Editorial | Mar 06,2021

Jan 21 , 2023.

Eyob Tekalign, state minister for Finance, took to social media platforms last week to sanitise the speculative market of an impending devaluation of the Birr against a basket of major currencies. He tried to debunk the widely and long-held market perception of an “inevitable” devaluation as “completely unfounded”. However, Eyob’s message might have come too late to make the impact he may have desired to see.

The State Minister’s belated message signalling the market instead reveals how the administration he serves is trailing behind in responding to market realities in real-time and effectively. The persistent and relentless claims from inside and outside of Prime Minister Abiy Ahmed’s (PhD) administration of eventual devaluation measures have already been expended. Market forces have made up their mind, hence taking their moves, hoping to shield themselves from losses they anticipate from sudden changes in the forex market.

In his Twitter message last week, Eyob cautioned the market not to have concerns over “mere devaluation”, attributing his advice to a “sensible macro reform” the administration has on its agenda.

Ironically, the trouble begins here.

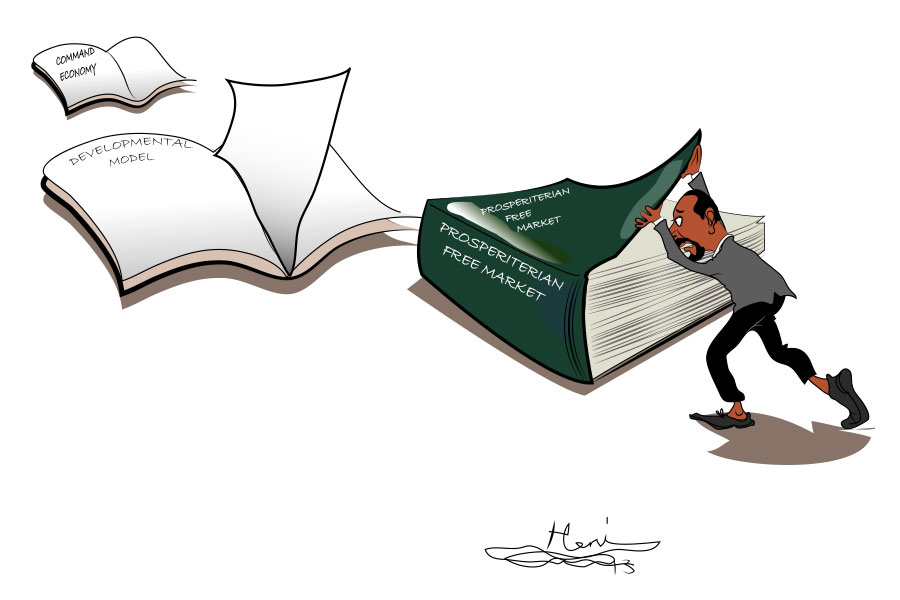

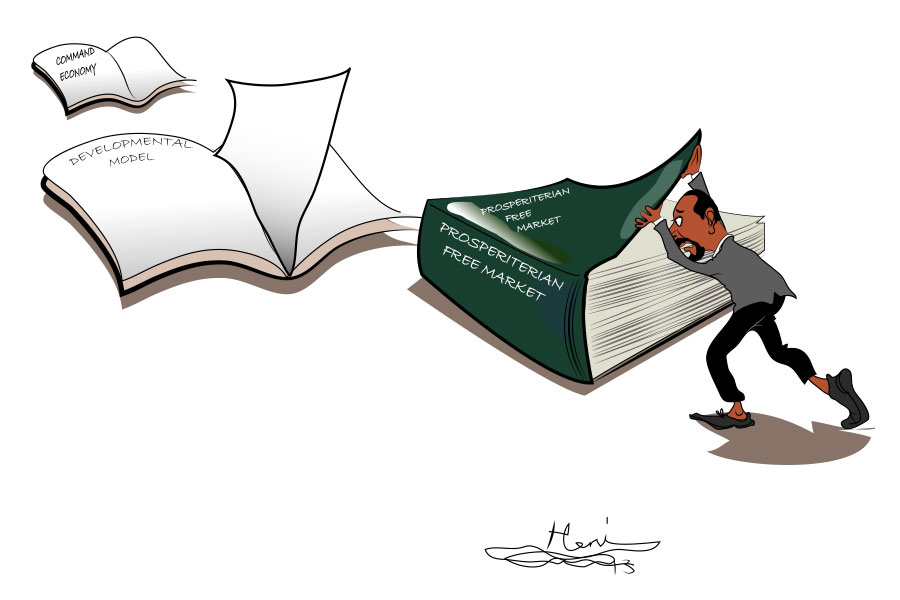

What is the federal government’s macroeconomic agenda? What ideological convictions of the ruling party underpins this agenda? If any, what are the organizing and operating principles of the incumbent Prosperity Party (PP), governing the relationship between the state and society, and the many policies it ought to beget?

Prosperitians are the most unpredictable lots governing this country in recent memory. Oddly, their strength may have come from such unpredictability, including on the macroeconomic policy fronts. It is tasking to hold them against established and known standards, lest their declared statement of faith has been a “big tent” in political mobilisation and pragmatism in policymaking. These are governance traits as fuzzy and ambiguous as they can get.

It may not be reasonable to blame the incumbent administration for the macroeconomic imbalances which predate its coming to political power. Ethiopia’s economy suffers from a twin curse of extremely low productivity and lack of competitiveness in the global market. Addressing these structural impediments to ensure sustainable growth and advancing citizens' welfare should take much more than twinkling monetary policies and adjusting the macroeconomic agenda.

There ought to be an overriding and encompassing worldview articulated by those upon whom voters entrusted their faith to govern them. Not having or communicating if there is one leaves the electorate and the market only to be guessing, as they often do.

There also appears to be official inertia on the extent and impact of the economic hardship citizens go through - a severe business slowdown, stagnant wages and the rising cost of living. However, it is recurrent to hear on power corridors that these are hardships experienced worldwide due to global inflation, geopolitical tensions, pandemic and the consequences of climate crises. These could be issues hard to disregard.

The global economy is perhaps going through changes where the resource demand has never been so high. The era of cheap capital in advanced economies chasing high returns in developing countries appears to be over. Equally, the largess from wealthy countries supporting needy populations in the global south and generous loans from bilateral and multilateral creditors are drying up. It has left several fragile economies, such as Ethiopia, in a debt trap.

Many are on the verge of defaulting on their international obligations, bar debt restructuring negotiated with creditors through the International Monetary Fund (IMF). Not surprisingly, Ethiopia is one of these countries whose failure to secure a deal with its creditors and win back IMF’s billions of dollars in special drawing rights could land it in the economic abyss.

Eyob and other policy wonks would accept the old adage that there could be no smoke where there is no fire. The devaluation smoke comes from a widely held realisation that Ethiopia’s macroeconomic policymakers would have to agree to bridge the gap between Birr’s exchange rate of nearly 55 Br at the official market with almost double the amount exchanged in the parallel market.

The macroeconomic team chaired by the Prime Minister may use policy lexicons such as “floating the exchange rate” or introducing a “multiple exchange rate regime”. Nonetheless, these do little to conceal the reality that responding to IMF’s demand to allow the Birr to be traded on its market value would be inevitable.

Devaluation may sound like a decision made by central bank governors with a pen stroke, following a political decision from the highest order. Nevertheless, the Birr's value has been under erosion for two decades, although the pace has been rapid since 2018. It has lost its value against the dollar by over 1,000pc, with a history of official devaluation made five times since the early 90s.

The rationale for devaluation is to allow the Birr to claim its market value and support exporters earning foreign currencies competing in the international market. It has remained an elusive policy target in an economy where the trade balance disfavors Ethiopia.

The market should bear no blame if it panics with the “rumours” of an impending devaluation. It could only mean adding fuel to the inflationary pressure with the year-on-year consumer price index (CPI) remaining stubborn at over 30pc.

The two immediate challenges for Eyob and his policymaking colleagues to overcome are high inflation and a balance of payments crisis.

Inflation has been a persistent problem for decades, reaching a peak of nearly 50pc in 2008, before falling. Various factors, including an increase in the money supply, a decline in Birr's value, and rising costs for goods and services, are to blame.

The balance of payments crisis is characterized by a large and persistent deficit in Ethiopia's current account, which measures the flow of goods, services, and financial transactions with the rest of the world. This deficit has been fueled partly by the large trade deficit, as Ethiopia imports more goods and services than it exports.

For every 30 dollars Ethiopia had exported two years ago, it bought 90 dollars worth of goods and merchandise. Last year, Ethiopia spent 13 billion dollars more paying import bills than the nearly four billion dollars it had earned from exports – imports’ value grew by 26.2pc from the previous year, surpassing the increase in export by 5.6pc during the same period.

The balance of payments crisis has put pressure on Birr's value and made it more difficult for the federal government to finance its operations and investment projects, many of which sadly have to serve little purpose than projecting “prosperity”.

The federal government's attempt to address these immediate economic challenges, seeking financial assistance from international organisations and donor countries, remains a roadblock to implementing structural reforms, improving the business environment and enhancing the competitiveness of the country's exports. Policymakers like Eyob should know better where to focus on overcoming this impasse. Donors want to see Ethiopia's political deadlock addressed through negotiated settlements before they open their taps.

PUBLISHED ON

Jan 21,2023 [ VOL

23 , NO

1186]

Editorial | Mar 06,2021

Fortune News | May 25,2019

Life Matters | Jan 22,2022

Fortune News | Oct 24,2020

Fortune News | Sep 01,2024

Radar | May 08,2021

My Opinion | Dec 31,2022

Agenda | Aug 10,2019

Radar | Jul 22,2025

Photo Gallery | 173102 Views | May 06,2019

Photo Gallery | 163323 Views | Apr 26,2019

Photo Gallery | 153237 Views | Oct 06,2021

My Opinion | 136467 Views | Aug 14,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 12 , 2025 . By BEZAWIT HULUAGER

A sweeping change in the vehicle licensing system has tilted the scales in favour of...

Oct 12 , 2025 . By NAHOM AYELE

A simmering dispute between the legal profession and the federal government is nearin...

Oct 12 , 2025 . By NAHOM AYELE

A violent storm that ripped through the flower belt of Bishoftu (Debreziet), 45Km eas...

Oct 12 , 2025 . By BEZAWIT HULUAGER

An evolving joint venture between Etihad Airways and Ethiopian Airlines is shaping up...