Feb 25 , 2023

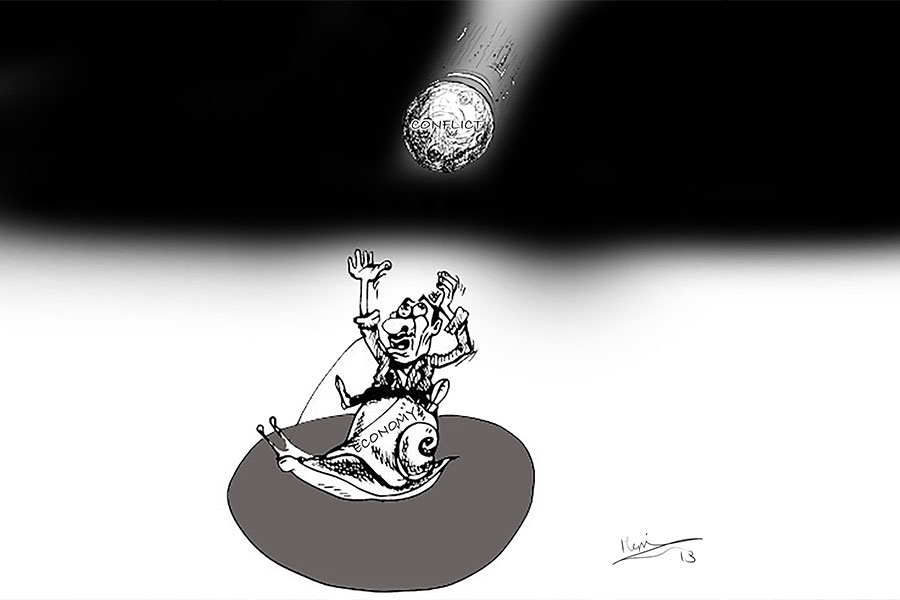

Ethiopia’s government contemplates implementing policy recommendations from the pundits in the World Bank and the International Monetary Fund (IMF), hoping to attract financial support from external sources. The country must significantly reduce its trade deficit to address the severe forex problem. It is a situation of deep concern that requires a visionary mindset, strong will, and concerted efforts to plan for a better future, writes this contributor, whose identity is withheld upon request.

Ethiopia is facing a severe forex crisis, with its foreign exchange reserves at an all-time low and unable to pay even for a month’s worth of imports. A significant trade deficit, where the country spent 90 dollars in imports for every 30 dollars it exported, has caused this crisis. A huge external debt burden of nearly 27 billion dollars needs to be repaid along with interest in time.

With external debts maturing en-masse, the country’s foreign exchange reserves are dwindling, jeopardising its ability to repay its loans on time. According to the latest Ministry of Finance (MoF) debt analysis report, external debt service is expected to rise steadily over the next two years, exceeding 2.5 billion dollars in annual payment, four times larger than a few years ago.

The cost of living has become unbearable for many, with the consumer price index showing year-on-year inflation at 33.8pc for January this year. The past few years have been hit badly due to the COVID-19 pandemic, below-par agricultural produce due to natural calamities, and widespread insecurity.

These are challenges hardly new; they have been brewing for several years. They have no quick-fix solution but require foresight and a visionary mindset. With a strong will from all of us and determination to come together to make concerted efforts, we can address the severe forex problem.

Granted, the response will not be as simple as it may sound. It requires a comprehensive approach that involves changing the entire socio-economic fabric of the country, capitalising on its strengths and inviting foreign capital to make the country ready to gallop fast with the changing world.

The country needs to acknowledge its strengths and assets as much as it must recognise its weaknesses and requirements. Policymakers need to prepare a fact sheet and make a systematic plan to open the economy to participate in the global economy.

However, before moving into the long-term solution, Ethiopia must have its leaders focused on addressing the short-term problems of inadequate forex reserves. One potential solution could be introducing a dual exchange rate regime, where policymakers set different exchange rates for other transactions or various groups of people.

This system would involve marking a lower rate of exchange for the import of essential commodities such as drugs, petroleum, spare parts, and capital goods, as well as servicing external debts. A higher exchange rate goes for other imports of inessential and luxury products and remittances from abroad, exports, and tourism.

The dual forex regime would gradually move towards liberalisation of the exchange rate linked to the forex market, where the floating exchange rate system is prevalent. It is a system that could offer several benefits.

It would bolster the export industry by keeping the remittance rates high, creating more employment, and increasing liquidity. The preferential treatment of essential commodities would control local prices of the products, keeping inflation at bay in a country where 80pc of imports are crucial and thus strategic.

This way, the dual exchange rate system can use the theory of price discrimination to the country’s advantage, where a low exchange rate is applied to high-priority, and a high rate is applied to low-priority goals.

However, there are potential pitfalls to the dual exchange rate system. It could create market distortions, with businesses manipulating the system to their advantage, resulting in economic inefficiencies. The system would require constant monitoring and adjustments to function as intended.

We must also be wary of its drawbacks.

A dual forex regime could allow speculative market forces to take advantage of the arbitrage opportunities of the eco-system to generate large gains without contributing to productivity. Those who want to import raw materials and export value-added products would find the environment beyond their competitive edge. It may also incentivise official corruption and favouritism as the government is the only agency to set exchange rates.

Managing the exchange market is complex and cumbersome; it demands large administrative machinery and bureaucratic competence. It requires a highly complex system of trade and exchange controls to sustain it. Ultimately, the cost of imports would become high due to the increased demand for foreign currency, leading to volatile market conditions. Without adequate forex reserves to stabilise the market, the economy puts under inflationary pressure, discouraging foreign direct investments as the exchange rate is very unstable and repatriation of profits impossible to carry out.

However, a dual exchange rate regime could offer a respite if operated with diligence and care. A regulatory body should perform this function and regulate it systematically with a particular gateway for all essential products coming in at a special rate, conducting an auction to determine the exchange rate for the remaining transaction by maintaining a retention rate to ensure supply. This would also require regular and close watch, making necessary course corrections by policymakers.

Members of the federal macroeconomic team recently met in Bishoftu (Debrezeit) town to discuss the uphill task ahead. Hopefully, they bear in mind that Ethiopia needs to boost its export capacity and reduce import dependency, which will require a massive investment in infrastructure, skills development, and technology transfer. They must create an enabling environment for foreign investors, removing bureaucratic hurdles and addressing security concerns.

They may also want to take inspiration from Ghana’s experience in the early 1980s. Its political leaders and macroeconomic policymakers had effectively instituted a multiple official exchange rate, with each rate serving different transactions, promoting exports, surcharging imports and giving waivers for essentials.

They demonstrated that a better-managed forex reserve could reignite economic recovery and drive further growth through long-term capital investments. It can also help restructure long-term external debts and a better offering from the IMF.

PUBLISHED ON

Feb 25,2023 [ VOL

23 , NO

1191]

Covid-19 | Apr 25,2020

Fortune News | Jul 28,2024

Agenda | Mar 02,2024

View From Arada | Dec 09,2023

Editorial | Nov 21,2020

Commentaries | Apr 30,2021

Commentaries | Oct 12,2019

Viewpoints | Jun 17,2023

News Analysis | Nov 16,2024

News Analysis | May 06,2023

Photo Gallery | 171605 Views | May 06,2019

Photo Gallery | 161844 Views | Apr 26,2019

Photo Gallery | 151581 Views | Oct 06,2021

My Opinion | 136311 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Oct 5 , 2025 . By NAHOM AYELE

In Meqelle, a name long associated with industrial grit and regional pride is undergo...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The federal government is set to roll out a new "motor vehicle circulation tax" in th...

Oct 5 , 2025 . By NAHOM AYELE

The Bank of Abyssinia is wrestling with the loss of a prime plot of land once leased...

Oct 5 , 2025 . By BEZAWIT HULUAGER

The Customs Commission has introduced new tariffs on a wide range of imported goods i...