Editorial | Aug 18,2024

Jan 19 , 2024.

A shadow economy thrives, largely neglected yet ubiquitous, undermining the formal economic structures and posing a formidable challenge to macroeconomic stability. This parallel market, sustained by contraband trade, appears to have woven itself into the broader economy, evading the grasp of stringent regulations and law enforcement.

The societal impact of contraband trade is myriad. It breeds and protects powerful underground organisations within society, entangling organised crime networks. It also catalyses anarchic behaviours, with smuggled armaments fueling violence and crimes.

The contraband market in Ethiopia is not a novel phenomenon. Its roots trace back to the 1960s, particularly along the Togo Wuchale-Jigjiga corridor. Despite decades of legislative efforts, including an existing legislation Parliament passed in 2009, which defines contraband as goods whose imports, exports, or transit are banned by law or international agreement, the illegal trade persists. The surreptitious movement of goods across borders, such as electronics, garments, cosmetics, and even armaments, continues unabated, feeding a clandestine market that reaches deep into the economy.

The economic implications of contraband trade are evident in various sectors. The Anti-Illicit Trade Summit hosted by the Ethiopian Chamber of Commerce & Sectoral Associations uncovered the impact on sectors such as livestock, pharmaceuticals, tobacco, and textiles. For instance, the contraband livestock trade accounts for an estimated 90pc of all livestock exports, revealing the extent of the problem.

According to the Financial Crime News, an online publication monitoring money laundering and terrorism finance in sub-Saharan Africa, the most frequently smuggled goods into Ethiopia are electronics, garments, perfumes, cosmetics, and armaments, while goods smuggled out are coffee, livestock, cereals, animal skins, and fuel. In addition to goods, currencies of different countries are smuggled into and out of the country. These goods smuggled in the four years beginning in 2012 were estimated to be 1.85 billion Br.

While both incoming and outgoing contraband trade has remained a feature of the economic contours for most of Ethiopia's modern economic history, a marked increase in volume and variety of items has occurred over the past few years. Within a single week last month, a whopping 808 million Br worth of items were seized by branches of the Ethiopian Customs Commission, with the amount halfway split between those entering and leaving the country's borders.

The chief of the Federal Customs Commission, Debele Qebeta told parliamentarians during the final report for the last fiscal year that a staggering 10.2 billion Br worth of items had been seized. Many actors claiming a share of the economic pie suspect the amount to be a tenth of what the authorities report.

The illicit trade has profound implications, not only for the federal government's revenue through customs duties reaching over billions of Birr but also for the broader economic landscape. According to a study conducted a few years ago, contraband trade siphons off approximately 4.47pc of federal revenues annually from customs duties. The ramifications extend beyond fiscal losses, impacting domestic industries and initiatives.

Local manufacturers, from tobacco to steel, lament the influx of unregulated, often inferior-quality goods that distort markets and present public health hazards. Habit-forming drugs and poor-quality goods can cause widespread health issues, with federal law enforcement continuously striving to respond to these dangers.

The influx stifles the growth of domestic industries, making them unable to compete with the lower-priced contraband goods. The illicit trade discourages ambitions, as the smuggling of counterfeit products undermines the efforts and investments of businesses, diminishing the incentive to develop new products critical for economic growth. The presence of counterfeit goods in the market, infringing upon intellectual property rights, weakens the motivation for starting a business, a bedrock of economic advancement.

Smuggling leads to tax evasion, straining government budgets and impeding the provision of public goods. This, in turn, affects productivity, development, and growth.

The economic ramifications of contraband trade are not limited to government revenues and public health. They extend to the heart of economic development. The micro, small, and medium enterprises (MSMEs) are anchored as crucial agents for income and employment generation. Yet, they are severely impacted by the influx of cheaper contraband goods that undercut their market share and impede their growth.

Recognising the gravity of this issue, the authorities have tried over the decades to implement various strategies to combat contraband trade. They disbanded the customs police force in 2008, replacing it with federal police, alongside amending customs and tax laws to streamline the process and empower law enforcement. These include simplifying trade procedures, introducing tax incentives for legal trade, and providing information and assistance to small-scale traders at borders. Yet, corruption remains a persistent issue, undermining these efforts.

Their attempts to combat contraband include legal measures. For instance, the law imposes rigorous imprisonment and hefty fines for those involved in smuggling activities. Such legal measures are intended to serve as a deterrent, yet their effectiveness is contingent on consistent enforcement.

The sheer magnitude of the problem, exacerbated by a sprawling 5,300Km border shared with five countries, demands more than traditional control mechanisms. It calls for bilateral and multilateral cooperation to address cross-border smuggling. Undoubtedly, there is a need to tighten border controls and law enforcement to curb illegal trade. However, there is a recognition that overly stringent measures could push small-scale traders further into the shadows, worsening the problem.

Innovative solutions like the deployment of drones, radar technologies, and electronic tracing of goods have been proposed to enhance border control. Coordination between various law enforcement and regulatory agencies and the meticulous gathering and dissemination of intelligence remains vital. However, resource constraints and the adaptive strategies of smugglers continue to pose significant challenges.

A viable strategy to combat illicit trade should involve raising public awareness about the detrimental effects of contraband trade on the economy and society. Such a strategy can promote community engagement, reflecting an understanding that a top-down approach alone is insufficient. Engaging the community, particularly in border areas, is crucial for sustainable solutions. The challenge remains significant, but durable solutions are imperative to ensure the viability of legitimate businesses on whose tax the state depends. These businesses are no less indispensable in keeping hundreds of thousands livelihoods humming.

PUBLISHED ON

Jan 19,2024 [ VOL

24 , NO

1238]

Editorial | Aug 18,2024

Fortune News | Dec 26,2020

Sunday with Eden | Mar 27,2021

Radar | Jun 11,2024

Fortune News | Nov 10,2024

Radar | Jul 30,2022

Fortune News | Nov 16,2019

Fortune News | Jun 17,2023

Sunday with Eden | Mar 25,2023

Photo Gallery | 154874 Views | May 06,2019

Photo Gallery | 145142 Views | Apr 26,2019

My Opinion | 135104 Views | Aug 14,2021

Photo Gallery | 133577 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 15 , 2025 . By AMANUEL BEKELE

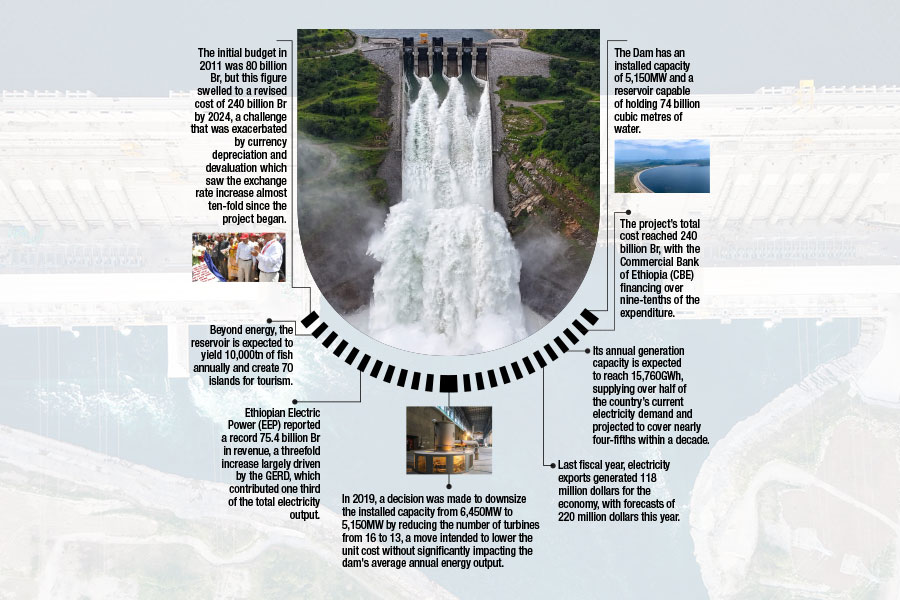

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Sep 13 , 2025 . By BEZAWIT HULUAGER

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...