Editorial | Jun 22,2024

Jul 22 , 2023.

In the tempestuous seas of global finance, the Ethiopian banking sector seems to be sailing in an unusual boat. Decisions taken by policymakers, bereft of a comprehensive ideological compass, are becoming increasingly self-defeating.

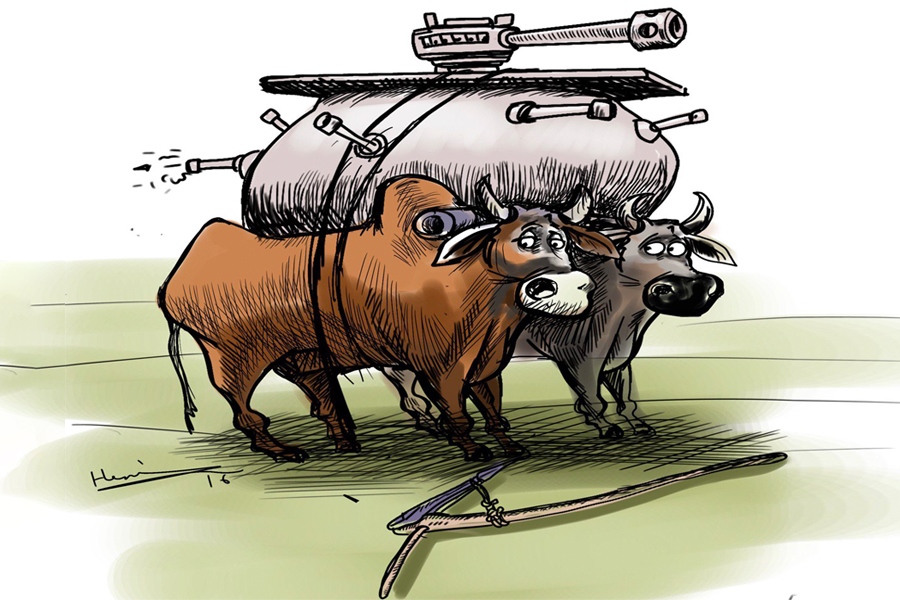

A case in point is the distortion brought about by obliging private banks to purchase bonds from the Development Bank of Ethiopia (DBE), a policy bank held tightly in the government's grip. The consequences of this policy are disquieting, as they have rocked the liquidity stability of private banks, leaving them teetering on the brink of financial precarity. Over the past decade, the Ethiopian government has treated the DBE as its magic wand for managing resources.

The Bank's mission?

To siphon resources from private banks and channel them toward sectors deemed of national importance, such as agriculture and manufacturing. A scheme initially devised during the developmental state period under the reign of the Revolutionary Democrats, it has since morphed into an obligatory purchase of DBE bonds by private banks.

This government dictum has caused the mandatory bonds pile to burgeon alarmingly on the private banks' balance sheets. The DBE's assets, in turn, have experienced stunning growth, from 8.8 billion Br a decade ago to a colossal 150 billion Br in the second quarter of 2022/23. The figures reveal that much of the 34pc of these assets originate from private commercial banks.

On the surface, this might seem like a clever resource allocation strategy. But in the real world, the policy is a recipe for market distortion, gradually eroding the liquidity of private banks. Adding insult to injury, private banks find themselves forced to buy bonds from the DBE at an eight percent yield, only to have the DBE's management deposit the same money back into private banks, demanding an interest rate close to 13pc.

The damage does not stop there. An antiquated policy demanding that banks allot 20pc of their loans and advances to purchase treasury bonds from the Ministry of Finance compounds the liquidity strain. What were initially instruments to corral domestic resources to offset the swelling budget deficit have metamorphosed into millstones around the neck of the banks' liquidity.

While the initial intention of this policy might have been to direct resources towards crucial sectors, it has ended up twisting the market dynamics and putting severe strain on the liquidity of private banks.

Yet, like a phoenix rising from the ashes, the Ethiopian banking industry has shown a commendable spirit of resilience and growth. Remarkably, the total assets of the commercial banking industry swelled by a whopping 30pc year-on-year, reaching a peak of 2.3 trillion Br in 2023 from 1.7 trillion Br the previous year. Likewise, loans and advances leaped by 35pc, climbing to 1.4 trillion Br from one trillion Br in 2022.

Nevertheless, these numbers need to be examined within their broader context.

The surge in time deposits may imply improved financial literacy and increased faith in the banking system. Yet, a deeper look unveils that this shift is largely driven by affluent depositors who are cornered into the banking system due to the prevailing market distortions and escalating insecurities in the country. Private commercial banks, too, have turned to time deposits as a safe haven to secure higher interest rates, thus sparking off unhealthy competition among themselves.

The rosy picture of asset growth and loan advances belies the liquidity crises facing private banks. The Ethiopian regulatory environment, marred by policy distortions and inefficient foreign exchange (forex) market regulations, poses significant threats to the banks' financial health.

Fueling the liquidity conundrum is the inconsistency between reserve requirements and actual reserves. Fluctuations in excess reserves, and even instances of banks failing to meet their required reserves, hint at potential liquidity risks. This is a glaring testament to the negative impacts of policy distortions. The failure of banks to maintain reserve requirements is a desperate cry for help - a clear sign of banks being stretched thin in their attempt to balance mandatory bond and treasury bond purchases, while also trying to meet the surging credit demand in the economy.

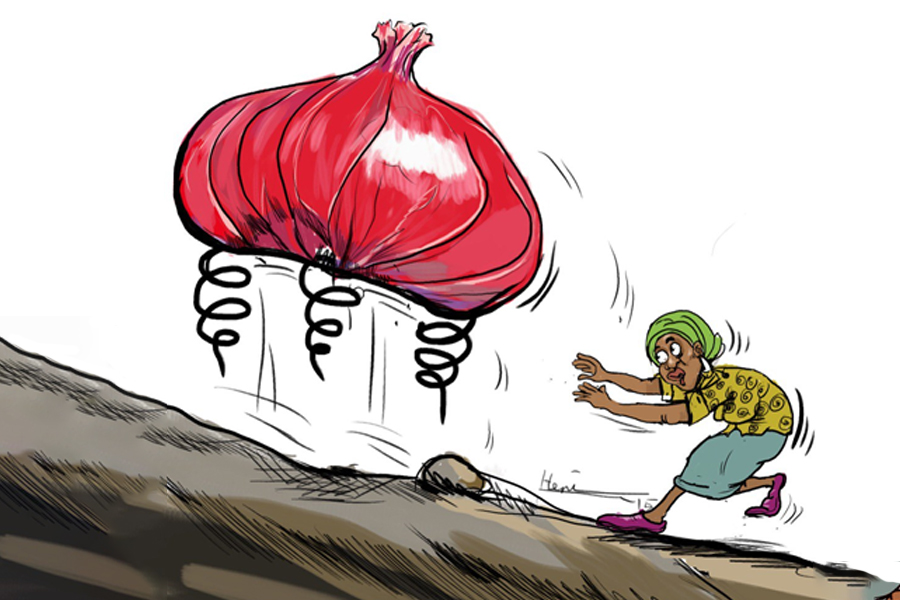

On a wider scale, the surge in foreign assets and liabilities underscores an increased exposure to foreign exchange risk. With the high margin in the parallel forex market and the policymakers' ineffectiveness in regulating it, adverse forex movements could plunge the banking sector deeper into liquidity woes.

Banks need to bolster their liquidity management practices and establish robust systems to manage forex risk. This could involve more prudent lending, investment practices, and effective hedging strategies to mitigate forex movements.

To respond to the existing policy distortions, Finance Minister Ahmed Shide and Central Bank Governor Mamo Mehiretu need to make some bold moves. This also rings true for senior macroeconomic and monetary advisors like Girma Birru and Teklewold Atnafu. A good place to start would be to review the policy requiring private banks to purchase mandatory bonds from the DBE and treasury bonds. It would be helpful to see them overcome their indifference in the face of a parallel forex market offering a margin double the official rate, an unsettling development never seen in the monetary history of this country.

Stress tests should be conducted on the banks to assess their resilience to adverse economic conditions, including forex shocks. This could offer valuable insights into potential vulnerabilities and guide more effective regulatory decisions. Stricter oversight of the banking industry is also in order, ensuring that banks adhere to prudential standards. This includes maintaining sufficient liquidity and complying with reserve requirements, which can be ensured through regular and meticulous audits.

The Ethiopian banking sector has displayed impressive growth and resilience despite the challenges. However, policy distortions have seriously strained private banks' liquidity, undermining their financial health and market dynamics. Policymakers need to draw lessons from past missteps and make informed decisions for the sustainable development of the banking industry. If not, the adage "those who do not learn history are doomed to repeat it" might take on a chilling reality in the Ethiopian banking industry, leading to catastrophic consequences.

PUBLISHED ON

Jul 22,2023 [ VOL

24 , NO

1212]

Editorial | Jun 22,2024

Editorial | Jul 07,2024

Radar | Jun 07,2025

Fortune News | Dec 30,2023

Editorial | Jun 21,2025

Agenda | Dec 02,2023

Editorial | Sep 16,2023

My Opinion | Oct 21,2023

Fortune News | Aug 23,2025

Commentaries | Jan 19,2024

Photo Gallery | 171422 Views | May 06,2019

Photo Gallery | 161662 Views | Apr 26,2019

Photo Gallery | 151380 Views | Oct 06,2021

My Opinion | 136289 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...