Fortune News | May 15,2021

Sep 17 , 2022

By Yehualashet Tamiru Tegegn

The counterclaim is a domestic law concept, which is gaining international recognition in investor-state dispute settlement, either through treaties or tribunals, writes Yehualashet Tamiru Tegegn (yehuala5779@gmail.com), lawyer and researcher. The views and opinions stated in this article are solely those of the author and do not represent the institutions or projects he is affiliated with.

A counterclaim is the right of the respondent party in the proceeding to turn against the plaintiff and pursue its own claims. Under domestic law, the requirement to accept counterclaims is provided under Civil Procedure Law as it is a procedural matter. A counterclaim is aimed at achieving procedural economy by preventing the duplication of cases and the cost of proceedings.

There are two requirements: the counterclaim should be fall within the jurisdiction of the court entertaining the principal claim and it should be related to the main action brought by the plaintiff. While civil procedure is the primary source in domestic litigation, the principal foundation of counterclaims under international law is unclear. As a claimant, investors often objected to counterclaims brought by the respondent state because of the absence of clear recognition, among others, in bilateral investment treaties (BITs).

The first and foremost source is the statute of the International Court of Justice (ICJ). The 38th article of the document allows for the court whose function is to decide under international law such disputes shall apply, among other things, the general principles of law recognised by “civilised nations”.

For a domestic principle and right to be elevated as a source of law at the international level, it should have to be recognised not merely in one legal system but in others as well. As the right to bring counterclaims is somehow recognised under major legal systems, it is possible to say that it is recognised under international law. Therefore, arguably, one source of counterclaim under international law is the ICJ statute.

The right to file a counterclaim is also well recognised under various institutional arbitrations. One of the most well-regarded is the Permanent Court of Arbitration. Its rules of arbitration in various instances indicate the right of the respondent to bring counterclaims.

The second institutional arbitration which recognises counterclaim is the United Nations Commission on International Trade Law. In its rules of arbitration, it said that “in his statement of defence, or at a later stage in the arbitral proceedings, if the arbitral tribunal decides that the delay was justified under the circumstances, the respondent may make a counterclaim arising out of the same contract or rely on a claim arising out of the same contract for the purpose of a set-off.”

The scope of application of counterclaim under the Commission seems narrow. It does not refer to counterclaims related to a contract but rather only those arising out of the same contract. Because of this, under the Commission's rules of arbitration, a tort claim does not arise out of a contract but merely related to it, and might be rejected on jurisdictional ground.

The Convention on the Settlement of Investment Disputes between States & Nationals of Other States (ICSID Convention) and its rule of arbitration is the other institutional example that provides the right of the respondent to bring counterclaims. A valid and admissible counterclaim before the ICSID should fulfil three elements: the parties should agree to submit a counterclaim, it should be within the jurisdiction of the Convention and arise directly out of the subject of the dispute. If the counterclaim has sufficient closeness with the principal claim, the tribunal will assume jurisdiction on prima facie.

The right to counterclaim is somehow recognised by implied form under various BITs. By inherent implication, they indicate that the state party to the agreement may also be aggrieved by the application and interpretation of the treaty and the contract. It may have the right to refer the dispute to the dispute settlement mechanisms indicated under the treaty. Usually, the BITs referred “any dispute” rather than listing out the type of claims that the parties could submit.

For instance, under the treaty between Ethiopia and Qatar, “any dispute between an investor of one Contracting Party and the other Contracting Party concerns an alleged breach of an obligation.” As far as the dispute emanates from the terms and conditions specified under the treaty, the host state is entitled to bring a counterclaim.

Furthermore, no exclusion clause in any BIT prohibits the host state from bringing counterclaim. As one of the cardinal rules of interpretation dictates, what is not forbidden is presumed to be permitted.

Although, in principle, the host state as a litigant party is entitled to any defence, the government is limited at least in the area of set-off and counterclaim for the purpose of 'denial of benefit.' The right to counterclaim is also indicated in the model BITs.

Various counties developed model BITs to serve as an archetype for negotiating future investment treaties. Unlike the global north model, the global south has incorporated an explicit recognition of the host state's right in bringing counterclaim. For instance, under the Southern African Development Countries (SADC) model, a host state may initiate a counterclaim against the investor before any tribunal is established pursuant to the agreement.

Article 38 of the statute of ICJ also recognises judicial decisions as a subsidiary source of international law. These decisions mainly emanate from the international court of justice, municipal courts, prize courts and international arbitration tribunal. The decision made by international arbitration tribunals are not binding. Still, they have often been followed as precedents by the other tribunal for similarly situated cases and are one sources of counterclaims.

The 'Bevenutti and Bonfant SRL v. People’s Republic of Congo' case is interesting here. An Italian Limited Company, Benvenuti & Bonfant Srl (“B&B”), whose registered office is in Rome, and the government of Congo jointly formed and run a business organisation called PLASCO. From November 1975 on, the government embarked upon a policy of “radicalisation,” which involved the creation of government agencies such as the “Management-Party-Union” (“the Trilogy”), and interference by these agencies in the management of PLASCO. Considering that their personal safety was no longer guaranteed, most of the Italian personnel of PLASCO hastily left the Congo and the Army subsequently occupied their registered office.

In this case, the respondent, which is the Republic of Congo, made a counterclaim to damages. It was for the non-payment of duties and taxes relating to imports, overpricing of raw materials, damages for defaults in the execution of the supply agreement, defects relating to the construction of the plant and reparation of intangible loss (“prejudice moral”). The tribunal accepted and entertained the counterclaim of the respondent.

In another case, 'Desert Line Projects v. Yemen,' in which a dispute arose out of disagreements over amounts owed for executed works under several road construction contracts, leading to the suspension of works. The claimant argued that the respondent breached the bilateral investment treaty and international law. By way of counterclaim and set-off, the respondent claimed that to the extent the tribunal exercises jurisdiction over the case, it is entitled to damages resulting from the breach of contract and damages for the unfulfilled obligations.

All in all, the counterclaim is a domestic law concept which is gaining international recognition in investor-state dispute settlement. Although there is no explicit reference in BITs, a counterclaim is well recognised under various institutional arbitrations and case laws, which as per Article 38 of the ICJ statute, are one of the sources of international laws. The tribunal may entertain a counterclaim if it comes within the jurisdiction of the tribunal and is directly connected with the subject matter of the initial or original claim by the other party.

PUBLISHED ON

Sep 17,2022 [ VOL

23 , NO

1168]

Fortune News | May 15,2021

Fortune News | Oct 09,2021

Fortune News | Jul 08,2023

Commentaries | May 24,2025

Radar | Oct 22,2022

Radar | Nov 06,2021

Commentaries | Jun 05,2021

View From Arada | Mar 30,2019

Viewpoints | Oct 30,2021

Commentaries | Sep 08,2024

Photo Gallery | 156282 Views | May 06,2019

Photo Gallery | 146565 Views | Apr 26,2019

My Opinion | 135227 Views | Aug 14,2021

Photo Gallery | 135080 Views | Oct 06,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...

Sep 6 , 2025

The dawn of a new year is more than a simple turning of the calendar. It is a moment...

Aug 30 , 2025

For Germans, Otto von Bismarck is first remembered as the architect of a unified nati...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Sep 15 , 2025 . By AMANUEL BEKELE

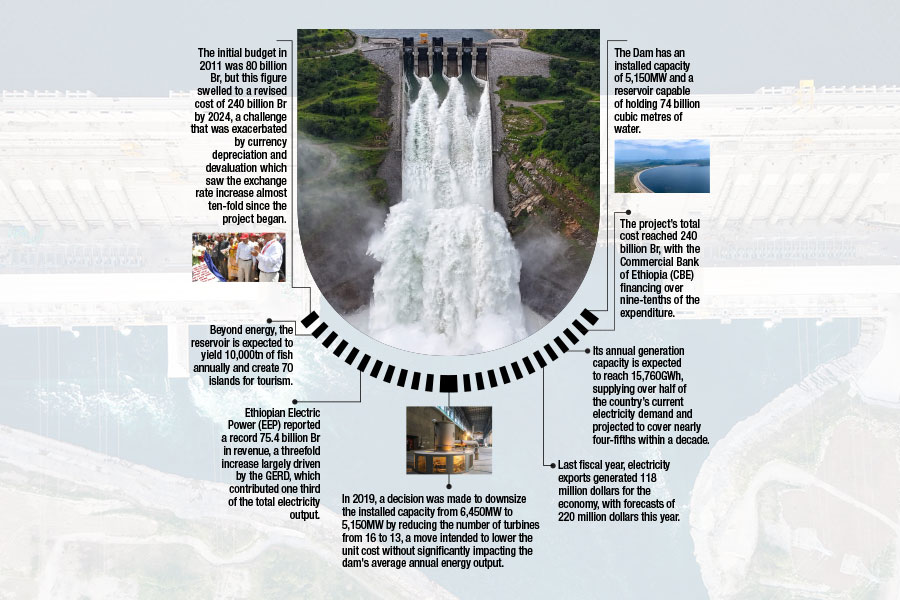

The Grand Ethiopian Renaissance Dam (GERD), Africa's largest hydroelectric power proj...

Sep 13 , 2025

The initial budget in 2011 was 80 billion Br, but this figure swelled to a revised cost of 240 billion Br by 2024, a challenge that was exac...

Banks are facing growing pressure to make sustainability central to their operations as regulators and in...

Sep 15 , 2025 . By YITBAREK GETACHEW

The Addis Abeba City Cabinet has enacted a landmark reform to its long-contentious setback regulations, a...