Aug 12 , 2021

The National Bank of Ethiopia (NBE) has ordered commercial banks to suspend all collateral-based loans, an unexpected measure communicated to executives through text message on August 11, 2021.

The National Bank of Ethiopia (NBE) has ordered commercial banks to suspend all collateral-based loans, an unexpected measure communicated to executives through text message on August 11, 2021. The National Bank of Ethiopia (NBE) has ordered commercial banks to suspend all collateral-based loans, an unexpected measure communicated to executives through text message on August 11, 2021.

The suspension includes the disbursement of loans that have already been approved.

The text messages did not specify how long the suspension is to last. Neither are officials at the central bank forthcoming to explain the rationale behind their abrupt measure. The decision was made to curtail "economic sabotage," according to senior government officials.

Private commercial banks disbursed loans totalling 121.2 billion Br in the 2019/20 fiscal year while collecting 93 billion Br in repayment over the same period.

PUBLISHED ON

Aug 12,2021 [ VOL

22 , NO

1111]

Radar | Aug 13,2022

Radar | Sep 24,2022

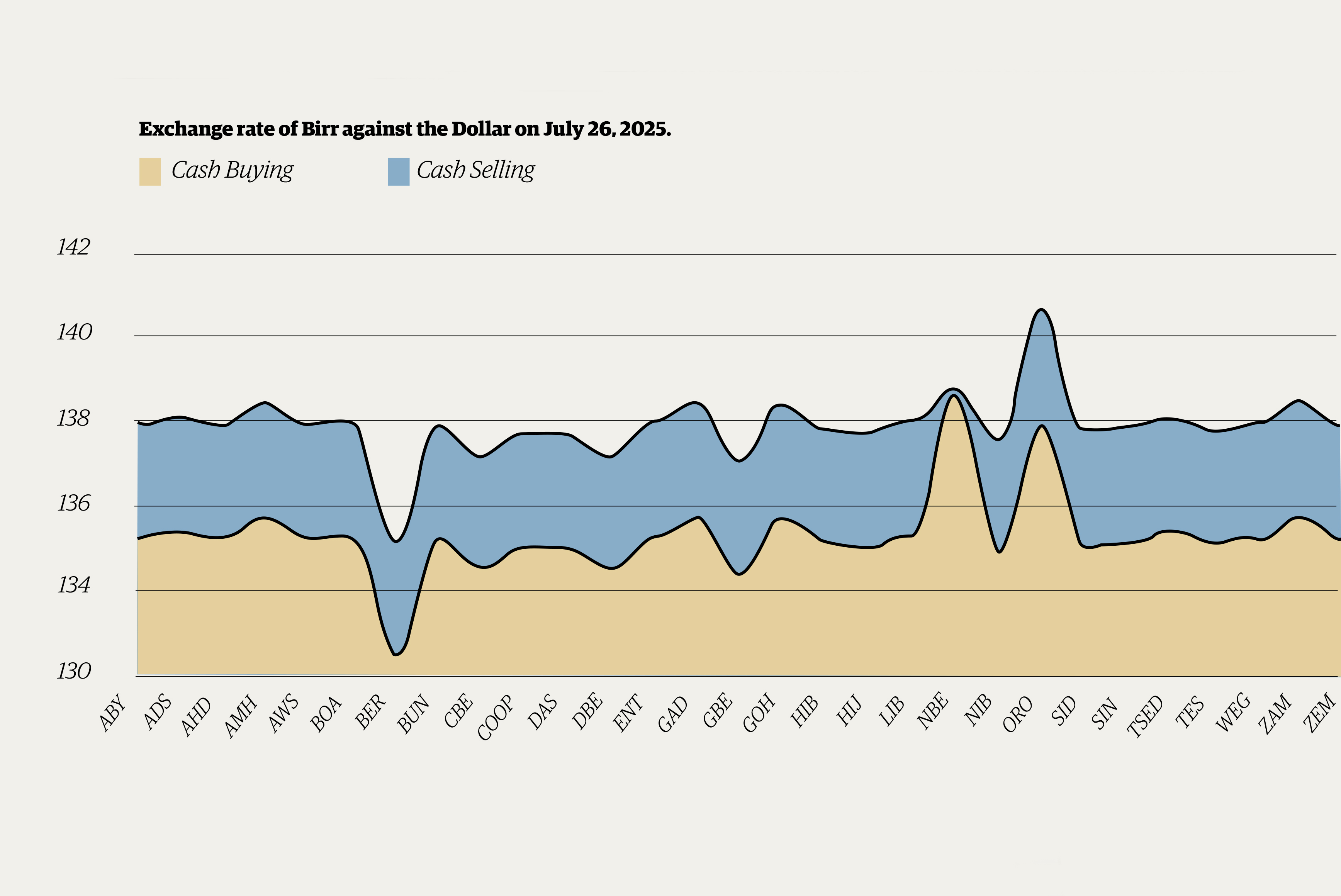

Money Market Watch | Jul 27,2025

Fortune News | Feb 05,2022

Radar | Oct 30,2021

Addis Fortune | Feb 14,2022

Radar |

Fortune News | Feb 08,2020

News Analysis | Nov 03,2024

Sponsored Contents | Jun 17,2021

Dec 22 , 2024 . By TIZITA SHEWAFERAW

Charged with transforming colossal state-owned enterprises into modern and competitiv...

Aug 18 , 2024 . By AKSAH ITALO

Although predictable Yonas Zerihun's job in the ride-hailing service is not immune to...

Jul 28 , 2024 . By TIZITA SHEWAFERAW

Unhabitual, perhaps too many, Samuel Gebreyohannes, 38, used to occasionally enjoy a couple of beers at breakfast. However, he recently swit...

Jul 13 , 2024 . By AKSAH ITALO

Investors who rely on tractors, trucks, and field vehicles for commuting, transporting commodities, and f...

Oct 4 , 2025

Eyob Tekalegn (PhD) had been in the Governor's chair for only weeks when, on Septembe...

Sep 27 , 2025

Four years into an experiment with “shock therapy” in education, the national moo...

Sep 20 , 2025

Getachew Reda's return to the national stage was always going to stir attention. Once...

Sep 13 , 2025

At its launch in Nairobi two years ago, the Africa Climate Summit was billed as the f...