Radar | Jan 14,2023

For the past 15 years, horticulture farmers in the thriving towns have lived through a paradox - booming business with no solid footing on the land they operate upon. Investors have long navigated the convoluted maze of the land policy - or the lack of it - giving rise to a web of competing rights.

A missing piece in the puzzle is the absence of legislation which governs urban agriculture that would provide investors leasing plots the right to secure their holding. This has left them high and dry when it comes to essential business activities like securing tenders, expansion projects, accessing credit, or even simple license renewals.

Consider the 10 companies in horticulture farming nestled between Bishoftu (Debreziet) and Batu (Zeway), in Oromia Regional State. They saw their businesses blossom for over a decade and a half, leasing land predominantly through high-priced rent agreements and contracts from local farmers. Such arrangements seemed workable until the maturity time approached, and the original landholders had to be compensated-a process involving regional officials and investors.

Seven years ago, a clock began ticking in these agreements when the renewal rate came to the fore. While the ongoing rate was 25 Br for a square meter, officials argued that this was no longer tenable, suggesting an alignment with the residential rate of 470 Br. The investors found this proposal exorbitant. Seeking a middle ground, both parties agreed to peg the rate to an impending study's results. But like many bureaucratic processes, the study has been slow to conclude.

Solomon Abebe, the deputy head of the Oromia Land Bureau, acknowledged the delay but stressed the necessity of "thoroughness," especially given this is a pioneering effort. He is optimistic about the study's outcomes, though.

"We believe the results will lay a credible foundation for the urban agricultural land lease system," he told Fortune.

The delay, however, has its cost. Companies like Zeway Rose Plc, which sprawls over 42hct in Batu, have found their hands tied due to the policy vacuum. Incorporated in 2006 with a capital of 114 million Br, the majority owned by a Dutch family, Zeway Rose has had to put its ambitious expansion plans by an additional 100hct on the back burner. The company exports 100 million flower stems annually to international markets.

Says Ermias Solomon, the operational manager: "The lack of urban tenure security has inhibited our growth, preventing us from leveraging title deeds to secure finance for expansion."

Such troubles are not unique to Zeway Rose. Six other flower farmers in Bishouftu and four in Batu share a similar experience. According to reports, these delays have given rise to myriad investment issues, which have persisted and may impact Ethiopia's position as the fifth-largest flower producer globally. It earned over 600 million dollars from flower exports last year, claiming a minuscule 1.65pc of the global cut-flower turnover of 36.4 billion dollars in 2022. The Netherlands, Colombia, Ecuador, and Kenya are the largest exporters; the primary export destinations for Ethiopia include the Netherlands, Saudi Arabia, and the United Kingdom (UK).

The Ethiopian Horticulture Producers & Exporters Association has not been a silent spectator. Close to 70pc of the Association's 126 members operate in the Oromia Regional State.

Tewodros Zewde, the Association's general manager, expressed his concerns, pointing out the undue delays in the much-awaited study.

"While the government's efforts to streamline urban farmland ownership are commendable, the protracted delays have curtailed the industry's output potential," he said in a letter he issued to the authorities.

As the World Bank discovered, sub-Saharan African countries have weak land property rights, leading to heightened disputes and high registration costs. According to agricultural economist Shimelis Araya (PhD), such ambiguities around land rights often deter private sector investments, restricting them from making significant advances into land or transferring it for productive use.

"Clear landholding rights inspire investor confidence, encouraging them to make valuable, long-term investments," noted Shimelis.

Floriculture is an input-intensive business, where up to 90pc of expenditures are reported on raw materials imports. The United States and China are the major sourcing countries for raw materials.

The industry, predominantly focusing on roses, summer flowers, and cut flowers, has blossomed as a significant industry in Ethiopia, particularly in towns like Batu, Bishoftu, Holeta, and Sululta. Over 57,000 people find employment in this industry. It is a policy-induced sector in which the authorities often take pride in their keenness to woo foreign direct investment after 2009. However, the process was riddled with ambiguities.

The rising foreign investments, coupled with a booming population and economic growth, have escalated land values and the demand for communal lands.

However, recent initiatives indicate a shift.

Officials of the Ministry of Urban & Infrastructure appear to be leaning towards an integrated approach, focusing on land tenure regularisation and registration. Minister Chaltu Sani's recent announcement, disclosing plans to recognise 25,000 land rights across various urban centres, may have come as positive news for the investors in the Oromia region. The implications of her announcement could be significant in a country where land disputes have long caused impediments to large-scale agricultural investment.

With 1,800hct under flower farming - the industry with 18pc average growth in the past five years - the move may give the required momentum to investors sitting on the fence.

Yet, the past offers a note of caution. Before 2009, despite an open-arm policy towards foreign direct investment, the unclear procedures to obtain land led to uncertainties. The need to attract foreign investments had to be balanced with the intrinsic duty to protect the rights and livelihoods of farmers.

Ermias Deneke, deputy head of the Oromia Investment Bureau, shed light on the intricacies of the permit process.

"It's not just about land rights," he recalled. "Our evaluations considered potential employment opportunities, returns on investment, and the likely revenue retention in the region."

To date, the Bureau has granted 24,000 permits to investors, a figure that might see a sharp rise with more straightforward landholding laws.

But the road ahead is still not without its roughshod. As determining land rates based on the study moves forward, striking a balance between investor expectations and the policymakers' vision remains crucial. However, for companies like Zeway Rose Plc and numerous others operating in uncertainty, the move, even if incremental, offers hope.

PUBLISHED ON

[ VOL

, NO

]

Radar | Jan 14,2023

Radar | Apr 12,2020

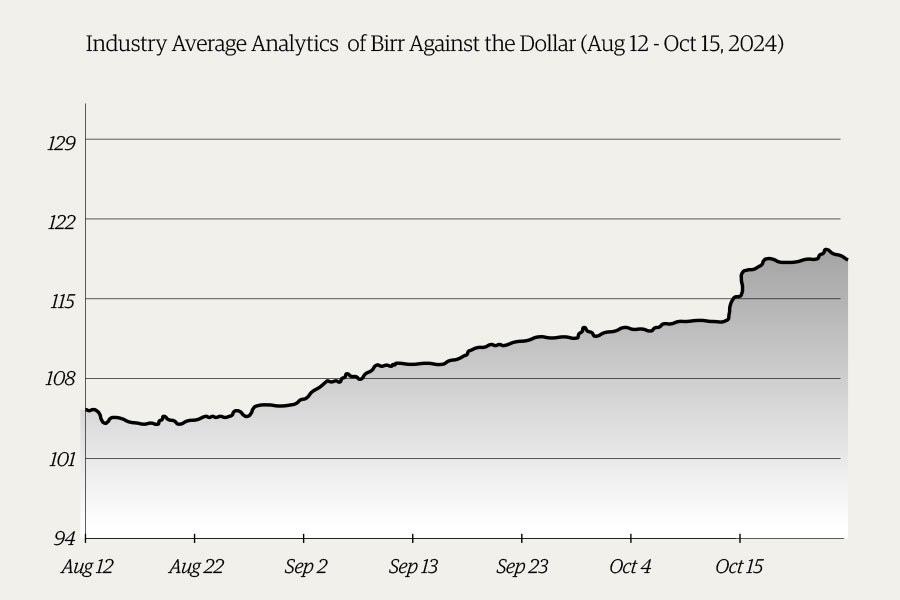

Money Market Watch | Oct 27,2024

Fortune News | Nov 24,2024

Fortune News | Apr 17,2020

Fortune News | Nov 04,2023

Radar | Jun 15,2025

Radar | Jul 11,2021

Fortune News | Mar 14,2020

Radar | Apr 21,2024

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...