Fortune News | Feb 29,2020

The pressing need to diversify exports and generate more foreign currency pushes the federal government to consider reviving an agency to promote exports. Officials expect the agency to begin work next year, following the approval of an export development strategy under preparation by experts at the Ministry of Trade & Regional Integration (MTRI).

The agency will be responsible for identifying potential markets and anchoring foreign investors to diversify export commodities, says Haimanot Tibebu, director of trade promotion at the Ministry.

It will not be a novel endeavour for the country. An export promotion agency was established in 1998 with the mandate to boost the competitiveness of exporting enterprises in international markets. It was dissolved six years ago, transferring its mandates to the Trade Ministry.

The value of Ethiopia's exports remains lower than a 10th of the gross domestic product (GDP), less than half of the average for developing countries. The dominance of primary products and a few industries with value addition in the export portfolio have been bottlenecks. Ethiopia exported items valued at 3.6 billion dollars last year, with agricultural commodities accounting for over two-thirds. This year's performance is on track for a repeat.

The export strategy is prepared based on the recommendations of a year-long study conducted by Dalberg, a consultancy firm headquartered in Switzerland. It outlines the key factors constraining exports and supports required to realise potential over the coming decade and a half. Although the agriculture and mining sectors are low hanging fruits, the study suggests that manufacturing and services are the better bet in the long run.

Ethiopia remains dependent on exporting unprocessed and semi-processed products to Europe, North America, and Asia, where the industry is light years ahead. The strategy in the making presages these markets continue to drive demand for commodities from Ethiopia in the coming decade but notes that African markets present opportunities. Less than a fifth of exports are destined for African markets.

This should be exploited as Ethiopia improves its industrial capabilities, says Haimanot.

Sewale Abate is an assistant professor of finance and investment at Addis Abeba University. He observed that fragmented value chains and a lack of traceability for export commodities have resulted in revenue leakage.

"Not much can be done without building an efficient logistics sector," he said.

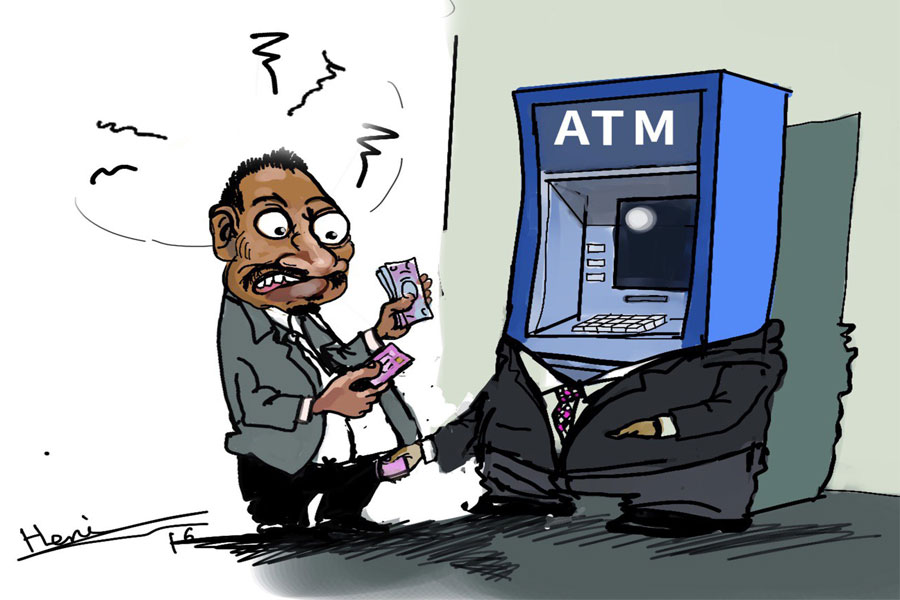

The strategy looks to introduce financing schemes to boost export competitiveness and curb incessant issues with limited access to finance.

Anbessa Shoe Factory is one of a small number of companies exporting manufacturing items in leather products. It generated 300,000 dollars last year, less than half it had brought in six years ago.

Its executives had planned to boost export revenues, growing the ratio of products shipped abroad to 70pc, according to Bamlaku Demissie, general manager. Anbessa acquired Habesha Tannery in Bahir Dar, Amhara Regional State, for 29 million Br in 2019. However, the acquisition did not bring the results the company had hoped for.

"We're exporting a tenth of our products," said Bamlaku.

The company plans to expand its operations by acquiring a Chinese-owned sole factory operating in Addis Abeba's Akaki-Qality District. Two months ago, Anbessa applied for credit from the state-owned Development Bank of Ethiopia (DBE).

“We're still awaiting a response,” said Bamlaku.

A month ago, the company requested a loan from the Commercial Bank of Ethiopia (CBE) to help cover operational costs. Exporters like Anbessa are often required to present collateral to secure credit from banks, which offer exporters two kinds of credit schemes. An export term loan is divided into three varieties depending on the length of the repayment period. A pre-shipment export credit scheme – a loan facility extended for the procurement of raw materials - is also available.

Banks disburse loans without collateral to those with excellent credit scores and good revenue generation records, according to Melkam Belete, director of small and medium loans at the CBE.

The strategy considers implementing three types of export-oriented financial schemes. A grant fund scheme for small- and medium-sized exporters, who will be required to match state grant funds with their own financing. Another is an export guarantee facility, which protects companies against risks of non-payment by international buyers.

The strategy will be sent to the Prime Minister's Office following a final round of consultations, according to Mesfin Abebe, director of agricultural product export at the Trade Ministry.

PUBLISHED ON

May 28,2022 [ VOL

23 , NO

1152]

Fortune News | Feb 29,2020

Fortune News | Jun 21,2025

Editorial | Oct 28,2023

Viewpoints | Jun 08,2024

Radar | Jan 03,2021

Radar | Aug 03,2019

Radar | Apr 25,2020

Radar | Nov 02,2019

Commentaries | Nov 05,2022

Radar | Jul 24,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Aug 23 , 2025

Banks have a new obsession. After decades chasing deposits and, more recently, digita...

Aug 16 , 2025

A decade ago, a case in the United States (US) jolted Wall Street. An ambulance opera...

Aug 9 , 2025

In the 14th Century, the Egyptian scholar Ibn Khaldun drew a neat curve in the sand....

Aug 2 , 2025

At daybreak on Thursday last week, July 31, 2025, hundreds of thousands of Ethiop...