News Analysis | Mar 02,2024

Jul 7 , 2024.

The federal budget has crossed a symbolic threshold, approaching the one trillion Birr mark at 971.2 billion Br, equivalent to 16.7 billion dollars at last week's official exchange rate. The exponential growth of the budget since the early 2000s, when it languished under 100 billion Br, reflects a country experiencing a robust economic expansion while besieged by profound fiscal crises. The budget's trajectory offers insights into the economic policy direction and the difficulties successive policymakers face over the decades.

For much of the 2000s, the real value of the budget exceeded the nominal figure, owing to moderate inflation and a stable exchange rate during that decade. However, the trend reversed around 2016 as inflation began to outstrip nominal growth, eroding the real value of public spending. This was also the year the country entered a delicate phase of political turmoil that was yet to abate. The rapid depreciation of the Birr against the Dollar since then has exacerbated this trend, increasing the cost of imports and foreign debt servicing, thereby diminishing the purchasing power of the budget.

The exchange rate tells a tale of volatility and inflationary pressures. In 2001, the Dollar traded at around 8.2 Br, reaching 8.8 Br six years later. This period of relative stability ended in 2008, and the Birr has since depreciated sharply, particularly after 2016, with the exchange rate hovering around 58.5 Br to the Dollar late last week. For those curious to look closer, this consequential depreciation reflects deeper structural economic issues, including inflation and the balance of payments deficit.

Over the past quarter-century, the federal budget has seen a steady nominal increase, with a notable surge starting around 2017-18. Last week, Parliament ratified a near-trillion Birr budget - rather unanimously - reflecting the federal government's expanded fiscal policies and its leaders' appetite for increased public spending. However, when adjusted for inflation, the real budget has remained flat or even declined in recent years, demonstrating the impact of inflation on Birr's purchasing power.

Finance Minister Ahmed Shide and his deputy, Eyob Tekalegn (PhD), have responded to inflationary pressures with substantial nominal budget increases to sustain public investment and services. Yet, these efforts have not fully addressed the structural causes of economic instability. The divergence between nominal and real budget trends should raise concerns about long-term fiscal sustainability. Continuous nominal budget increases without corresponding real value growth could lead to fiscal imbalances and mounting public debt.

Prime Minister Abiy Ahmed’s (PhD) administration faces the persistent headache of addressing currency depreciation and runaway inflation. His senior officials are inching towards closing a deal with the IMF for a bailout, as the Prime Minister signalled to Parliament last week. Ethiopians might soon witness the floating of the currency exchange market or a substantial devaluation of the Birr. The administration has pinned its hopes of stabilising the economy by bolstering foreign exchange reserves, anticipating a bailout package exceeding 10 billion dollars from the IMF, the World Bank, and development partners.

However, simply securing a bailout is not enough. Boosting export performance, implementing prudent fiscal management, and ensuring transparency and efficiency in public spending are crucial. These measures are indispensable to ensure that budgets drive economic growth and development effectively. A deal with the IMF will come with stringent conditions such as budget tightening, spending discipline, and austerity measures, which are hallmarks of such programs. In international policy circles, austerity typically involves tax increases, spending cuts, or both, used by governments to reduce budget deficits.

These measures are applied when there is concern about government expenditures exceeding revenues. Ethiopia's budget fits into this picture.

The recently ratified federal budget reveals a complex balancing act between the administration's ambitious economic plans and the underlying fiscal constraints. While it demonstrates a focus on regional development and infrastructure, it also raises questions about debt sustainability and sectoral allocations. Heavy reliance on domestic borrowing and substantial debt servicing requirements pose risks to fiscal stability, especially amid global economic uncertainties.

In essence, the federal budget architects have taken noteworthy steps to offset inflation and maintain public services. Yet, the real battle lies in addressing the structural economic issues to ensure long-term stability and growth. The administration's efforts to secure a substantial bailout package may reflect its commitment to stabilising the economy, but the road ahead demands robust fiscal reforms and strategic economic policy measures.

Regional subsidies, at 222.7 billion Br, dominate the budget as the largest single expenditure item. This substantial allocation may have been thought to address regional inequalities and political priorities but risks underfunding essential national programs in health, education, and infrastructure. Domestic borrowing, at 325.60 billion Br, forms a considerable part of the revenue structure, reflecting the government’s strategy to leverage internal sources. While this approach can stimulate the domestic economy, it brings its own problems in debt sustainability and the potential crowding out of private-sector borrowing.

Public debt servicing is allocated 139.3 billion Br, a large expenditure contrasting with allocations for economic development sectors like health, water and energy. The disparity unveils the opportunity cost of high debt servicing, limiting funds available for direct investments critical for long-term growth. Urban development receives 104.7 billion Br, with a strong emphasis on infrastructure, whereas agricultural and rural development are allocated only 23 billion Br. Given that much of the population resides in rural areas and relies on agriculture, this prioritisation appears imbalanced. There should be a need for more inclusive growth strategies.

Defence expenditure has spiked in response to security challenges, but sustained high spending could strain the budget.

The misalignment in budget priorities is not limited to allocations to agriculture, rural development and provisions of essential services. Health and education, receiving 33.9 billion Br and 79.8 billion Br, respectively, are critical but modest compared to regional subsidies and debt servicing. Investing more heavily in these sectors would have been a prudent strategy for expanding human capital and ensuring long-term economic stability.

Over the past decade, the federal budget has seen a marked growth, nominally and as a percentage of GDP. Revenue and grants have soared, driven by increased tax revenues and external grants. However, the share of GDP attributed to these revenues has declined, exposing the limitations in broadening the tax base and mobilisation inefficiency. This has led to a widened fiscal deficit, compelling the federal government to depend on borrowing to finance its expenditures.

Ironically, public spending is less on capital investments in a ratio to recurrent expenditures, a trend that has shifted in recent years, with a reallocation towards recurrent expenditures due to conflict-related priorities and other national emergencies. A noticeable shift from external to domestic borrowing to finance the budget deficit will have far-reaching implications, including the burden on local financial institutions and overall debt sustainability. Servicing external debt remains a substantial burden, particularly for state enterprises.

Macroeconomic policymakers can focus on tax reforms to broaden the tax base, improve collection efficiency, balance capital and recurrent expenditures, and implement a strategic debt strategy to manage debt sustainability. Addressing inflation through prudent monetary policies and prioritising investments in critical sectors will support sustainable development.

When Inflation Targets Clash with Climate Goals

At the end of April, in a speech at the Sorbonne, French President Emmanuel Macron suggested that European leaders should consider broadening the European Central Bank’s (ECB) mandate to include decarbonisation targets. His proposal has mostly been ignored; for many, it probably seems too radical to be worth discussing. But it is not radical, and disregarding it would amount to a major missed opportunity.

Like its independence, the ECB’s price-stability mandate has always been considered “untouchable.” But, the pursuit of price stability does not happen in a vacuum. The Maastricht Treaty, which established the legal framework for Europe’s monetary union, recognises this. While the treaty states that the ECB’s primary objective must be to maintain price stability, it also dictates that, “without prejudice to” that objective, the ECB should support the European Union’s (EU) broader economic policies, with a “view to contributing to the achievement” of the bloc’s objectives.

This has always been interpreted as a hierarchical mandate: price stability comes first, but other objectives – such as employment and financial stability – should also be pursued. When the ECB suggested, in its 2021 strategy review, that it would incorporate “climate change considerations” into its policy framework, it was operating on the assumption that climate would be secondary to price stability.

But what happens when the ECB’s objectives clash?

The pursuit of price stability can, after all, involve trade-offs. Yet, there is currently no established ECB procedure for setting monetary policy when the quest for price stability conflicts with other EU priorities. Macron’s provocative proposal should force European leaders to reckon with this gap – beginning at the next ECB strategy review, planned for next year.

The ECB is not alone.

Inflation-targeting central banks (like the Bank of England (BoE) or Nordic-country central banks) and the US Federal Reserve (which has a dual mandate) confront the same types of trade-offs. These central banks pursue their inflation targets on a medium-term horizon, but allow some divergence in the short term, precisely to avoid or reduce transitional costs, such as lost employment or output. As former BoE Governor Mervyn King once said, “An inflation targeter is not an inflation nutter.”

But, as with the ECB, these central banks might need a more nuanced and flexible approach. Specifically, when getting inflation back to target quickly is likely to have high costs – in terms of employment, financial stability, and efforts to combat climate change – it might be wise to prolong the central bank’s time horizon. Formal criteria for linking costs to time horizons would have to be formulated.

Accounting for the climate transition will not be easy. Consider the impact of regulatory constraints on fossil-fuel technology – a key component of net-zero strategies. These work, like supply constraints arising from supply-chain disruptions or geopolitical shocks, shifting the supply curve to the left and making it steeper. Under these circumstances, changes in demand could lead to price volatility, and inflation-targeting monetary policy might adversely affect employment.

When supply-side factors cause inflation, monetary policy’s impact is limited, so other instruments must be used to ease the constraint.

Though mainstream macroeconomic models assume that monetary policy does not affect potential output, empirical evidence suggests that steep interest-rate increases might reduce investment in sectors that are perceived to be riskier, even if they might prove more productive in the long run. Perhaps most important in our example is investment in research and development in green technology, which requires massive up-front investment. Monetary policymakers must, therefore, ensure that efforts to achieve the inflation target do not impede such investment.

While investment in green tech can be encouraged using financial and fiscal instruments, it remains sensitive to financial conditions. If central banks tighten those conditions to control inflation in the short run, they risk undermining productivity and sustainability and even fueling inflation in the longer run. After all, an economy that is less productive and more exposed to supply constraints and climate risks will be more vulnerable to inflation. Of course, there are also costs to delaying anti-inflationary interventions. The right balance must be struck.

Far from being an esoteric topic for academic economists to discuss among themselves, this is a serious practical challenge that central banks will have no choice but to face in the coming decades. Because the green transition involves rebalancing production away from “dirty” processes, it is likely to be characterised by temporary inflationary pressures. Central banks must ensure their response does not amplify the disruption and increase output costs.

Recognising this, some central banks have already incorporated flexibility into how they approach their mandates. But now, they must operationalise that flexibility by devising a transparent and research-based framework for managing the costs and benefits of inflation and other objectives. Macron’s suggestion should kick-start this process.

Lucrezia Reichlin, a former director of research at the European Central Bank, is a professor of economics at the London Business School. This article is provided by Project Syndicate (PS).

PUBLISHED ON

Jul 07,2024 [ VOL

25 , NO

1262]

News Analysis | Mar 02,2024

Verbatim | Jan 07,2024

Fortune News | Jul 06,2025

Advertorials | Dec 19,2023

Sunday with Eden | May 24,2025

Fortune News | Apr 03,2023

Fortune News | Jan 07,2023

Radar |

Radar | Oct 12,2024

Radar | Feb 10,2024

Photo Gallery | 157304 Views | May 06,2019

Photo Gallery | 147590 Views | Apr 26,2019

Photo Gallery | 136187 Views | Oct 06,2021

My Opinion | 135305 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 15 , 2025 . By AMANUEL BEKELE

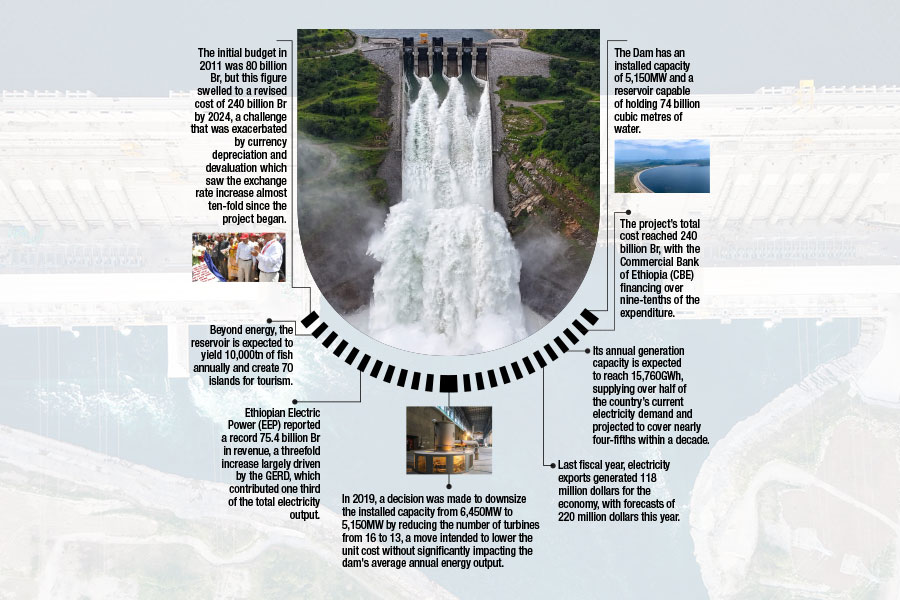

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...