Commentaries | Mar 05,2022

With excitement, Berhan Bank shareholders left a meeting two weeks ago, learning their earnings per share had more than doubled from last year. However, the Bank's overall performance is not only half of the industry average but also that of two years ago.

Much of the blame for the sluggish performance lies on the rise of non-performing loans the Bank advanced to construction companies that have defaulted on the guarantee bonds. The Board Chairman described it as a "massive burden" on performance.

Banks provide unconditional advanced and performance guarantee bonds to private construction companies helping them ink deals with clients. If companies fail to deliver the contracts on time, banks would have to pay the agreed amount to the client, according to Sewale Abate (PhD), a lecturer of finance and investments at Addis Abeba University.

The dividend Berhan Bank paid shareholders declined by 65pc due to these unreturned guarantee bonds to contractors who defaulted to complete projects in the two years before 2021. Several clients, including the Ethiopians Roads Administration, have taken the Bank to court, claiming funds they paid in advance.

The Bank has set strict procedures and requirements for issuing guarantee bonds, says Netsanet Worku, Lancha branch manager. She believes the dividend performance was impressive in customer-base record with the growth it showed compared to the last 10 years.

Berhan Bank's directors tried to delight shareholders by reporting a profit of 478 million Br from its operations in 2021/22, growing by a whopping 146pc. This brought positive earnings per share (EPS) of 156 Br, recovering from a dip of 74 Br registered the year before.

Etenesh Takele, a housewife and mother of two, is among the 15,000 shareholders. She was pleased to see the Bank made the curve for the better.

"It showed a little improvement from the previous year," she told Fortune.

Berhan generated 3.2 billion Br income from interest on loans, advances and central bank bonds, showing a 24pc growth. The revenues from service charges and commissions on foreign exchanges show a rise of 22pc to one billion Birr. It is a performance hailed by experts observing the banking industry.

"Revenues growth is remarkable," said Abdulmenan Mohammed, a financial statement analyst based in London with close to two decades of experience.

However, an expansion of expenses accompanied the growth in revenues. Interest expenses increased by 24pc to 1.2 billion Br while salaries and benefits also shot up by 39pc to 1.2 billion Br.

Provision for assets declined by 11pc from the previous year to 337 million Br. Abdulmenan puts the considerable amount as one of the reasons for Berhan's lower profit from the industry average.

"Berhan needs to reduce the provision for assets impairment to an acceptable level," he said.

The Bank's President, Girum Tsegaye, echoed the expert's bid. He said that the previous years' experience in defaulted loans and advances triggered the soaring provision, pointing out the work done on non-performing loans and reducing claims on guarantees as one of the Bank's performances in the reported year.

"It affected the profit and EPS growth," Girum conceded.

Girum was appointed by the board last year as a restructuring to address the challenges Berhan faced before the departure of Abraham Alero, who served it for seven years. He has nearly 30 years of experience in banking, starting as a clerk with the Commercial Bank of Ethiopia (CBE), where he served for 11 years. A father of four, Girum did his undergraduate studies in management and postgraduate in business administration, both at Addis Abeba University.

Under Girum, Berhan Bank opened 60 new branches, expanding its network to 362.

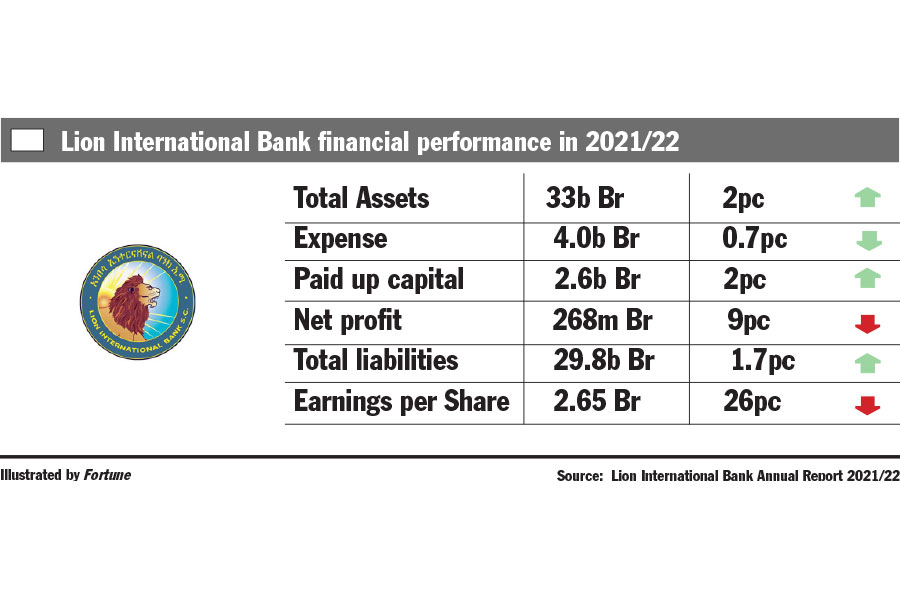

Investments in central bank bonds have fallen by nearly 13pc to 3.3 billion Br, which now represents 10pc of total assets and around 11pc of the Bank's total liabilities. The total assets of Berhan expanded by 22.8pc to 33 billion Br.

Abdulmenan sees the growth recorded last year as "good and reasonable", considering the prevailing economic and political crises.

Gumachew Kussie, Berhan's board chairman, agreed.

"Much effort was exerted to uplift the Bank from the depth of challenges," he said in a statement issued for the shareholders.

The loans and advances disbursed in the reported year accounted for nearly 21 billion Br, marking a 22.5pc increase, while deposit mobilisation upsurged by 20pc to 26 billion Br. As the growth of loans and advances outstripped that of deposits, the loan-to-deposit ratio jumped by two percentage points to 80pc from last year, inching closer to the prudent ceiling of 90pc. The Bank has reached the limits, and pushing it further could cause liquidity problems, warns Abdulmenan.

The Bank's deposit and credit provisions performance represent half the industry's average for the last year.

However, Girum argues that the ratio does not show the risk of liquidity problems. He said that higher outstanding loans would have been recorded if regulators at the central bank had not suspended loan disbursements last year. The central bank froze collateral-based loans advanced by commercial banks for four months later last year.

Berhan's liquidity level showed an increase in value but a decline in relative terms. Its balances went up by four percent to 3.14 billion Br. The ratio of liquid assets to total assets dropped by two percent from the previous year, revealing Berhan Bank was operating with tight liquidity resources.

"Executives should watch the liquidity level carefully," Abdulmenan recommends.

Foreign banks' entry remains a challenge for private commercial banks as they are highly dependent on availing shares to the public to meet the regulators' demand in the next three years.

Despite the rise of its paid-up capital by nearly nine percent, Berhan remains unable to meet the central bank's requirement for capital threshold with 3.2 billion Br. It falls short by 1.8 billion Br before the deadline on June 2026.

"We're confident things will turn around in the next three years," said Girum.

PUBLISHED ON

Nov 12,2022 [ VOL

23 , NO

1176]

Commentaries | Mar 05,2022

Fortune News | Mar 25,2023

Radar | Jun 04,2022

Radar | Dec 29,2018

Radar | Nov 30,2019

Radar |

Radar | Aug 07,2021

Radar | Aug 26,2023

Fortune News | Oct 24,2020

Fortune News | Dec 10,2022

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Jul 5 , 2025

Six years ago, Ethiopia was the darling of international liberal commentators. A year...

Jun 28 , 2025

Meseret Damtie, the assertive auditor general, has never been shy about naming names...

Jun 21 , 2025

A well-worn adage says, “Budget is not destiny, but it is direction.” Examining t...

Jun 14 , 2025

Yet again, the Horn of Africa is bracing for trouble. A region already frayed by wars...