Fortune News | Feb 27,2021

Mar 9 , 2024

By Madalo Minofu

Climate-related risks present a formidable challenge to Ethiopia's sustainable growth and development. However, the private sector has significant opportunities to build and fund low-carbon and climate-resilient projects.

A recent World Bank Group report finds that climate change could shrink Ethiopia's gross domestic product (GDP) by between one percent and 1.5pc of GDP annually and rise to five percent by the 2040s, potentially pushing millions of Ethiopians into poverty. Millions in the greater Horn of Africa, including Ethiopia, face acute hunger as the region suffers one of the worst droughts in decades. The Ethiopia Country Climate & Development Report (CCDR) outlines how Ethiopia can attract private funds into its green economy to support projects in the agriculture, infrastructure, and water management sectors. These are the sectors with the highest potential to help Ethiopia develop greater climate resilience.

Ethiopia's government recognises climate change's challenges and has an ambitious Climate Resilient Green Economy (CRGE), a strategy designed to support resilient and sustainable growth. The strategy calls for investing in climate-smart agriculture practices to boost production and food security, expanding electricity generation from renewable sources, and modernising transport and industrial activities to be more energy efficient.

The price tag is sizable. The report finds that Ethiopia needs more than 27 billion dollars by 2050 and that the government cannot fund these goals alone. The CCDR offers a blueprint for how the private sector, supported by a robust regulatory framework, can help Ethiopia meet its climate ambitions.

For example, private sector financing could be used to modernise Ethiopia’s infrastructure — including roads and bridges — to better withstand climate shocks.

Potential investors also have opportunities to contribute to the country’s green energy sources. This could mean investing in renewable energy-independent power producers in the agriculture sector to expand access to irrigation and affordable post-harvest storage facilities, to develop climate-resilient livestock and seed, and for targeted insurance products.

The International Finance Corporation (IFC) is already working with partners to strengthen farmer resilience and boost food security. Through its work with Soufflet Malt Ethiopia and Heineken Ethiopia, a local supply chain was established. These companies are now sourcing from more than 70,000 barley farmers, which has helped drive an increase in their production and productivity.

To mobilise this financing, the CCDR recommends that the government leverage public-private partnerships to bring private-sector know-how and investment.

Ramping up green investment in Ethiopia is urgent: the country is particularly vulnerable to climate change, with extreme climate shocks, including drought and floods, adversely impacting agriculture and endangering critical infrastructure in the transport and energy sectors. IFC and the broader World Bank Group are ready to continue supporting Ethiopia in its efforts to attract investment and support its green development.

Ethiopia may not be the only country facing climate change. But given its location and population size, it has the potential to be a regional leader in leveraging creative private-sector engagements for a more sustainable future.

PUBLISHED ON

Mar 09,2024 [ VOL

24 , NO

1245]

Fortune News | Feb 27,2021

Radar | Jan 07,2023

Radar | Jun 14,2020

Fortune News | Dec 12,2020

Radar | Feb 25,2023

Viewpoints | Aug 01,2020

Fortune News | May 23,2021

Viewpoints | Apr 06,2019

Fortune News | May 25,2019

Life Matters | Mar 06,2021

Photo Gallery | 156704 Views | May 06,2019

Photo Gallery | 146993 Views | Apr 26,2019

Photo Gallery | 135547 Views | Oct 06,2021

My Opinion | 135265 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

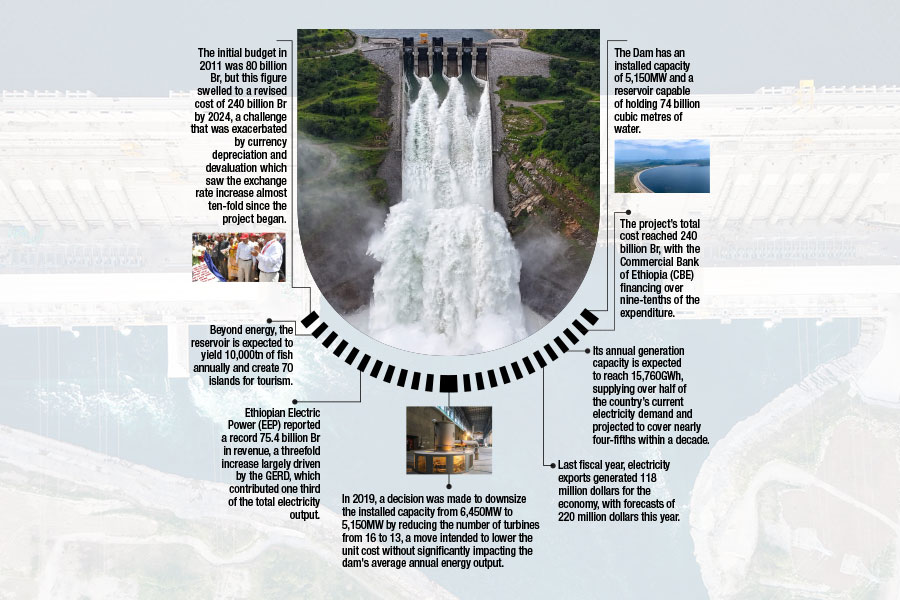

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...