Jun 4 , 2022

By BERSABEH GEBRE ( FORTUNE STAFF WRITER )

Central bank Governor Yinager Dessie (PhD) ordered all commercial banks last week to downgrade branches operating in the border towns of Togochale and Moyale to sub-branches status.

The Governor is concerned with a growing number of illicit operators using bank branches in border towns, circumventing the foreign currency account regime to transfer foreign currencies without permits from the central bank. Non-resident Ethiopians, native Ethiopians in the diaspora, and companies in the export sector are allowed to open foreign currency accounts with commercial banks. Spouses, employers and business partners can make deposits into these accounts in forex.

The Governor's instruction forces banks to limit services in their branches at border towns to deposit and cash withdrawals after carrying out due diligence based on Know Your Customer (KYC) rules, which became effective six months ago. The central bank has also suspended all types of transfers through the sub-branches.

Togochale and Moyale towns are prone to contraband trade, with reputations as hotspots for the parallel currency market. Almost all banks have branches in these small towns. Their presence is justifiable.

With a population of a little over 20,000, Togochale, in the Somali Regional State bordering Somaliland, is a cross-border trade hub 230Km from the Port of Berbera and 80Km from Hargeisa, the capital of the statelet Somaliland Republic. Livestock, khat and camel milk are the main traded items that make their way to neighbouring Somalia. Processed food items such as wheat, canned fish and edible oil are brought in.

Located 774Km south of Addis Abeba, which straddles the border between Ethiopia and Kenya, Moyale is prone to illicit trade. Agricultural products, livestock, as well as manufacturing items are heavily traded in the town, with a population of close to 25,000.

A study conducted last year by Global Financial Integrity on illicit financing in Ethiopia revealed that the forex acquired from parallel markets in these towns is used to make informal payments, acquire properties, and finance under-invoiced transactions.

Experts are wary. The arbitrary enforcement of the measure could hurt the local population, whose lives are dependent on the banks, according to Arega Shumetie (PhD), a senior researcher at the Ethiopian Economics Association.

“Tackling contraband trade should be given priority before imposing rules,” said Arega. “Preventing illegal traders from finding other options to launder their money is difficult.”

Some welcome the Governor's move in the industry, such as Genene Ruga, president of Nib International Bank.

One of the 79 branches Nib Bank opened last year was in Moyale, while it has a well-established presence in Togochale after it opened a branch there a decade ago.

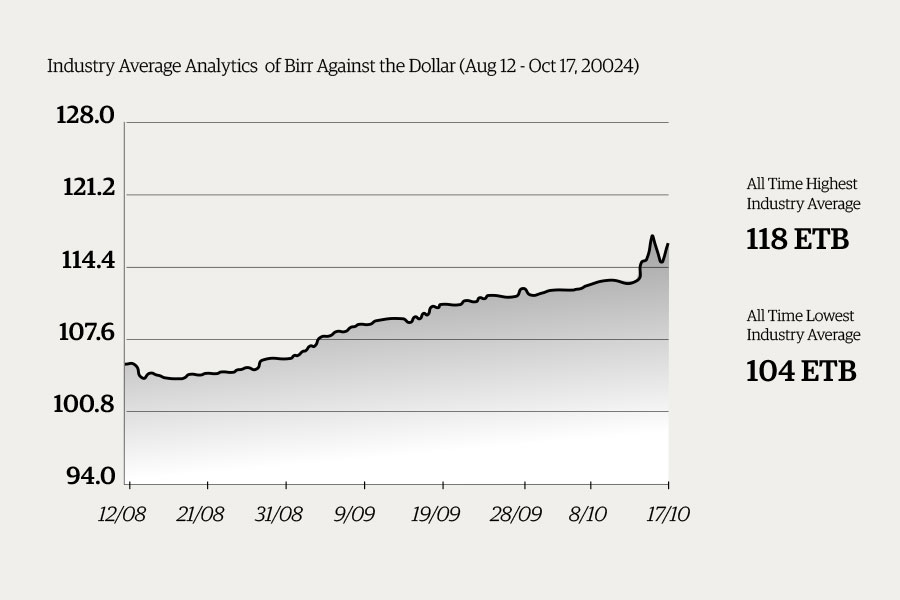

"I believe the move is a step in the right direction," Genene told Fortune. “However, the problem is likely to continue as long as the margin between the official and the parallel markets are wide.”

This margin has increased to an unprecedented 30 Br, with a Dollar exchanged for over 80 Br in Togochale and Dubai. The official exchange rate for a Dollar was 52.6 Br late last week.

Fikreselassie Zewdu, vice president for branch and digital banking at the Commercial Bank of Ethiopia (CBE), echoes the same concerns.

“More measures should be taken,” he said.

The CBE operates a network of more than 1,750 branches, including a sub-branch it opened in Togochale this year. It already has full-fledged branches in both towns.

“The branches in both towns didn't provide credit services even before the central bank's latest orders,” said Fikreselassie.

Genene of Nib Bank urged the Governor to use monetary policy tools to bridge the growing margin between the official and parallel markets.

PUBLISHED ON

Jun 04,2022 [ VOL

23 , NO

1153]

Radar | Oct 19,2024

Fortune News | Jun 21,2025

Money Market Watch | Oct 20,2024

Editorial | Mar 26,2022

Commentaries | Apr 03,2021

Radar | Jun 04,2022

Viewpoints | Nov 09,2019

Radar | Oct 11,2020

Fortune News | Aug 11,2024

Editorial | Nov 25,2023

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...