Viewpoints | May 23,2021

What makes the lab innovative? And a laboratory? Who selected the advisory board, and how can companies become eligible to get support from the lab? Our Managing Editor, Tamrat G. Giorgis, sat with Gizachew and Zafar to pick up their thoughts.

Gizachew Sisay: The innovative finance lab initiated by the UNDP in collaboration with the National Bank of Ethiopia. They realised that the micro-small and medium enterprises (MSMEs) have been underserved or have less access to finance. Studies found that most are missing the middle because they are too big for microfinance institutions and too small for banks. The innovative finance lab stepped in to identify, explore, test and experiment the alternative financial instruments that can work for the MSMEs in Ethiopia.

Ali Zafar: Innovative finance lab comes with experience from other parts of the world, especially from East Asia. Some firms were historically absent from the banking sector, and various instruments and mechanisms. These small and medium firms will get the finance to scale up and reach a specific size. No country has developed without a vibrant and well-developed financial sector. The innovative finance lab is a pioneer of this new effort to bring finance to firms that have not made it part of the financial ecosystem.

Q: Is this about selecting what you described are the "missing middle" by identifying companies with high growth potential?

Zafar: There are many innovative firms in Ethiopia without being able to get funds from the banking sector. This is because; either they do not have the history or a broad network. It is an excellent opportunity to graduate the firms, scale up, solve the binding constraints and finance them. The lab is not established to partner with big and established firms but to go after firms of a specific capability that have the potential to scale up.

Q: How do you envision the lab staying in business? It appears it is all but permanent.

Gizachew: We have three phases. We will take a lead role as UNDP and drive it together with the National Bank of Ethiopia using the setup mechanism. The second phase tests the scale of whether the alternative financial instruments will work. The lab will stay there. Its shape and scope might change over time. In the final phase, the lab will be there, but gradually it will be taken by the government to be a financial modality that can work for MSMEs, and our role will gradually diminish.

Q: Why do you refer to MSMEs if the lab targets the "missing middle"?

Gizachew: The lab will be working with the Ministry of Technology, looking for micro startups with innovative ideas, but cannot commercialise them due to a lack of finance. The Technical Assistance Facility (TAF) will be doing this. It will do the due diligence and select the micro, small or medium enterprises based on their growth potential. It refers the enterprises to the Enterprise Financing Facility (EFF), another segment of the finance lab. This year, we aim to reach out to 100 MSMEs.

Q: What will happen next week when you launch the lab?

Gizachew: The innovative and finance lab board will be elected and conduct its first meeting to endorse the terms of reference for the board. The board will also endorse and disclose development partners who will be informed of the purpose of the lab. The governance system will get a green light. The board will have an advisory role and provide strategic guidance. Both the UNDP and the National Bank of Ethiopia serve as secretariat. The lab is structured to have a separate office and experts doing the day-to-day activities.

Q: Can you give us an idea of the operational and governance structure of the lab?

Gizachew: The board is a mixture of government and private sector members, including the UN. Ministries of Finance, Labour & Job Creation, as well as Innovation & Technology, will be represented by their state ministers. Financial institutions and private sector representatives will take part.

Q: Who selected the board members? On what basis? To whom will they report?

Zafar: They are selected based on technical competence and excellence. The lab's vision is to have the public and private sectors together on the board.

Q: Where does the fund come from? Do you have commitments from your finance sources? What are your plans to keep it sustainable?

Gizachew: By making it work for its purpose. If it can work as planned, we assume everyone will jump on it - venture capitalists, crowdfunding, or alternative mechanism we use to make it work. We are taking the lead; the UNDP management is committed to financing the lab with one million dollars to set it up. We have already deployed the technical assistance facility for nearly half a million dollars. We are committed to investing from the technical assistance facility; but for the enterprise financing facility, it should come from other sources, including banks in Ethiopia.

Q: Is that the reason you have Dashen Bank onboard?

Gizachew: Yes. Others will also come in the future.

Zafar: The sustainability and financing model will not be for all brands. It will be a model of various financial instruments, including subsidised credits. We cannot tell you exactly how big it will be in five years. We need to understand the market more and see which players will come to the demonstration effect. But the financing model will be a combination of initially UNDP, some donors and then refunds of the money.

Gizachew: In the first phase, the lab aims to set up a finance facility of 10 million dollars that will gradually reach the second phase of 100 million.

Q: Asset-based loan guarantees and securing concessional loans for businesses not served by the traditional banking system is not a new concept. The UK DiFD, the USAID and MasterCard Foundation have been doing it for years. What else are you planning to do? What are the other innovative financial instruments?

Zafar: We feel like there are up-and-coming firms in Ethiopia, especially in the areas of retail, and agro-manufacturing, that have not been recipients of financial support. The board is not a classic bureaucratic board, but a mix of public and private operators who bring in the same equation to have a conversation and exercise due diligence. I think this is innovative about this project.

Q: Who decides whether or not a company is eligible to receive support from the lab? Is it the advisory board or the secretariat?

Gizachew: The Technical Assistance Facility will do the technical clearance. It will have a due diligence process, and anyone eligible will access the funds. The advisory board will decide on the overall envelope size and how the lab should operate.

Q: Have you made any projections on the prospect of job creation? How many jobs are we talking about here?

Zafar: We cannot give exact numbers, but we are optimistic that the employment gains from these MSMEs can be pretty significant. Our data is a lot from East Asia, even from places like India, where you have seen Fintech startups; startups in the manufacturing space catalysed very quickly within years. We hope there is a demonstration and a catalytic effect. Once you have some emerging firms, other firms see those firms and want to join. It is like a snowball effect.

Q: The sectors you targeted, such as horticulture & livestock, fintech & ICT, and textile & leather, have companies with not so much trouble in accessing financing from the regular banking system. Are you instead trying to target and focus on their suppliers?

Zafar: We are not targeting the established players in the industry who have access to the banking sector. The ICT sector has a lot of new innovative startups that are emerging. We are looking at firms with sufficient scale and vision without being established.

Q: Don't the identified sectors contribute insignificantly to the GDP?

Zafar: Yes, but economics is not static; it is dynamic. Look at the GDP composition in China or Vietnam in the 1980s, and contrast it between 2000 and 2010. By helping scale up different sectors and firms, the innovative lab can create more windows within sectors and eventually have a catalytic role. Most countries in the world began somewhere. We want to identify the next promising firms in Ethiopia in these sectors. There is tremendous potential in the Ethiopian economy, and we believe that we want to tap into that potential and then open up the space.

Q: One of the things you want to do is a lobby for regulatory and policy reforms. Do you have anything specific?

Gizachew: We have been exploring the policy document of the National Bank, and banks are expected to dedicate five percent of their resources to MSMEs. None of them is implementing this. That is the one policy agenda that we are promoting. Small businesses should have a service window because they are a nurturing ground for big companies.

Q: You seem to assume that the biggest obstacle in building the economy is a lack of access to markets and finance. In reality, the issue is about constrained access to forex and the absence of contract enforcement. Don't you want to deal with these issues?

Zafar: The innovative finance lab will address the forex problem. We envision an excellent governance framework, which is why we also have extensive experience and hybrid managers.

Q: I would have understood if this conversation had occurred under normal circumstances and economic challenges. However, a macroeconomic crisis is demonstrated by a balance of payments deficit, external debt burden, inflation and depreciated currency. How much impact can you make through this lab in such a context?

Zafar: The country has experienced several shocks in the last four to five years, beginning with a pandemic, drought, the northern Ethiopia war and the Ukraine war. It is true that there have been macroeconomic challenges. But a crisis is also an opportunity. Great reforms have been done during periods of crisis. India reformed in the 1990s. We think it is the right time to reform the financial sector to overcome some of the after-shocks coming from the outside. A more robust and resilient Ethiopian economy is needed in a world of global strength.

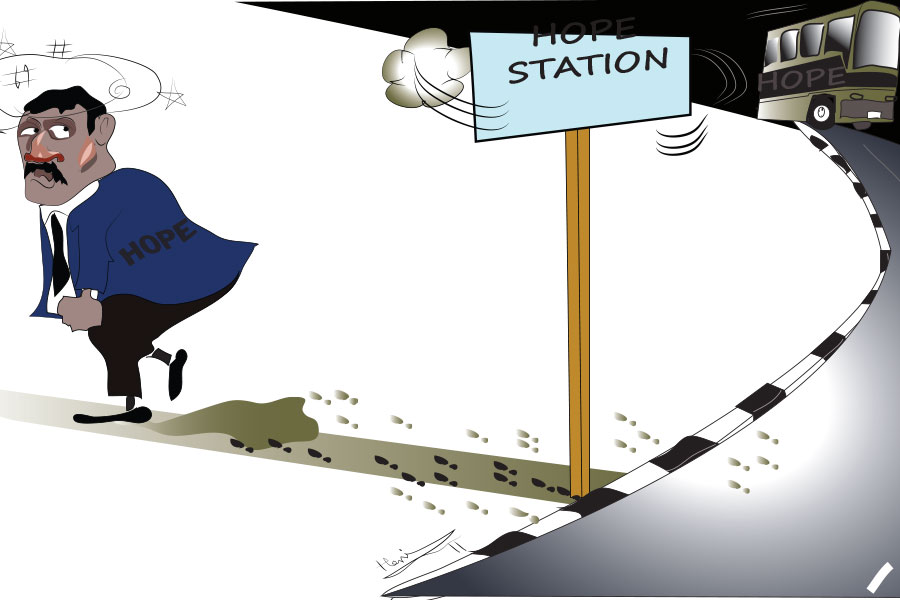

Q: Do you see hope for the Ethiopian economy?

Gizachew: We see the potential and the opportunity for the Ethiopian economy to grow for we have a very dynamic youth population.

Q: Several international donors and multilateral financial institutions have cut loans and grants to Ethiopia because of the war. You have begun to mobilise resources from development partners and international creditors to this lab. How do you think this matches?

Zafar: Aid worldwide is in decline. The Ukraine war has separated many essential points. However, many donors are interested in this innovative financial space. In this ecosystem of supporting startups, there is a lot of consensus of interest.

PUBLISHED ON

Oct 15,2022 [ VOL

23 , NO

1172]

Radar | Feb 09,2019

Commentaries | Mar 19,2022

Fortune News | Jan 28,2023

Commentaries | Jan 22,2022

Editorial | Jul 06,2019

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...