Sunday with Eden | Aug 27,2022

Local manufacturer Tihtina Legesse wrestles against a panoply of structural challenges to keep her company afloat.

She is the general manager of the furniture powerhouse Waryt. For the past few years, meeting the company's foreign currency needs has become an uphill battle. Established with 200,000 Br capital, the company now needs close to half a million dollars each year to import sponges, chemicals and a host of other inputs that uphold the standards. Apart from scarce quality materials, Waryt has also been challenged by declining sales and a skilled labour force.

"We operate at 20pc of capacity," Tihtina bemoaned.

Apart from the responsibility of keeping the company operational, Tihtina is tasked with upholding a three-decade-old brand that has become a household name for high-quality products. She believes that quality standards should be set to keep the local industry in line and foster the growth of the manufacturing sector.

"We also compete with lower quality products at price points," she said.

An ambitious initiative towards import substitution kicked off under the banner Let Ethiopia Produce about a year ago, with an exhibition aimed at inspiring local manufacturers unfolding last week at SkyLight Hotel. The gathering saw the attendance of high-echelon government figures such as House Speaker Tagese Chaffo, Minister of Industry Melaku Alebel and State Minister Hassen Mohammed.

Underneath the spirited campaign towards import substitution lurk structural challenges waiting to be addressed.

The shortage of foreign currency remains an issue extending its roots towards several sectors. Heavy reliance on imports for inputs that are necessary to uphold local manufacturing is one element squeezing the financial capabilities of producers. Those eyeing the local suppliers are frustrated with substandard quality while meagre awareness and nonconformity to environmental standards push them to the sidelines.

Poor policy frameworks compounded by shaky grounds of macroeconomy and a dearth of skilled labour plague the manufacturing sector. Latest report by the United Nations Development Programme (UNDP) reveals that a staggering 450 factories have closed down operations as the share of the manufacturing sector in GDP saw a 1.5pc decline last year.

The closure of 132 edible oil-producing factories from 231 total in the past few years best encapsulates the cacophony of crises that plague the manufacturing sector. according to Abraham Mekonen, vice president of the lobby group Ethiopian Edible Oil Manufacturers Association. He said the tedious bureaucratic maze and foreign currency shortage have dragged the manufacturing sector into unprecedented depths with the increasing onslaught of security problems in the past few years.

As the manager of Tena Oil, which is functioning at a fifth of its capacity, Abraham is not optimistic the multitude of challenges will be addressed short term. The factory, acquired by the SAMANU Group in 2015, processes 200tns a day at full capacity.

With the protracted foreign currency access, he began the quest to erect plants in Dukem town, Oromia Regional State and Qaliti district in the capital.

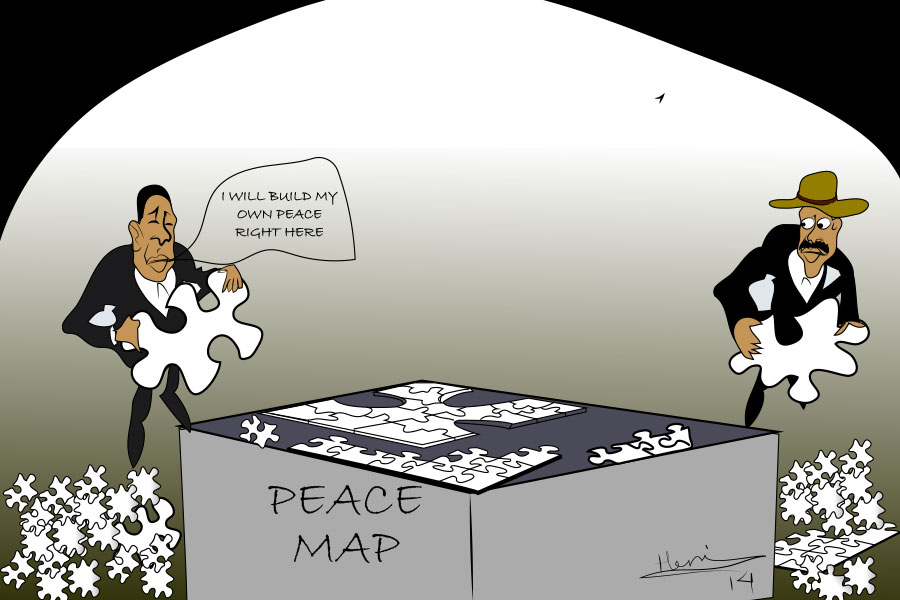

"I'm establishing a crude oil plant myself," he said, while indicating that his ambitions were met with challenges to access the raw materials from the regional state due to security concerns.

A recent restriction on forex permits by the Customs Commission, limiting its utility to one time amidst a long waiting list for allocation is considered another trouble for the manufacturing landscape.

Commissioner Debele Kabeta outlines a complex contraband network as a defining element in manufacturers' woes. He suggested that 86pc of imports are under invoice along with stark quantity differences between declared and imported ones. He emphasised the importance of closing loopholes to prevent any escalation despite the mismatch in the demand and supply of goods.

"We are implementing strategic reforms," he said.

Realising the spirited import substitution ambition with a small percentage of large-scale manufacturers, which account for 4,000 out of the 26,000 will not be without its difficulties. An ongoing endeavour to provide non-collateral loans to enterprises from eight commercial banks was revealed by the Ethiopian Enterprise Development (EED), which facilities support local factories.

Albachew Nigusse (PhD), director of the Enterprise, said improving the preparation of financial statements to enable better credit scoring will help ease the financial stresses. He indicated that the World Bank's recent 570 million dollar support to enable collateral-free loans through the Development Bank of Ethiopia is a promising development. Meanwhile, he points to the 120 manufacturers who export as one of the reasons for the selection of a mere 34 producers in a 25 million dollar financial package offered by the policy bank.

"Manufacturing is not prioritised," he said.

Kicking off operations in 2012 in Sebeta town Sheger City, Sanitary pad producer Guo Peyiun Co is among producers who have been struggling to import the necessary raw materials and maintain production capacity.

Nejat Ahmed, deputy head of marketing, points to the lack of a domestic supply chain capable of meeting the company's demands. Meanwhile, the protracted foreign currency allocation to sustain their demand has become a pressing challenge. The 10 varieties of raw materials which require 400,000 dollars annually have aided lower-quality alternatives keeping them from gaining the upper hand in the market, according to Nejat.

"Productions costs have spiked our prices," she told Fortune.

Ethiopia's vast resources in livestock have had little to show in voluminous production, with leather accounting for less than one percent of merchandise exports last year. Shortage of imported chemicals and poor handling of hides are major concerns of local producers.

Solomon Getu, leather technologist and former secretary of the Ethiopian Leather Industry Association, points to poor livestock management and foreign currency shortages as enduring challenges. He indicates the promises of the leather industry to boost the overall economic performance of Ethiopia despite 25 of the 30 tanneries struggling to keep the light on in their factories.

"Policy priority has pushed many out of business," he said.

The UNDP report also indicates that expensive logistics, an inefficient skilled workforce, low quality of inputs, and tedious bureaucracy are part of the problem in a manufacturing sector that lacks diversification, with half of production focused on four industries.

Ethiopia's import bill has overshadowed its exports by a third, with economists often blaming an overvalued currency, growing import bills, and depleting foreign currency reserves. To overhaul the reliance on imports, the federal government points to pending strategic reform in six areas: finance, raw materials, infrastructure development, customs procedure, capacity development and research.

According to State Minister for Industry Hassen Mohammed, while the limitations on finance and skilled labour are recognised, security concerns are considered transient. He lauds the restart of 370 factories which were deemed dormant, as one of the key features of the import substitution strategy.

Hassen acknowledged the 38pc substitution rate of domestic products for imports but forecasted that 2.6 billion dollars would be saved by local production this year.

As one of the crafters of the "Let Ethiopia Produce" initiative, Hassen firmly believes that despite the limitations squeezing most factories to perform below capacity, every country has to start somewhere and move forward aided by technology.

"Ethiopia can pull this off," Hassen told Fortune.

Conflicting forces emerge in aspirations of trade liberalisation amidst a lagging policy environment.

Melaku Desta (PhD), a researcher at the United Nations Economic Commission for Africa (UNECA), fears that strains on fiscal resources might resurface with renewed force if macroeconomic pressures are not alleviated. He raises concerns about policymakers' ability to learn from other countries' experiences who sank into whirlpools of fiscal deficits while embarking on uncalculated adventures of import substitution.

"Fervent optimism is not the way to go," he told Fortune.

Melaku underscores the importance of sector-specific policies, empirical analysis of market potentials and overall security and macroeconomic stability for successful realisation of such a grand initiative.

"Calculated structural reforms are crucial," he said.

PUBLISHED ON

Dec 16,2023 [ VOL

24 , NO

1233]

Sunday with Eden | Aug 27,2022

Sunday with Eden | Mar 09,2024

Radar | Mar 26,2022

Fortune News | Sep 08,2019

Radar | Apr 09,2022

Obituary |

Editorial | Sep 18,2021

Viewpoints | Jul 10,2020

View From Arada | Mar 13,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...