three years, lagging far behind the decade-long target of 4.4 million units.

Meanwhile, apartment prices in Addis Abeba have experienced a decline since last year, with prices for apartments falling from around 120,000 Br a square meter to as low as 58,000 Br a square meter. However, this price drop has not led to a surge in demand.

Addis Habte, a shareholder of Capducia Real Estate Plc, attributes the lack of demand to several factors. According to him, current conflicts have discouraged diaspora investors, while a scarcity of loans and increased competition from new developers contributed.

A major obstacle for the real estate sector is the tightening of credit supplies by banks, which has been implemented by the federal government to control inflation. This has left developers struggling to secure working capital.

Access to financing remains the most critical issue facing the sector. Eneyew Tadesse, a real estate consultant, believes that the new regulations will filter out unethical developers and create a transparent and efficient market.

"It helps separate the real ones from the incompetent," he told Fortune.

Eneyew also notes that the real estate market is evolving, with some companies shifting their focus from high-end developments to more affordable housing. As financing becomes an issue, developers are being forced to adapt their strategies and cater to a broader segment of the population.

Eneyew believes that without major changes to the banking system, including the establishment of more mortgage banks, developers will struggle to fund their projects, and buyers will find it increasingly difficult to afford homes.

Though obsolete for individuals like Alemnesh and Eyersualem, the real estate bill offers hope for a more accountable market, where safeguards are in place to prevent the exploitation of vulnerable investors. However, without effective implementation and continued vigilance, experts warn that more individuals could face the same hardships, noting the importance of balancing opportunity with consumer protection in the real estate space.

PUBLISHED ON

Oct 20,2024 [ VOL

25 , NO

1277]

Radar | May 21,2022

Fortune News | Nov 04,2020

Verbatim | Nov 05,2022

Radar | Oct 27,2024

Radar | Jul 21,2024

Radar | Mar 09,2019

View From Arada | Dec 24,2022

Fortune News | Mar 27,2021

Radar | May 23,2021

Fortune News | Jan 25,2020

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...

Jul 26 , 2025

Teaching hospitals everywhere juggle three jobs at once: teaching, curing, and discov...

Jul 19 , 2025

Parliament is no stranger to frantic bursts of productivity. Even so, the vote last w...

Jul 12 , 2025

Political leaders and their policy advisors often promise great leaps forward, yet th...