Agenda | Sep 30,2023

In a move that marks a year of transformation, Global Bank Ethiopia, formerly known as Debub Global Bank, has embarked on an ambitious course to redefine its corporate identity and boost its market presence.

The plan includes a new headquarters in the capital's financial district, hoping to enhance its stature in the banking industry. The announcement was made during the Bank's general assembly at the Millennium Hall in December last year, where Board Chairman Bikila Hurissa (PhD) emphasised the Bank's resolve to meet the central bank's minimum paid-up capital requirement of five billion Birr by 2026.

"Meeting minimum capital threshold would remain a top priority," he said.

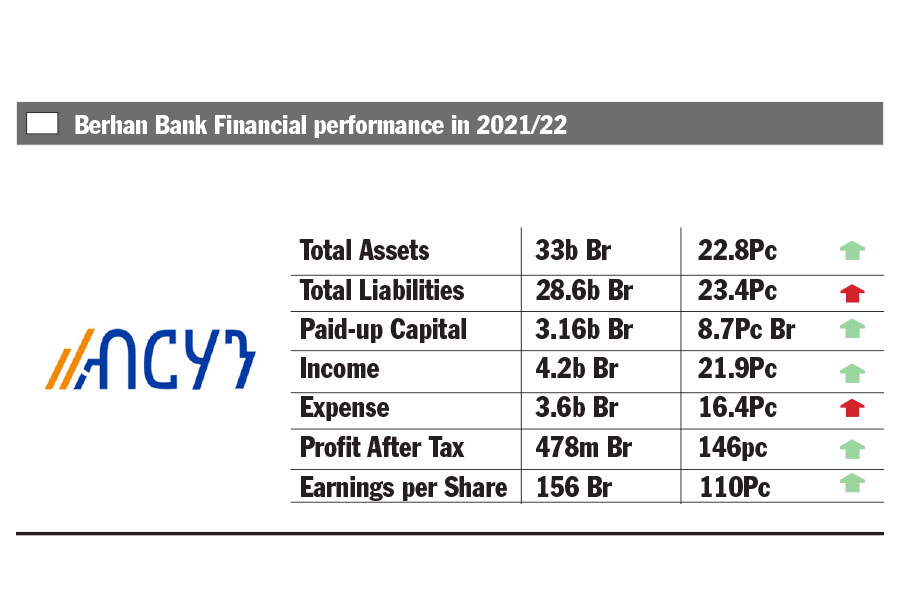

Financial performance metrics from the past fiscal year paint picture of a Bank that is not only surviving but thriving despite an array of hardships, including liquidity constraints and foreign exchange losses. Global Bank Ethiopia reported an 88.7pc increase in net profits, reaching 523.6 million Br, which outstripped many of its peers, signalling a strategic foresight by its leaders. The performance placed it ahead of Berhan Bank by 15.3 million Br and more than double Addis International Bank's 223 million Br, while trailing slightly behind Enat Bank's 543 million Br.

The surge in net profits translated into an impressive increase in Earnings per Share (EPS), which more than doubled to 292 Br from the previous year. The marked improvement in EPS was significantly higher compared to its peers, including Addis International Bank (129 Br), Berhan Bank (156 Br), and Enat Bank (239 Br). Global Bank achieved this feat while increasing its paid-up capital by 25.7pc to a little over two billion Birr, a growth rate that, although commendable, did not match the profit growth, amplifying the EPS.

Abdulmenan Mohammed (PhD), a financial analyst based in London, lauded the Bank's performance, noting the substantial growth in major revenue streams as a crucial factor behind the impressive profit surge while noting that it was still behind its height of 323 Br registered in 2019.

"There was a massive increase in profit after a surge in major revenue items," said Abdulmenan.

Global Bank's strategic emphasis on digital innovation and operational efficiency is underpinning these financial gains, according to Tesfaye Boru (PhD), president of the Bank. He emphasised the significant strides made in revamping the Bank's digital capabilities, which have been instrumental in enhancing service delivery and customer engagement. Its commitment to strict oversight on resource mobilisation and cost management was considered vital to sustaining its growth path.

Tesfaye came to the helm of Global Bank owing to his vast experience in the banking industry. Embarking on his career journey at Hibret Bank as a loan officer, Tesfaye has accumulated over two decades of experience. A graduate of economics, management, and business administration from Addis Abeba University and doctoral studies in business leadership from the University of South Africa, he has navigated various roles within the banking industry, including Abyssinia and Zemen banks. He served as vice president of Debub Global Bank in 2019 before succeeding Addisu Habba as president.

The Bank's operational performance was bolstered by a 32.6pc increase in interest on loans, advances, treasury bills, and bonds, which amounted to 2.28 billion Br. This was complemented by a significant recovery in service charges and commission revenues, which doubled to 397.34 million Br after a 41.4pc decline in 2021/22. Despite these revenue increases, the Bank also faced a substantial rise in expenses, particularly in interest on savings and general administration, demanding a strategic focus on cost management.

It saw the number of its branches grow by 19. Wages and benefits substantially increased by 72.2pc to 739.29 million Br. Although below Berhan's 1.62 billion Br, it is higher than Enat's and Addis International's 678.8 million Br and 481.8 million Br, respectively. It aligns with the bank's strategy over the year to "upskill and reskill" its 2,391 employees across 152 branches.

"The growth of total expenses, particularly salaries and benefits, should concern the management," said Abdulmenan.

Yitbarek Tadese, branch manager at Popolare Branch, expressed contentment over the past year's performance despite the difficulties presented by the liquidity crunch and political unrest. He pointed to the large number of corporate customers that his branch has the premier location for positive performance.

"Despite the risks of working with corporate customers, it is essential," Yitbarek told Fortune.

Despite the upbeat tone, the Bank's performance had its drawbacks. Some shareholders expressed concerns over the Bank's spending on aesthetics and renovations, questioning their contributions to longterm growth.

"These are not helpful for sustainable growth," said Kidane Lemlem, who joined Global Bank as a shareholder half a decade ago, buying 250,000 Br worth of shares.

Executives of Global Bank declined to comment.

Global Bank's foreign exchange dealings experienced volatility, with a notable recovery in net gains by 44.5pc to 201.34 million Br despite previous declines of 36.3pc the previous year.

Although the net gain saw a significant improvement, this area of business needs serious attention, according to the financial analyst. He commended the growth in total assets by 33.8pc to 18.85 billion Br for the 12-year-old bank incorporated with 138.9 million Br paid capital, which grew by 25.7pc to 2.03 billion Br. Global Bank had a capital adequacy ratio (CAR) of 17.8pc, indicating that it has substantial capital higher than Berhan's 15.4pc or Enat's 14.6pc and two percent shy of Addis International's.

The Bank disbursed loans and advances of 13.67 billion Br, an increase of 46.2pc, while it mobilised deposits of 14.25 billion Br, an increase of 29.8 pc. The loan-to-deposit ratio increased by about 11 percentage points to 95.9pc. Although the rise in the ratio brought in more interest income, it must have caused pressure on the liquidity position, according to Abdulmenan. The short-term borrowing of the Bank amounted to 667.48 million Br.

"This indicates the liquidity issue," he told Fortune.

Global Ethiopia's liquidity level decreased in value and relative terms. Cash and bank balances decreased by 6.7pc to 2.1 billion Br, equivalent to Addis International's 2.1 billion Br and nearly half of Enat's 4.1 Billion and 1.6 billion Br higher than Berhan banks. The cash and bank balances to total assets ratio decreased to 11.1pc from 15.97pc.

"Executives should install a better liquidity management mechanism rather than rely on short-term borrowing," said Abdulmenan.

PUBLISHED ON

[ VOL

, NO

]

Agenda | Sep 30,2023

My Opinion | Jun 29,2024

Fortune News | Aug 17,2025

Fortune News | Aug 02,2025

Fortune News | Apr 26,2019

Viewpoints | Mar 04,2023

Radar | Jul 02,2022

Fortune News | Nov 12,2022

Radar | Aug 04,2024

Radar | Apr 08,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...